Why the Reserve Bank should cut interest rates by 1.5% by Christmas

It is decision time this week for the RBNZ, and having started the rate easing journey in August, there has been a growing debate over whether this will not only continue but might be accelerated over the final two meetings of the year. The question is whether our central bank should cut the Official Cash Rate by 0.25% again, or go with a bigger 0.50% reduction, matching the move of the US Federal Reserve at their last meeting. Market commentators and economists are somewhat split between these two options but are we at a stage of this cycle where a more dramatic approach is needed? Should the RBNZ cut by 0.75% at this meeting as well as at the next one? There are compelling arguments both in absolute and relative terms, and such a move might just be the real “bazooka” that is needed for an economy facing yet another boom/bust cycle.

Real time inflation is already back around the RBNZ’s target midpoint, and likely to drift below 2% by year end. There is therefore a strong case for official rates to already be at neutral, which the RBNZ estimates to be 3.8% in their short-run horizon. With the OCR at 5.25% currently, there is arguably the case that Official rates should be below neutral already, with a 0.75% reduction needed not only at the meeting this week, but also at the one in November.

While forward looking sentiment indicators have improved in recent consumer and business surveys, there is no question that things are still very tough in the “here and now.” The NZIER’s Quarterly Survey of Business Opinion (QSBO) showed that the August rate cut has seen businesses become “cautiously optimistic” with a net 5% of firms expecting a deterioration in general economic conditions, well down from the 40% that were negative in the June quarter.

However, the measure of firms’ own trading activity points to continued weakness in demand. A net 31% of firms reported a decline in activity in their own business in the September quarter, the weakest since Q2-2020.

Are we getting a false sense of security from recent outlook surveys?

Confidence about the future is one thing, but so are actions and intent (hiring intentions are the lowest since 2009). Meanwhile household wealth is also soft, with the property market continuing to face headwinds. Consumers are becoming more confident, but from a very depressed base.

The pain of general cost of living pressures is clearly being exacerbated by high interest rates. Early KiwiSaver withdrawals in August exceeded $183 million, and are 38% higher than a year ago. Of this total, $38 million was because of financial hardship.

There appears to be a real risk of missing key RBNZ forecasts on the upside (unemployment) and downside (inflation, economic growth), and not in a good way. The RBNZ is expecting the flatlining economy to contract in the third quarter (-0.2% quarter on quarter), but even this outcome may be looking too optimistic.

The RBNZ sees unemployment peaking at 5.4% the middle of next year, but we may be getting near to that point already. Ongoing fiscal restraint with government agencies looking for savings of 6.5% is reducing headcount in the public sector. Major cost cutting by several large Zealand corporates such as Spark NZ ($80m) and Fletcher Building ($180m) is likely to result in lower employee numbers which is likely to be mirrored by the SME sector. Recent downsizing announcements from Winstone Pulp and the Alliance Group’s Smithfield highlight the pressure on New Zealand businesses.

We visit many businesses and it is clear that the economy is cratering. Pressures faced by big business are also having knock-on impacts to smaller companies. Software company Xero has highlighted that large NZ companies have materially pushed out payment terms, with the cost of late payments to small businesses between 2021 and 2023 rising by 81% to $827 million.

Meanwhile in the second quarter of 2024, New Zealand recorded the highest number of business failures (700) in a single quarter since 2016, according to the latest BWA Insolvency Quarterly Market Report. So should the RBNZ be hitting the “panic button” on the economy?

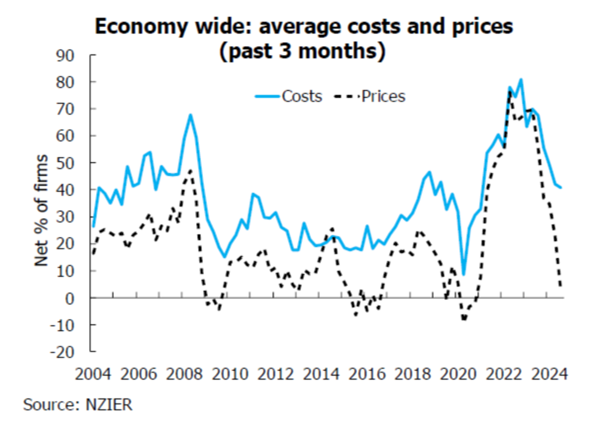

A reason to be measured with respect to rate cuts has been the persistence of inflation, but it is now possible that the RBNZ will become an “over-achiever” and go below its CPI inflation midpoint target of 2% (the target band is 1-3%). Inflation may even get to 1%. The QSBO showed that the softer economic environment is seeing business pricing intentions crater to materially below long-run averages.

Only 7% of respondents intend to raise selling prices over the next three months, which is the lowest reading (excluding Covid lockdowns) since 2015. Consumer demand has weakened, so businesses are struggling to raise prices. A soft labour market is driving down wage pressures. Currently 26% of businesses say that skilled labour is easier to find, the highest since Q2-2009. This all adds up to a much weaker labour market and also suggests there is still plenty of upside to the unemployment rate.

It could be suggested that an outsized move (i.e. more than 50bps) would be at odds with what other central banks are doing, so why should the RBNZ step out of line? As with most scenarios, some context is needed.

Last month the Fed eased rates by 50bps, with the US benchmark rate now sitting in a range of 4.75-5%. This “jumbo” cut surprised the market, with officials signalling a sharp increase in anxiety about current trends in the labor market. The RBNZ reduced rates in August by 0.25% to 5.25%. Official rates here are 0.375% higher than the US despite a materially weaker economic and employment backdrop, and arguably a greater risk of an undershooting in inflation.

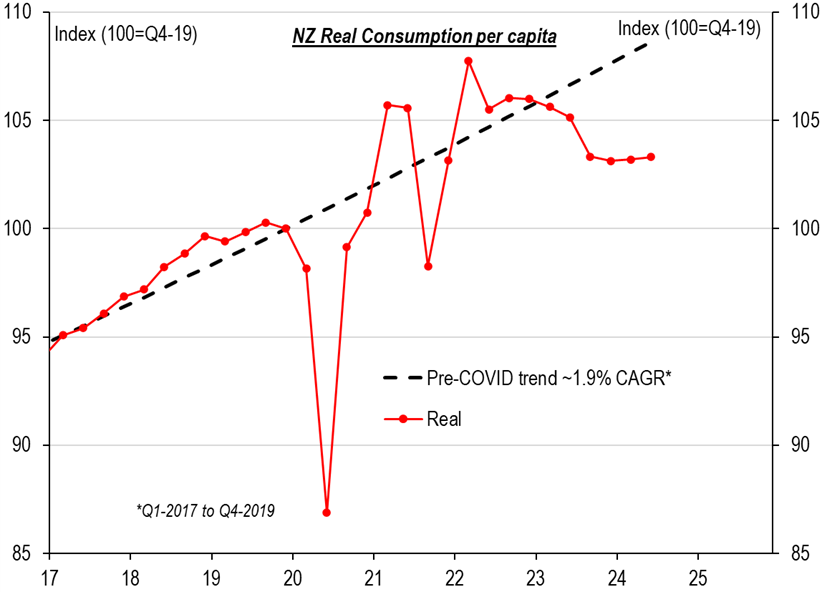

NZ’s economic data relative to the US is dire. NZ real consumption per capita is ~-5 percentage points below the pre-COVID trend while US real consumption per capita is ~11 percentage points above the pre-pandemic trend. The US recently reported real GDP growth at 3.0% annualized in the second quarter, while New Zealand’s real GDP shrank -0.5% year on year (or by -0.8% annualized) in the second quarter. Real GDP has contracted in New Zealand in four of the last seven quarters, with another quarter recording almost no growth.

Source: UBS

The Fed has flagged a slowing jobs market as a reason to cut rates, but the situation in NZ is worse. US Non-Farm Payrolls grew by 1.5% year on year in August. NZ filled jobs were down by around -0.5% year on year in July. The US unemployment rate was 4.2% in August 2024 while New Zealand’s (very lagged) June quarter unemployment rate was 4.6%.

Now let’s look at inflation. In the US, the Consumer Price Index retreated from a 2.9% annual increase in July to 2.5% in August. The RBNZ slashed their third quarter headline CPI forecast by 0.7% year on year in August to 2.3%. Our inflation data is dated (it comes quarterly with the next print on 16 October) but selected price indices covering ~45% of our CPI basket show inflation slowing to 1.7% year on year in August. NZ appears to be racing through to the bottom end of the RBNZ’s target range.

A lot of the “stickier” areas of inflation now appear to be deflating due to very weak domestic demand, as well as offshore factors. Insurance premiums are a clear example - growth is now flattening out (commercial rates are actually in decline) which compares to double digit price growth that was put through just six months ago. This was a material driver of non-tradables (domestic) inflation and this alone could reduce annual inflation by circa 0.3-0.4% over coming quarters.

Fuel prices (the strength in recent days on Middle Eastern tensions aside) also continue to retrace on a weaker global crude oil price and a stronger NZ dollar. Our currency has rallied 7% against the US over the last two months, and by 4% against the Chinese Yuan. Given our import dependence on goods from China, which is facing deflation itself, the currency strength is deflationary here too. It therefore appears quite likely the NZ inflation rate will undershoot the US CPI figures on current trends.

Bringing things a little closer to home, Australia seems to be some way off in even starting the easing process, but there are some clear differences between NZ and the “lucky country” across the ditch. The Australian economy expanded by 0.2% in the June quarter to be 1.0% bigger year on year (NZ’s shrank by -0.5%). Other stats in Australia that put New Zealand in the shade at present include unemployment (4.2% in Australia in August versus NZ at 4.6% in the June quarter) and retail sales values (growth of 3% in Australia in August versus a 1.5% decline in New Zealand as at June). Australian dwelling prices were up 6.7% annually in September while New Zealand’s were down 0.8% year on year in August. Seek has reported that August job ads were down 13% year on year in Australia while those in New Zealand were down 31%.

Australia also has cause to keep rates higher, given a backward-looking CPI measure has Aussie inflation (GDP-basis private consumption deflator) running at 4.4% versus 3.3% here. The fact also remains that the RBA never went as hard on the way up as the RBNZ did – official rates in Australia are 4.35% versus 5.25% for the RBNZ.

All told, the RBNZ looks considerably behind the curve and an aggressive 0.75% cut to 4.5% at the next meeting warrants consideration. Another reason to be more aggressive over the next two meetings is that the RBNZ has meetings in October and November, then a pause to February for the summer holiday (the Fed in contrast meets in December and January).

The downside of being too cautious on rate cuts over the next two meetings is the risk to growth, the impact on New Zealand households and inflation undershooting further. A lot can happen in three very important months of the year (December – February) for the economy.

Unfortunately, the RBNZ is unlikely to follow through this week with anything more than a 0.50% cut (central bankers by their nature are conservative). The RBNZ was one of the first central banks in the world (second only to Norway) to raise rates post the Covid boom, but will perhaps let the opportunity pass to make a powerful statement on the way down to get ahead of the “post sugar rush” bust.