AI’s Power Surge: How Australasia and the US are Electrifying the Future

Electricity demand is rising rapidly in many countries. This is being driven in part by surging data centre expansions, broad industrial electrification, growth in electric vehicles, and the rapid integration of artificial intelligence into nearly every sector. The US is experiencing a significant movement in electricity demand, with the same drivers applying to Australasia, too. Increasing total power consumption is an important driver behind our local Gentailer companies, as it helps underwrite new generation and provides support to the long run wholesale power price.

Electricity Demand Growth: United States

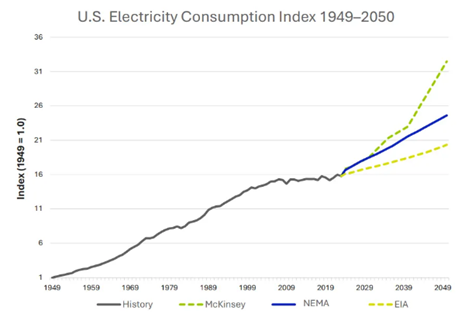

The US is experiencing a far steeper growth curve than our part of the world. Some forecasts indicate a 25% increase in electricity demand by 2030 and more than three times that by 2050 compared to 2023 levels. This marks a sharp departure from the near-stagnant growth that characterised the previous couple of decades. In the US, electricity demand growth is being accentuated by their massive data centre construction, industrial onshoring on manufacturing capacity, and the electrification of transport modes. As a result, most analysts forecast around 890 to 1,300 TWh of additional new demand in just ten years.

Data centres, now responsible for up to 4% of US electricity consumption, are expected to double that share to 8% by 2035, largely due to AI adoption and generative AI workloads.

Source: National Electrical Manufacturers Association

Electricity Demand Growth: Australasia

While on a smaller scale, Australasia is witnessing tangible, ongoing growth in underlying electricity demand. Australia’s National Electricity Market (NEM) is setting new records in 2025. In the first quarter of 2025, the average underlying demand in the NEM hit 25,162 MW. This equates to a 1.4% increase on the prior year and a new seasonal record. Similar to other markets, New Zealand has experienced largely flat demand growth since the mid-2000s. This is largely as a function of better device efficiency and the loss of several key industrial users (pulp and paper plants etc). However, this has also reversed now and is also growing year on year.

Data centres are already a significant consumer, accounting for around 6% of Australia’s electricity use—projected to double by 2030 as the AI-driven digital economy expands. Meanwhile, New Zealand’s electricity demand from data centres is less than 1% of our total power usage, but this is positioned to grow, with over 50 data centres either built or under construction across our nation.

Regional Response: Infrastructure, Policy, and Challenges

Australasia

Australia is leveraging its sun and wind advantage to pitch renewable-powered data centres as a national economic and industrial opportunity. Big tech companies are entering large-scale renewable energy purchase agreements to green their AI operations. Grid modernisation policies, targeted investments in transmission and storage, and incentives for grid-responsive data centre development are key responses. Policy is focused on achieving a “renewable digital dividend” by using AI’s electricity demand to underwrite investments in renewables, foster regional jobs, and enable net benefits for households and the national grid.

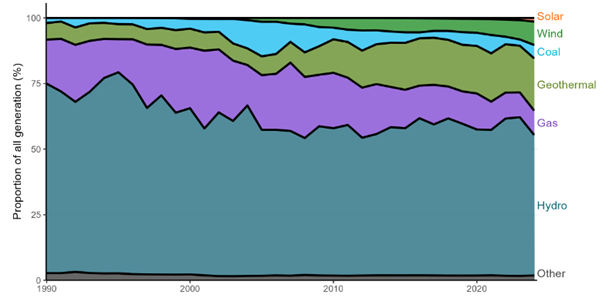

In New Zealand, we are fortunate to have our hydro schemes, which generate a large portion of the nation’s electricity. It is rare to find base load generation as clean and green as hydro. This presents the country with a great advantage for data centre owners, who would like to have a low carbon footprint.

Source: MBIE

The recent Frontier Report, which was commissioned by our government, is a helpful and supportive step to provide sensible regulation to an industry which requires political stability to progress their capital investment programs. Our four major Gentailers (Merdian, Contact, Mercury and Genesis) all have significant capex plans to deliver new solar, wind, battery and gas-fired generation. Adding supply will help offset demand growth and prevent prices from reaching unsustainable levels. Currently, our sector is working well to reach commercial outcomes for all stakeholders.

United States

The US approach is twofold: expand supply and embed efficiency and “smart grid” technology across their national grid. The significant industrial onshoring trend and the explosion in data centre development have led utilities to forecast and secure additional generation capacity, often through a mix of renewables, coal, gas, and nuclear.

Regions with the heaviest new digital loads face growing pains—strained transmission capacity, rising congestion costs, and local reliability risks. The US is also pushing for improved energy efficiency in AI hardware and smarter, grid-responsive data centres as both mitigation and adaptation strategies.

The Road Ahead

Electricity demand in both regions will remain on a steep upward trajectory through 2030 and beyond. Governments must do their best to set sensible regulations, which will then allow companies to build out generation assets. This should prevent any undue increase in power prices and provide a crucial foundation for economic growth in the years ahead.