Reporting Season: Winners and Whiplash Across NZ and Australia

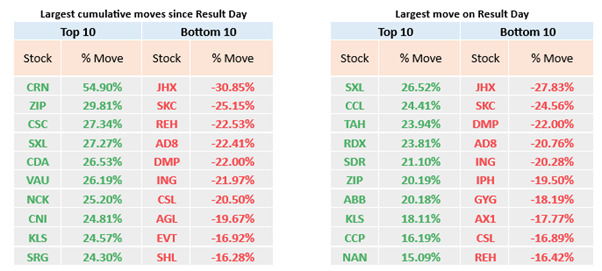

August’s reporting season drove pronounced share price swings across New Zealand and Australia. In Australia in particular, the reporting season was the most volatile on record, with a standard deviation of result day relative returns of 8.3%. Both the NZX and ASX faced conflicting macro signals: softer global growth prospects, ongoing trade skirmishes, and rising hopes of rate cuts as inflation prints continued to support a more dovish stance from central banks. Despite these macro risks, reporting season refocused attention on company fundamentals: company performance, guidance, and management credibility.

ASX Reporting Season Market Volatility

Source: UBS 27/08/25

Despite the volatility in Australia, the ASX 200 rose 3.1% in August, with the year-to-date performance now at 12.3%. Resources provided the necessary support for the market to reset records, with the sector returning a whopping 10.1% in the month.

CSL, one of Australia’s largest companies and once a market darling, reported full-year 2025 results that included a 5% increase in revenue to US$15.6 billion and a 17% increase in net profit after tax to US$3 billion. Despite these headline growth figures, market reaction was negative as gross profit and margins underperformed, especially in the flagship CSL Behring segment, the company's main plasma therapeutics business. This caused a massive share price reaction, a -16.89% move on result day.

James Hardie, a leading global manufacturer of fibre cement products, also disappointed in its latest results. This was primarily due to a significant decline in North America sales volumes, weak guidance, margin pressures linked to inventory destocking and rising debt from its recent AZEK acquisition. All roads led to a steep share price drop, down 27.83% on the day.

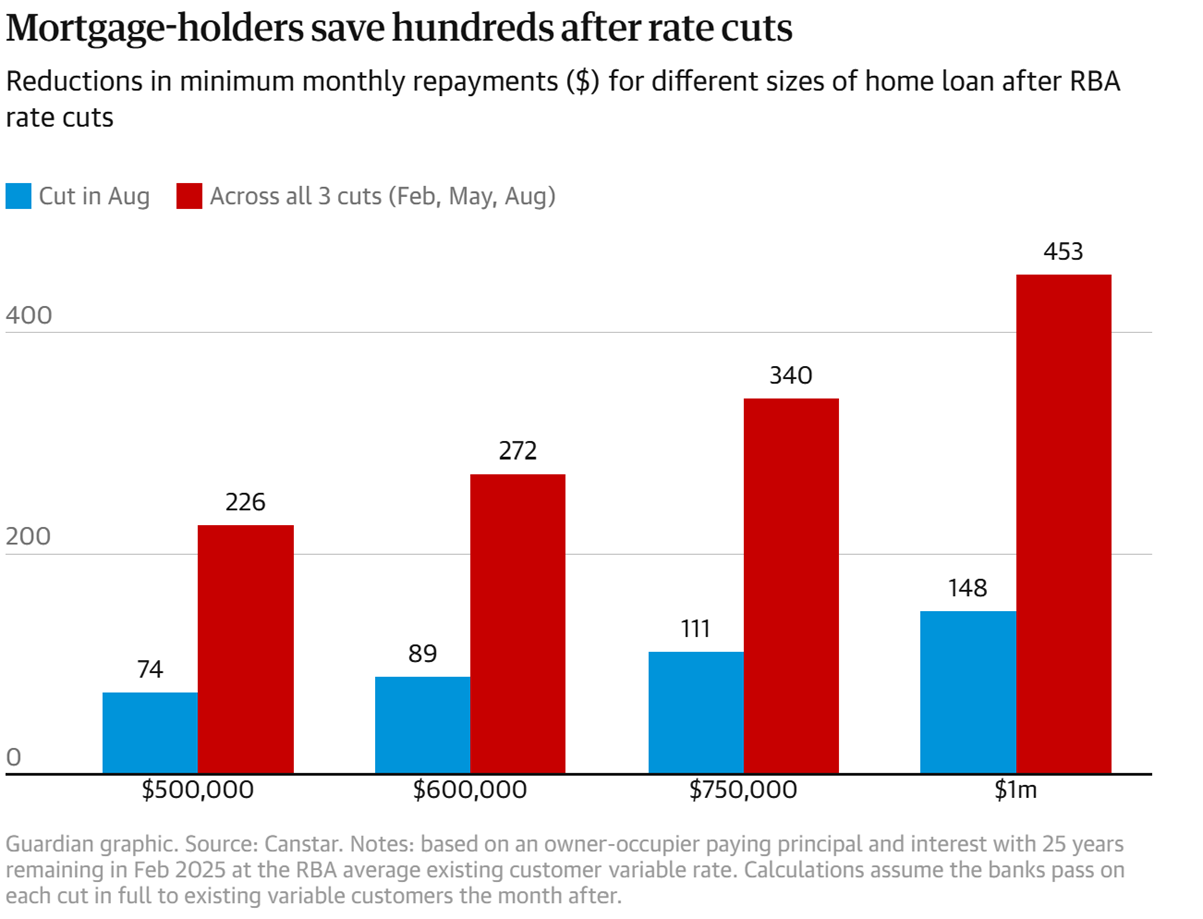

Also in August, the Reserve Bank of Australia delivered a widely anticipated 0.25% interest rate cut and a set of forecasts which we believe signalled they would be comfortable delivering at least two additional rate cuts in November 2025 and February 2026. This is good news for Australian mortgage holders.

In the New Zealand market, EBOS Group was the big surprise in the August reporting season after delivering a disappointing result, which drove a sharp retracement of the share price. The company reported higher than expected operating costs, which drove a reduction in future growth expectations.

Adding to the reporting season activity, SkyCity Entertainment Group confirmed a $240m heavily discounted capital raise ahead of its 2025 financial results, despite strong opposition from its 15% shareholder. The share price, post the raising, struggled to find a bottom. Meanwhile, the company is still waiting on a fine from the South Australian regulator for historical breaches, but has committed to spending $60 million on improving compliance measures until 2027.

Noticeably missing from company results in August was the mention of any green shoots. The government is attempting to implement policies to boost productivity and long-term investment, including a new Business Investor Visa and major reforms to overseas investment rules. There are now new targeted pathways for overseas businesspeople:

• NZ$1 million investment in an established business for a three-year work-to-residence process.

• NZ$2 million investment in an established business for a fast-track 12-month residency

These pathways replace the existing Entrepreneur Category, which had low volumes and a weak impact. The hope is that this will support job creation and income growth, though its impact will take time to filter through.

The Overseas Investment (National Interest Test and Other Matters) Amendment Bill was also introduced in August 2025. It aims to streamline and consolidate existing national interest, benefit-to-NZ, and investor tests into a single, risk-based assessment for most assets (excluding farmland/residential land). It will also set a new statutory approval timeframe of 15 working days for most business asset consents, down from prior expectations of 18–35 days. Repeat investors will be allowed to bypass some consent requirements, encourage strategic investment, and introduce efficient delegation to the Overseas Investment Office. Barriers for overseas investors to increase their stake to 100% will be removed (except for strategic businesses). Ultimately, the focus is on timely approvals, lower compliance costs, and clear processes for significant business investments—especially where national interest risks are minimal.

In a similar move to Australia, the Reserve Bank of New Zealand (RBNZ) cut rates by 25 basis points to a three-year low of 3.00% in August and flagged further reductions in coming months as we face domestic and global headwinds to growth. The RBNZ said the economy had stalled in the second quarter, and that two members of the six-strong policy committee had even voted to cut by 50 basis points in August. This was an unexpectedly bearish tone from the RBNZ. Most banks are now forecasting 25-basis-point cuts in both October and November, which will be welcome news for mortgage holders. However, monetary policy settings can take 12 to 18 months to be fully felt in the economy.

Globally, equity markets performed strongly in August. The US S&P 500 rose 2.0%, Japan’s Nikkei 225 gained 4.1%, Hong Kong’s Hang Seng rose 1.3%, and London’s FTSE 100 was up 1.2%. The positive momentum was supported by robust corporate earnings and easing trade tensions. The US saw notable strength, with around 80% of S&P 500 companies beating earnings expectations, with the technology sector leading the gains.

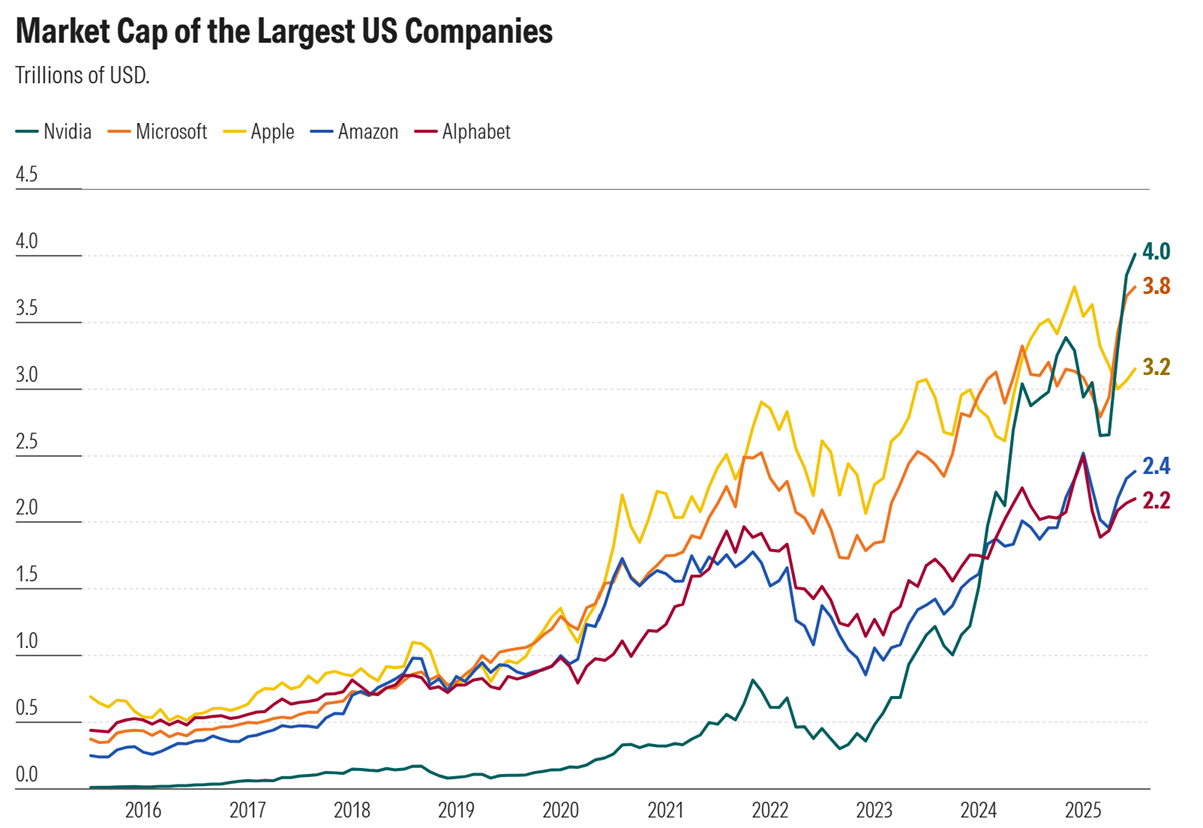

Nvidia reached a significant milestone by becoming the first US$4 trillion company, reflecting the rising influence of AI-related stocks. There are a few companies even remotely close to Nvidia’s US$4 trillion status. Microsoft has a roughly US$3.7 trillion valuation, closely followed by Apple with a valuation of US$3.1 trillion. Alphabet and Amazon top US$2 trillion, while Meta completes the US members of the trillion-dollar club. Tesla has been a member of the club, but currently trades below the threshold.

Apple was the first company to touch a US$3 trillion market capitalisation in early 2022, at the time, Nvidia was valued at about US$750 billion. Apple then didn’t close above the US$3 trillion level until mid-2023, at which point Nvidia was sitting around US$1 trillion. This demonstrates the quick pace of Nvidia’s historic rally.

Source: Morningstar

Despite the volatility we’ve seen this month, markets are forward looking. This is good news in both Australia and New Zealand, with interest rate cuts signalling better times may lie ahead. Certainly, the first day of spring is cause for some much-needed positivity.