Still in charge

By Greg Smith, Head of Retail at Devon Funds

Globally, March was a robust month for markets. The US indices performed strongly once again, although were outdone by Japan’s Nikkei, and also the FTSE100 as the UK recession proved a shallow one, and the Bank of England signalled rate cuts were imminent. Other major central banks largely stayed on hold (apart from Japan which signalled the end of its negative interest rate policy) but many also flagged that rate cuts were on the horizon, even if the exact proximity remained up for debate. Markets in NZ and Australia (the ASX200 hit an all-time high) performed strongly, with the RBNZ and RBA both displaying somewhat less hawkish tendencies.

All three major averages in the US notched their fifth straight winning month, capping off a very strong start to the year. The S&P500 surged 10.2% for its best quarter since 2019, with the most record closes (two out of every five trading days) in over a decade. The Nasdaq rose 9.1%, while the Dow jumped 5.6% over the quarter. Key factors included a resilient economy (also reflected in a strong earnings season), falling inflation (despite pockets of persistence) and a Fed prepped for rate cuts (without providing a firm timeline).

For the month the Dow rose 2.1%, the Nasdaq gained 1.8%, while the S&P500 surged 3.2%. The respective gains show that the rally which has been powered by super-cap AI-related names, while still powerful, is not as influential as it was. While Nvidia was up around 10% (and 80% for the quarter), the Nasdaq100 was fairly flat. While some super-caps have been strong (Microsoft and Nvidia made record highs during the month), other constituents have been less than “Magnificent”. Tesla fell nearly 30% in the first quarter.

Largely, the “Ides of March” came to pass without incident. This was despite a number of challenges, including two wars, a rising oil price (WTI hit a 10-month high), two relatively hotter-than-expected US inflation prints, and the revelation that three major economies (Japan, Germany and the UK) slipped into recession. The timeline for rate cuts by the Fed was also pushed out.

The Fed’s March meeting was significant in other respects. Rates were held at 23-year highs. Investors were however buoyed by officials appearing to indicate they will tolerate inflation being a little bit higher for longer than was previously the case. US economic growth projections for 2024 were lifted significantly (to 2.1%), while core inflation estimates were revised upwards slightly. Fed Chair Jerome Powell said that a strong jobs market wouldn’t stop the central bank from cutting rates and that the first-rate cut would be “highly consequential.” This also appears to suggest that the first cut will be followed quickly in succession by others.

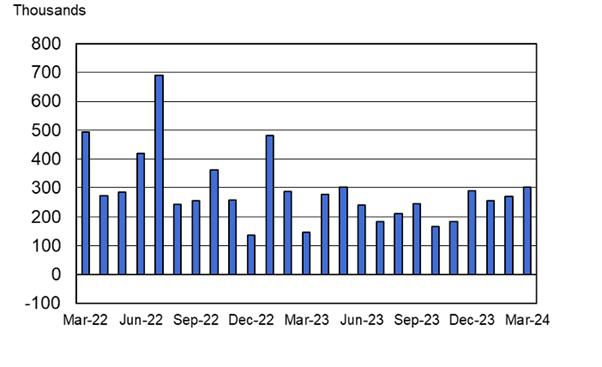

Odds of a June rate cut are currently around 50% according to Fed Funds futures pricing. A recent print of the Fed’s preferred inflation gauge was relatively benign overall, but had elements of “stickiness”. A resilient economy will also reduce the urgency of the Fed to cut rates if it so desires. The US manufacturing sector is in expansion mode for the first time since September 2022. The employment market in the world’s largest economy meanwhile has cooled but remains relatively strong from a historical perspective. After exceeding 2 to 1 during the pandemic, the ratio of positions to available workers is down to 1.35. The latest non-farm payrolls report showed job additions of 303,000 in March, substantially higher than consensus estimates for around 200,000. This is still well down from the gains of 400k+ regularly seen during 2022.

Source: Bureau of Labor Statistics

This will tick a box for the Fed as it looks to cut rates, even as recent inflation reads have been hotter than expected in some respects. After easier yards in 2023, the “last mile” of getting inflation back towards target was always going to be somewhat more of a challenge. Fed Chair Jerome Powell has expressed confidence in the economy a number of times in recent weeks but has also suggested that more evidence is needed that inflation is easing to lower rates. The markets are however still pricing in three rate cuts in the US this year.

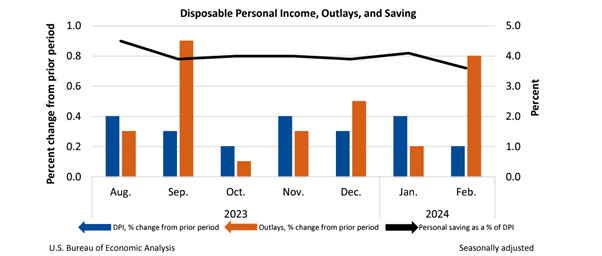

Elements of inflation have clearly been somewhat persistent. The Core Personal Consumption Expenditures Price Index (the Fed’s preferred inflation gauge) rose 0.3% in February, down from 0.5% in January and below estimates, but higher than levels in late 2023. A bright spot was that services prices only climbed 0.3%, half of January's advance. On an annual basis, core PCE eased to 2.8% from 2.9%, and is still trending lower.

Commodities markets are still also saying that rate cuts are on the horizon and that the US dollar will weaken further. Gold prices hit a record during the month, and are approaching US$2,300. Rising commodity prices are a double-edged sword, putting pressure on headline inflation. Rising demand and geopolitical tensions explain some of the increases in commodity prices seen to date. WTI oil edged above US$85 a barrel and has risen almost 20% in 2024. Copper has hit a 13-month high, while aluminium is at a 24-month high. Silver is at 2-year highs. Helped by unfavourable weather, cocoa prices have also hit a record, grossing about US$10,000 per metric tonne for the first time in history.

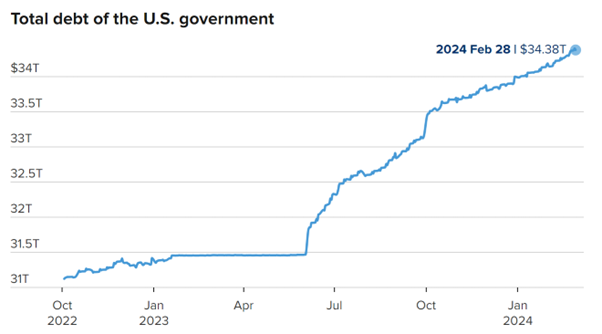

The prospect of rate cuts is taking the wind out of the US dollar’s sails, as is the US debt pile which is growing at the rate of US$1 trillion every 100 days. The national debt, which is what the federal government borrows to fund operating expenses, stands at over US$34.4 trillion.

All that said, inflation is continuing to trend down globally, and quickly in some places. Inflation in the eurozone slowed in March to 2.4%, with the core rate dropping to its lowest in more than two years. The European economy meanwhile has skirted a recession but remains tepid, as the ECB is prepped for rate cuts. The Swiss Central Bank has already been the first major central bank to hit the easing button, with a surprise rate cut during the month. European markets jumped in March, with the German DAX hitting a record. Other economies are also gliding onto a soft landing. After entering a shallow technical recession in the December quarter, the UK economy returned to growth in January. UK inflation has fallen decisively from a peak of over 11% to 3.4%.

It has been a slightly different story in Asia. The Nikkei in Japan soared to a record above 40,000 during the month. Strong wage growth data proved the catalyst for the Bank of Japan ending its policy of negative interest rates, and increasing rates for the first time in 17 years. Higher salaries are expected to fuel domestic demand for a country that has struggled with deflation for decades.

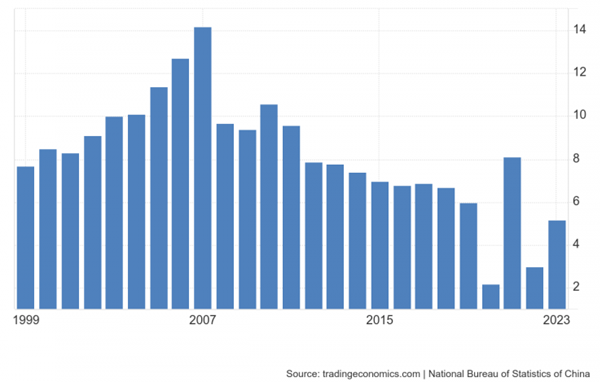

Chinese markets were more subdued, despite officials committing to a growth rate of 5% this year, the same as that achieved in 2023. The feat will be no easy one, particularly without further meaningful stimulus. There have nonetheless been pockets of positive data. China’s Official Manufacturing Purchasing Manager’s Index printed in expansion mode, ahead of estimates. A private survey meanwhile was even better in March, and the strongest since February 2023. While the property market is a concern, China’s growth target may not prove so fanciful – good news for NZ and Australia.

China GDP growth rate

It was a month of record for several markets, and this included Australia. The ASX200 hit an all-time high of 7,896, despite a subdued performance from the base metal miners as iron ore flirted with US$100 a tonne. Energy and gold stocks were buoyed by rising oil and bullion prices respectively. However, it was the banks that led the charge, and helped the ASX200 to rise 2.6% over the month, and 4% over the quarter.

There is momentum behind the big four banks in Australia. Commonwealth Bank of Australia is trading around record highs, while NAB, owner of BNZ, is around the highest level since prior to the GFC. ANZ is around the highest since 2017, and Westpac since 2019. While lower interest rates will dampen margins, and the mortgage market remains competitive, investors are reacting to the reality that bad debt levels and provisions have been lower than anticipated. High bank dividends are also more appealing as interest rates fall. People are (at this stage) getting through it all, with the mortgage cliff not panning out as badly as feared even if it is manifesting itself in other forms, such as lower retail spending (although Aussie retail sales got a kick from Taylor Swift last month).

Source: ABS

Inflationary prints during the month were also “investor friendly” in Australia. The monthly Consumer Price Index rose 3.4% in the 12 months to February, below forecasts for 3.5%. Annual inflation excluding volatile items has continued to slow over the last 14 months from a high of 7.2% in December 2022. Good news for the RBA. The minutes from their last meeting indicated that rate rises were firmly off the table, and the rates are heading lower from here.

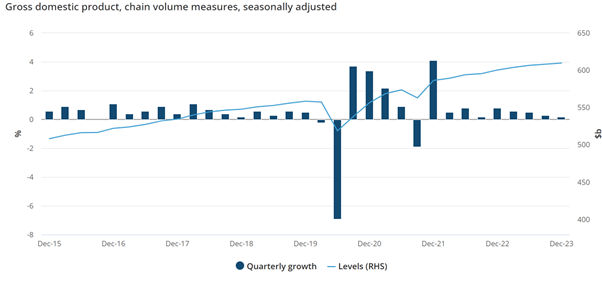

Australia’s economy has also glided to a soft landing, with real gross domestic product increasing 0.2% in the three months ended December. Household consumption grew by just 0.1% in the quarter and declined in per capita terms. Annual growth of 1.5% was however greater than the 1.4% expected, but still was the lowest rate of growth since 2000 after the dotcom bubble burst.

Source: ABS

Against this backdrop, an overweight towards Australia, and high-quality blue-chip names served the Devon Trans-Tasman portfolios strongly during the month. Light & Wonder, Sandfire, Santos, Macquarie and CSL were among the notable outperformers.

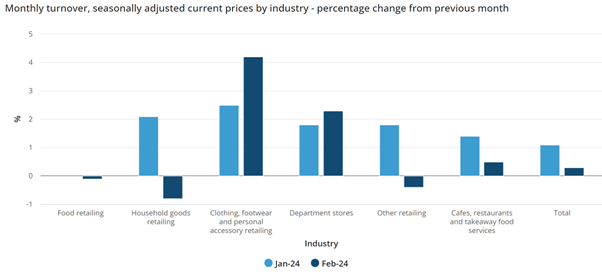

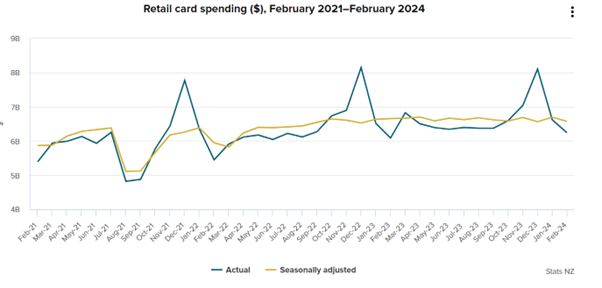

The Kiwi economy was not so fortunate, slipping into a double-dip recession in the December quarter. GDP fell 0.1% q/q and was down 0.3% annually – down 0.7% and 3.1% on a per-capital basis respectively. It was the fourth quarter in five where the economy contracted. Goods-based sectors showed the most strain. A cost-of-living strained consumer is also feeling the pinch and this was also evident in sentiment surveys and card spending numbers during the month, along with results/updates from several retail names. This is not surprising. One of Devon’s predictions for this year was that the Kiwi consumer discretionary sector would remain a tough place to be.

The local index has been a little late to the bull market party but appears to be getting there. After starting the month below par, the 3.1% gain in March for the index takes the benchmark’s rise for the first quarter to 2.8%. With NZ now in recession, “optimism” is growing that the RBNZ will also be cutting rates this year, with plenty of challenges ahead – nearly 60% of mortgage holders are yet to reset to higher rates. Dairy prices are meanwhile rising again, which is good news for a key part of the economy.

While there are challenges ahead, there is also some evidence of green shoots in the corporate sector. Activity indicators are picking up, and the manufacturing sector appears to be improving after having been in contraction for 12 consecutive months. Inflation expectations have fallen, and wage pressures are also moderating a bit. The economy is tracking in the way the RBNZ would expect and quite possibly “grinding out” a small positive growth number for the March quarter.

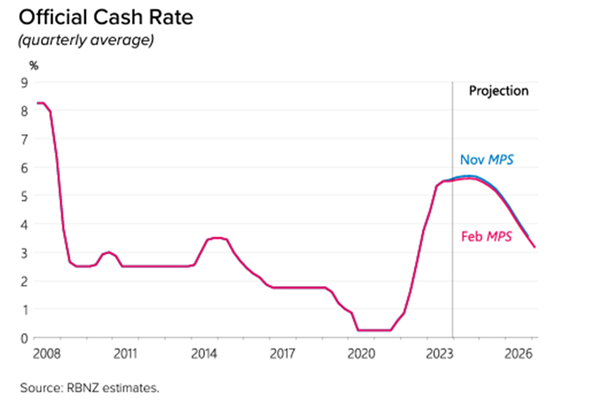

Sentiment during March was also lifted by the RBNZ’s monetary policy statement, and subsequent press conference at the end of February, which was definitely less hawkish than expected. The forward track of rates was slightly lower, with the peak coming down from 5.7% to 5.6%.

There was welcome acknowledgment from the RBNZ that headline and core inflation had fallen (as have expectations thereof) more than expected. Adrian Orr though suggested that the risks to the inflation outlook are “balanced.” The economy has clearly cooled though, with demand better matching supply capacity.

Company wise there were some notable announcements at different ends of the scale. Fisher & Paykel Healthcare soared to a 10-month high. Investor appetite for the company, which makes up nearly 13% of the NZ stock market, was stoked by the healthcare name upgrading its full-year revenue guidance and raising its forecast for net profit for the current financial year to $260m-$265m.

Fletcher Building shares meanwhile regained some poise as the company rang through the changes after the poor earnings result in February. Pricing tension was also boosted by the A$4.5b takeover approach for peer CSR across the Tasman.

Further down the boards, and one of the more interesting stories of the month was Synlait Milk which fell to a new record low. The half-year results were unsurprisingly a cause for concern, and debt challenges are being exacerbated by the company’s lack of progress with divestments. Synlait is not held in any of the Devon funds. The company’s fortunes contrast with those of key customer and shareholder A2 Milk whose shares have risen around 40% this year.

Elsewhere, Contact Energy was a strong performer during the month as was cinema software group Vista in the wake of the strong full-year result and forward guidance in late February. Vista is riding a strong box office, with 2023 taking up 30%, with “Barbenheimer” a big driver.

Overall, Devon’s Trans-Tasman strategies have had an overweight stance towards both Australian and NZ companies with offshore-facing businesses. This strategy has served us well. From a macro perspective, a key area of interest in the months ahead will be any clarity on when rate cuts from various central banks will be forthcoming.