Staying in May

An interest piece written by Greg Smith, Head of Retail at Devon Funds.

The old market adage about “selling in May and going away” turned out to be the antithesis of sage advice. Stock markets globally performed strongly last month, with investors encouraged by what appeared to be a de-escalation of trade frictions. The White House rolled out its first deal with the UK, European tariffs were paused, while tensions also cooled a little between the US and China, with both agreeing to bring tariffs down from nosebleed levels.

The US earnings season was solid, even as outlook statements were cautious in many instances, given macro uncertainties. Data on the US economy continued to paint a somewhat resilient picture, providing some comfort, despite trade matters remaining far from resolved. A new dimension was also added to the mix late in the month with the Supreme Court possibly having to decide whether to invalidate Trump’s tariff policy altogether. Despite a host of uncertainties, investors looked at the brighter side – the S&P 500 rallied 6.3% for its best May since 1990 and best month since November 2023.

Kiwi and Australian markets also delivered robust performances during the month, with gains of 4.3% and 4.2% respectively. The RBNZ and RBA both delivered rate cuts during the month, and with inflation in both central banks’ target range, officials set the scene for further easing against the backdrop of domestic economic challenges and international macroeconomic uncertainties.

The worst-case scenario painted by Donald Trump on Liberation Day has clearly diminished, and regardless of the motivation/drivers, there have been multiple “refinements” of tariff policies since then. Pauses, increases, and then reductions in proposed tariffs have been commonplace. All told, Trump has made material “adjustments” more than 20 times. Investors (and the Fed) are not surprisingly becoming accustomed to taking his words with a pinch of salt, and a bit of salsa. The acronym TACO (“Trump Always Chickens Out”) has caught on, even if it hasn’t sat well with the President himself.

The elephant in the trade war room though certainly got much smaller and less uppity during the month. The White House slashed its duties on Chinese goods from 145% to 30%. China reciprocated, lowering its tariffs on the US from 125% to 10%. This came as a huge relief to markets, with the quantum as well as the swiftness of the tariff reduction much better than expected.

The Trump administration maintained the 20% “fentanyl related” tariff on China, but stripping this out, both nations “equalised” their reciprocal tariffs to 10%. The US is retaining tariffs that were in place before early April for specific sectors/Chinese products (including steel and aluminium), but the magnitude of the overall tariff reduction is much larger than expected. There is now a 3-month window for Beijing and Washington to reach a more concrete trade arrangement.

Both sides had their own narratives in the wake of the ceasefire agreement. Donald Trump claimed a win, saying that China had agreed to “fully open up” to US goods. He said the talks were “friendly.” Beijing, meanwhile, also claimed victory, noting that a publicly defiant stance was the reason Chinese officials were able to strike a deal in Switzerland with relatively few concessions. A few weeks on, and there have been a number of stumbling blocks, with the US claiming China has held back on rare earth deliveries, and Trump saying Xi is “difficult to deal with.” China, meanwhile, has become publicly annoyed about the ban on Huawei. There may well be further twists and turns in this story yet.

Some will argue that the US has ceded to pressure, backtracking again, appreciating that America needs China more than vice versa. It may mean that this has all been about “muscle flexing” rather than driving US jobs or boosting the coffers.

It could also be argued that the “Trump put” is alive and well, with the President also having an eye on the stock market. In any event, investors were greatly relieved that tensions had de-escalated in quick time and that the tariff ceiling had also been lowered.

Investors have grown increasingly accustomed to TACO, but one backflip during the month was arguably the quickest yet. After calling for a 50% tariff on EU goods, with duties beginning from June 1 (and saying trade negotiations with the EU were “going nowhere”), the mood whipsawed from hostile to conciliatory. Officials from Europe said that negotiations have “new impetus” and that they were “ready to advance talks swiftly and decisively.” This conciliatory mood has continued despite Trump recently doubling the tariffs on steel and aluminium to 50%.

From the US perspective, the ability to play hardball with Europe for long was limited. A 50% tariff threat would hit over US$300 billion worth of US-EU goods trade, and lower the US gross domestic product by close to 0.6% according to some calculations, while boosting prices. The EU was also in retaliation mode.

This is also while major trading partners are making contingency plans in the event that things don’t work out. Beijing is planning for a new “Made in China 2025” campaign, which would prioritise technology, including chip-making equipment, over the next decade. There are also reports that trade officials from the EU and China are set to meet again soon. Europe has since stitched up a deal with the UK, rolling back the clock on Brexit.

As America’s largest trading partners, China and Europe have been a focal point for investors, and to a lesser extent, the UK, but more from a symbolic perspective, given that it was the first deal out of the box. There will still, though, be significant interest in just how many more deals can be agreed in principle before the broader 90-day pause expires. Japan, South Korea and India are likely to rank highly in terms of interest.

This is also while an “evolving” trade situation is now starting to flow through in economic data. Investors are now having to assess the future impact of Donald Trump’s “Big, Beautiful Bill”, which is with Congress. The Act is projected to raise the federal budget deficit by US$3.8 trillion over the next 10 years, according to the Congressional Budget Office.

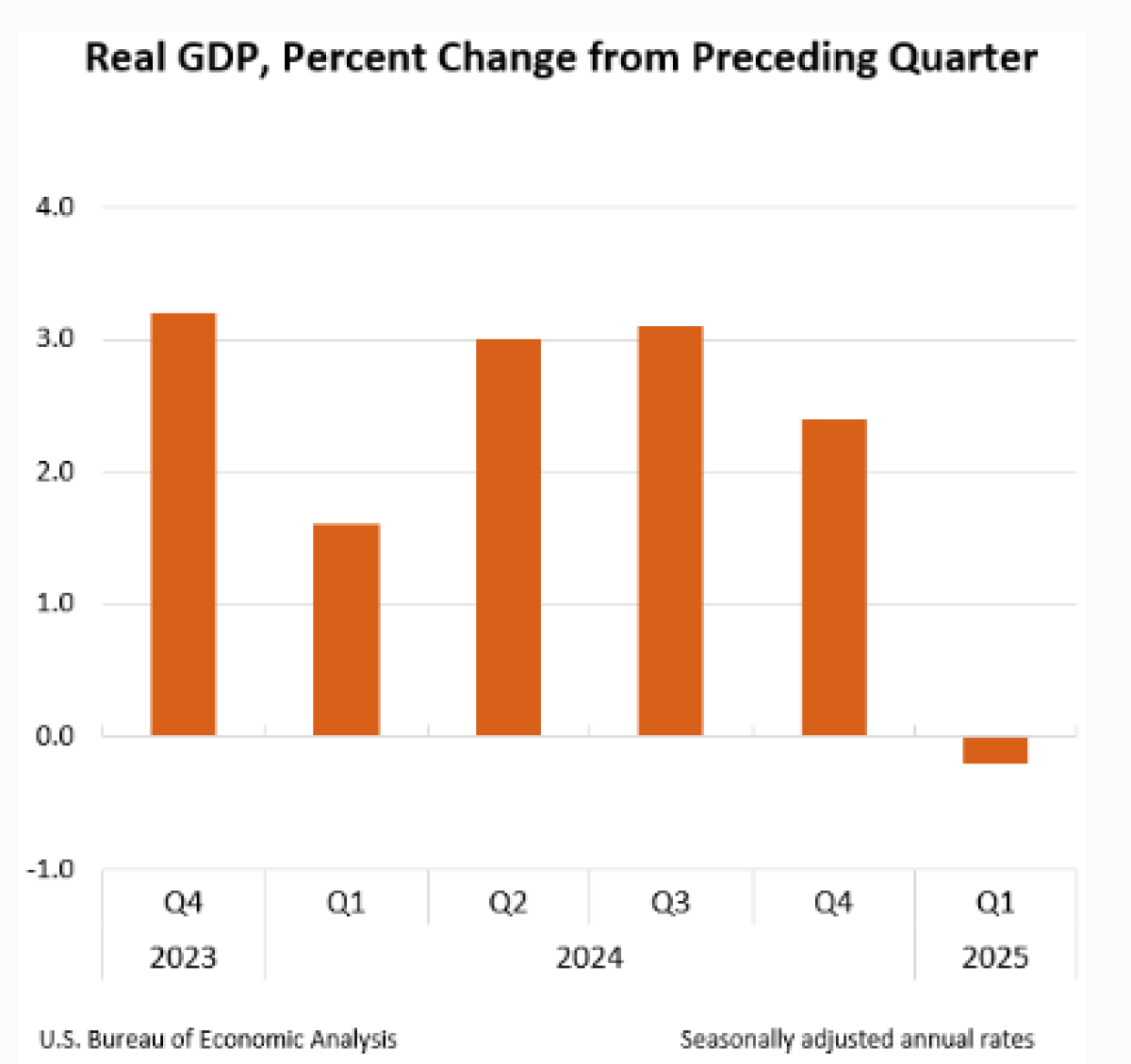

The US economy recorded its first contraction since 2022. US GDP shrank by a revised 0.2% in the first quarter of 2025, following 2.4% growth in the prior quarter. Weakness was attributed to softer consumer spending (+1.2% vs prior estimates of 1.8%) and a 43% surge in imports ahead of anticipated tariffs. An upward revision in the gross private domestic investment gain to 24.4% helped offset lethargy on the consumer side.

This is despite American consumers appearing to be a little more resilient than first thought. US retail sales edged up in April, and consumer confidence came in better than expected. Consumers appear to be optimistic about the trade situation following recent deals and tariff pauses. May’s rebound followed five straight months of declines.

US consumers are also optimistic about the labour market, but there are signs that this is softening. Continuing weekly claims are running at the highest levels since late 2021, and private sector hiring came in around a third of what was estimated, and the lowest level in more than two years in May.

Another tariff-induced weakness was also evident in a report from the Institute for Supply Management, which showed the US services sector unexpectedly softened in May. The latest “Beige Book” from the Fed also showed that the U.S. economy has contracted over the past six weeks. Tariffs were mentioned 122 times in the report. Factory activity in the US also remained in contraction for the third consecutive month in May.

Data from the New York Federal Reserve, meanwhile, has shown that three-quarters of companies that have seen increased costs have passed along at least some of the tariff increases onto customers. There has also been some divergence in this respect from US firms over the reporting season, not surprisingly correlated to the extent to which they rely on overseas sources of goods. Gap, for example, said that current tariffs would cost the company between US$250 million to US$300 million without mitigation.

With the bromance over, Elon Musk has said that Trump’s tariffs will send the US economy into recession in the second half of the year. His claims are not without substance. The OECD recently downwardly revised its outlook for US growth to just 1.6% this year and 1.5% in 2026. Immediately before Liberation Day, the organisation was expecting a 2.2% expansion in 2025. Policies on immigration and the DOGE initiative are also not helping.

The OECD assumes that “tariff rates as of mid-May are sustained despite ongoing legal challenges.” Time will tell whether this proves correct, and whether trade deals see the ultimate tariff rates come down further.

Donald Trump has pointed the finger at the Fed for recent economic data and called on the central bank to lower rates. Blaming the US central bank for economic weakness seems something of a stretch, given that its dual mandate includes price stability, which is at the very least being “complicated” by a dynamic trade situation. The “Big, Beautiful Bill” is creating a further complication.

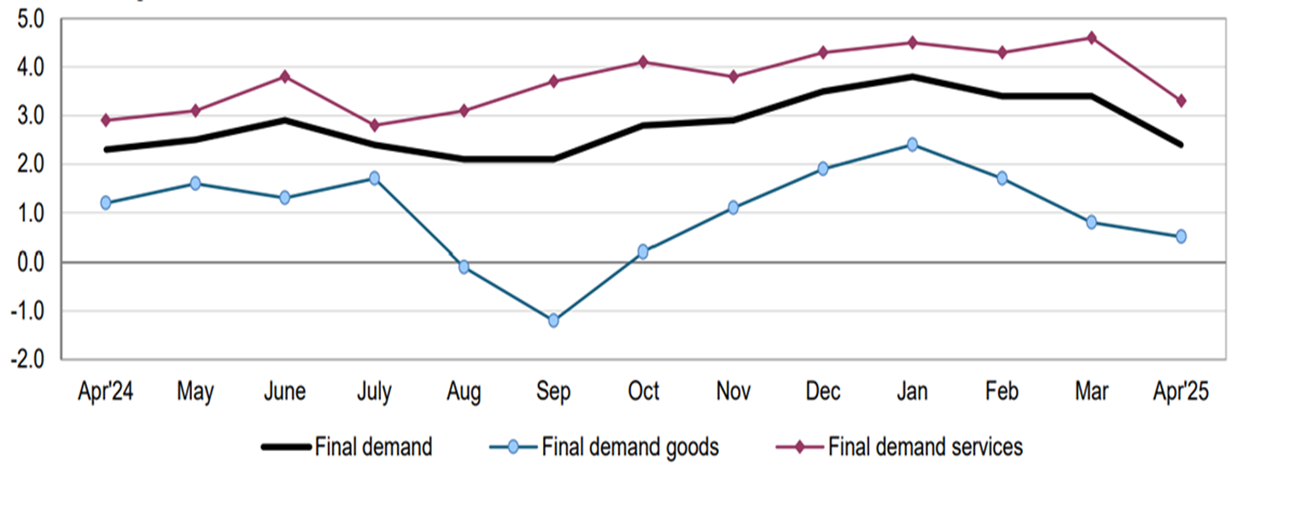

Inflation readings during the month generally came in better than expected, on both the consumer (CPI/PCE) and producer (PPI) side. There is, though, the prospect (as some Fed officials have noted) that this situation could reverse. The OECD has also revised the projection for US inflation for this year up to 3.2%, up from a previous 2.8%. They also said US inflation could even be closing in on 4% toward the end of 2025.

US Producer Price Index

Against this backdrop, there is a mix of views developing at the Fed. Some officials still see an interest rate cut before the end of the year, some are on the fence, and others appear concerned that lower inflation readings could reverse after tariffs work their way through the economy. There, meanwhile, seems to be a growing view that tariffs, while having an inflationary impact elsewhere, will have a deflationary impact in other areas, potentially exacerbating economic imbalances. Easing inflation and a benign outlook saw the ECB last week cut rates for the 8th time last week – rates on the Continent are less than half what they are in the US.

The Aussie market finished up 3.7% for the month and has recently been pushing up towards record highs. The RBA came through with their second rate cut this year, taking the cash rate down 0.25% to 3.85%. This was the first time since 2023 that the rate has gone below 4%. The cut was widely predicted, given that the bank's preferred inflation measure is below 3% and within the target range for the first time since 2021.

What was perhaps not predicted was that the central bank considered cutting rates by 0.5%. Officials said that uncertainty in the global environment had contributed to the decision. The bank downgraded its key economic forecasts, lowering projections for growth in exports, business investment, and household consumption and cutting its forecasts for US economic activity. GDP forecasts for Australia for FY26 were slashed from 2.4% to 2.1%. Michele Bullock said things were finely poised and officials were “ready to act” if needed.

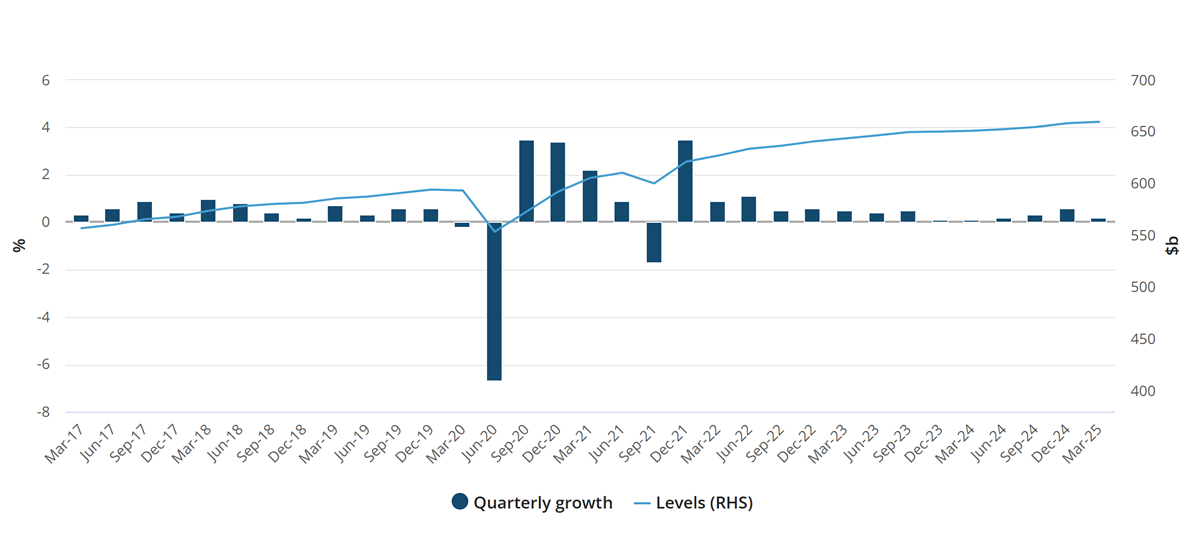

A soft quarterly GDP print last week (with falling government spending not being sufficiently countered by private investment) increased the prospect of further RBA rate cuts. Bullock noted that things were “finely poised” with worse-than-expected trade outcomes potentially leading to a downturn with unemployment hitting 6%, while inflation could go either way. Markets are now pricing in another 2-3 rate cuts by early next year.

Australian GDP

Source: ABS

What, however, is interesting is that the RBA considered cutting rates by 0.50%, and their economy is in a far better position than ours. The consumer, which Bullock emphasised was a big focus, is much more fragile here.

The NZX50 closed out May with a gain of 4.3%. Big gainers during the month included Fisher & Paykel Healthcare and Mainfreight, which were up 7% and 27% respectively. The earnings season was a somewhat mixed affair.

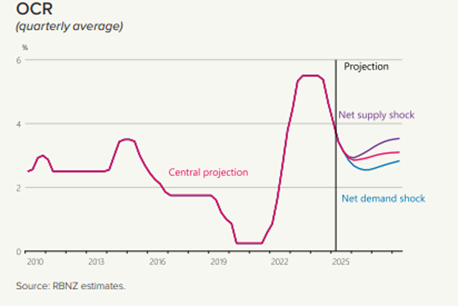

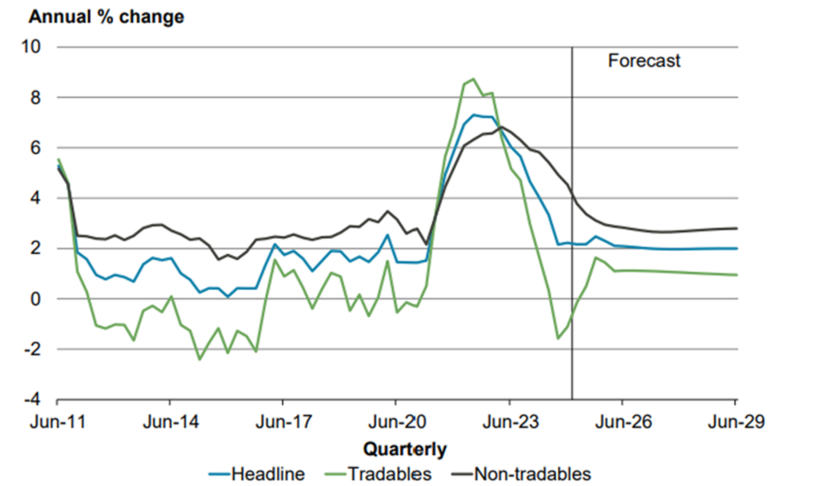

In the end, the RBNZ came through with a widely predicted 0.25% cut to interest rates, but retained full optionality and said it had no bias around their next move. The last quarter of this year has the OCR bottoming out at 2.85% as a quarterly average. Officials have noted that inflation is within the band, and the NZ economy is recovering after a period of contraction. However, measures of inflation expectations have increased, and projections for global economic growth have weakened since the February statement. On balance, the Committee expects the increase in global tariffs to result in less inflationary pressure in the NZ economy.

The MPS gives different scenarios with different outcomes (demand vs supply shocks), giving the Bank optionality, which creates some uncertainty.

Data since the OCR decision continues to paint a less-than-convincing picture of the economy. The May ANZ Business Outlook had headline confidence fall 12 points to +37, not exactly buoyant. The ANZ-Roy Morgan Consumer Confidence print had Headline Consumer Confidence falling five points to 92.9 in May. Perceptions regarding the economic outlook over the next 12 months have also weakened further.

Property market activity remains soft. Stats NZ reported the total annual value of building work consented fell $1.65 billion or 5.8% to $26.9 billion in the 12 months to April. The number of new homes consented has fallen for three years in a row. The data is not great and suggests that residential construction malaise is likely to continue for a while yet, with substantially fewer new homes coming onto the market as a result. Might this then see a pick-up in prices on the other side? Time will tell.

The agricultural sector, though, remains a bright spot; however, that said, the latest dairy auction saw a 1.6% fall in the GDT index. Previously somewhat resilient due to constrained supply, is the sector now finally starting to see the impact of softer demand?

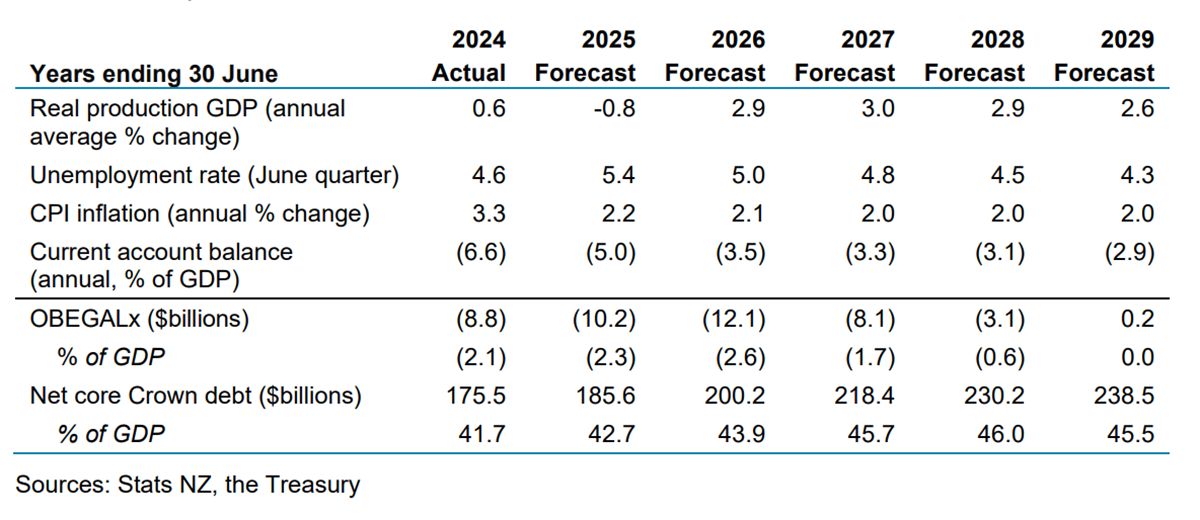

The Government Budget 2025 also underscored the weakness of the economy with less tax revenue, and the surplus was delayed until 2029. Net debt is projected to rise to 46% of GDP in 2028 before starting to decline. An average of $5.3b is being cut out of government spending (including the pay equity overhaul) for each of the next four years, but countered by new spending of $6.7b a year, with budgets upped for defence, health and education, along with law and order.

There were more positive surprises, including the new tax incentive called Investment Boost. It allows firms to deduct 20% of the value of new assets in the year they are purchased. This should increase business investment and boost economic growth. The initiative will cost $6.6 billion over the four years through to 2029 but is expected to lift GDP by 1% and wages by 1.5% over the next 20 years, with half these gains in the next five years. Business investment raises the productivity of workers, lifts incomes and drives long-term economic growth. We need this, given NZ has one of the poorest rates of productivity in the OECD.

The changes to KiwiSaver also look to be a net positive. The government is halving contributions, and higher earners are cut out, but 16 and 17-year-olds will start getting them. Phasing in a higher default minimum is the right move. Kiwis are historically bad savers, and the move is a great way to prompt more saving and diversify wealth. It also should be positive for first home buyers in the future, giving them a little helping hand to get on the ladder.

The Budget highlights what a soft position our economy is in. Meanwhile, current inflation levels provide plenty of cause for the central bank to deliver more rate cuts.

CPI inflation

Source: Stats NZ, The Treasury

We see the prospect of further rate cuts on both sides of the Tasman as being supportive for the respective economies, markets, and may also facilitate a further repricing of many of our high-quality names that we believe continue to trade at attractive levels.