Starting with a bang – will the ‘risk-on’ party continue?

By Greg Smith, Head of Retail at Devon Funds

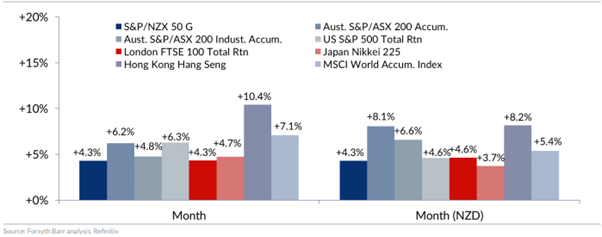

While the weather in the upper North Island has made for a challenging start to the year, it has been a very different story for markets, which globally have enjoyed a very strong rally thus far in 2023. The US indices have set the tone, with the S&P500 having had its best January in four years with a gain of 6.3%. Technology stocks have driven the momentum, with the Nasdaq up 10.7% and enjoying its best January since 2001.

The kiwi market has also caught a New Year tailwind, with the NZX50 rallying 4.3% in January. Other China facing countries have also seen their markets perform very strongly amid the country’s pivot away from a Covid-zero policy. The ASX200 in Australia surged 6.2% in January, while the Hang Seng in Hong Kong has leapt over 10%.

Upward momentum for stock markets in 2023 of course follows what was a very challenging 2022 for investors. Risk appears to be back on the table, on the view that the worst-case scenarios priced into markets will not eventuate.

But is newfound investor optimism justified, and what are the implications for markets in the coming months, and the rest of the year?

Global equity market performances in January 2023

Positive starts to the year historically bode well for the rest of the year. Looking at the S&P500, since World War II, a positive January has seen strength through the remainder of the year over 85% of the time. Gains have been more pronounced after a big sell-off. Of the five instances in which the S&P gained more than 5% in January after a negative year, the benchmark index rose 30% for the year on average. The broad US index typically carries a strong degree of influence on how other markets perform, including those in NZ and Australia.

Will history repeat?

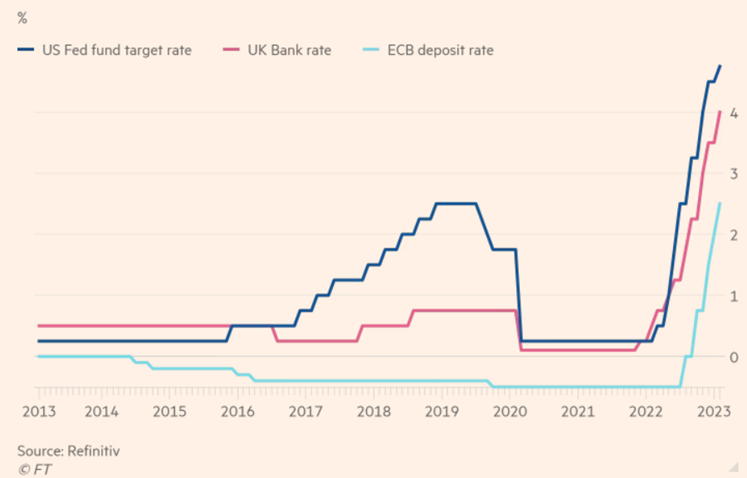

The central banks hold many cards, and recent central bank meetings were in focus for pointers as to when rates will peak.

The US Federal Reserve put through a highly anticipated 25bps increase in the Fed Funds Rate to a target range of 4.5%-4.75%, the highest since October 2007. The central bank signalled that ongoing increases were “appropriate,” and remains cognisant of persistent inflationary pressures. Markets though rallied hard after Jerome Powell’s subsequent address, and his noted “gratification” that disinflationary processes were underway.

Actions however speak louder than words. The 25bps rate hike was a step-down from the rapid pace of increases seen last year. The Fed increased rates by 50bps in December after four consecutive 75bps increases previously. There was also a subtle change in the language of the official statement, with Fed Committee now looking at the “extent” of future rate increases as opposed to the “pace” thereof.

The Fed Chair’s speech has provided cause for markets to continue the strong rebound that has been seen so far this year. The Fed Chair talked the talk about staying the course against inflation, but acknowledged that it was coming down (as he also did in another speech this week). The Personal Consumption Expenditures Index (the central bank’s preferred inflation gauge) moderated in December to 5%, from 5.5% in November.

Significantly, Powell also sees a soft economic landing. Markets really liked that, and this would be some feat given an aggressive rate tightening program which is nearing its end.

This is a key point, and perhaps one that is driving markets higher at the start of 2023. Concerns last year centred around the stickiness of inflation, and the consequent rate tightening that was needed, along with the related prospect of a hard economic landing. The Fed may need more evidence, but inflation is coming down in the US, and globally.

Other central bank officials elsewhere have also indicated that inflation is easing, and interest rates are close to peaking. The Bank of England raised rates by 50bps but indicated that the tightening cycle was nearing an end, with officials now expecting any recession to be short and sharp. Officials previously forecast that the UK economy would enter its longest recession on record.

The ECB also raised by 50bps, vowing to stay the course, but likewise recognised that inflationary pressures were easing. President Christine Lagarde (who like Powell said there was further ‘work to do’) acknowledged that the risks to the Euro area’s economic growth and inflation (exacerbated by the war in Ukraine) have become more “balanced.” She said it was likely the pace of hikes could slow from May onwards. Eurozone inflation fell for the third consecutive month, coming in at 8.5% in January, well down from the 9.2% recorded in December. The Eurozone economy has also proved more resilient than expected.

Reaching the mountain top – official rates in the US, UK and Europe

Globally, officials appear to be saying that while the war against inflation has not been won yet, the finish line is in sight. This is while economies may escape the growth expectations priced in by markets last year.

Across the Tasman, inflation may also have peaked. The RBA’s Head of Economic Analysis recently spoke to a Senate Select Committee about the cost of living. She said that inflation peaked at the end of 2022 at around 8%, and pressures will ease over the course of this year. These are gratifying forecasts for Australian consumers and borrowers.

The RBA met this week and put through a ninth consecutive rate rise, taking the cash rate 25bps higher to 3.35%. This was in line with expectations, although RBA Governor Philip Lowe adopted a slightly more hawkish tone than expected, suggesting that rates were likely to rise another couple of times yet. Market expectations are though for the cash rate to peak at 3.5-4%. Inflation is expected to fall to 4.75% by the end of the year. The RBA appears however to be maintaining a “data dependent” stance.

With the Fed, Bank of England, ECB and RBA effectively all acknowledging that global disinflationary processes are underway, and that rates are nearing their peak, it will be interesting to see what the RBNZ does at the next meeting on the 22nd of February.. Central banks do not operate in silos, and typically a degree of implicit co-ordination exists. The New Zealand central bank has however marched to a slightly different beat at times.

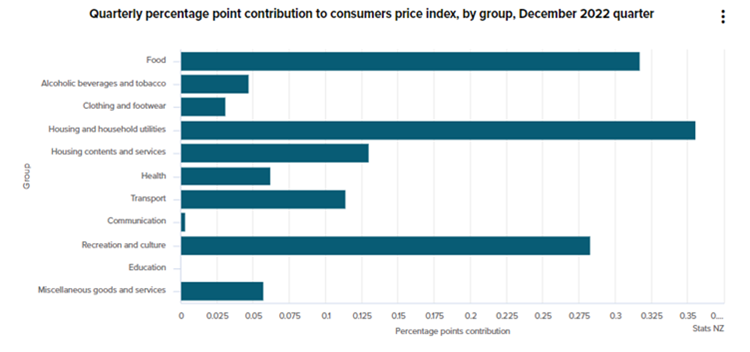

Receding global inflationary pressures bode well for the situation in New Zealand, albeit domestic drivers of inflation have remained persistent. The recent CPI release showed that inflation held at 7.2% in the December quarter, although was lower than the 7.5% forecast by the RBNZ for the period.

Key local drivers of inflation include food, with these prices increasing 11% on an annual basis. Upward pressures here could increase further following the damage to various crops from the floods. Construction and insurances costs are also potentially set to heap further upward pressures.

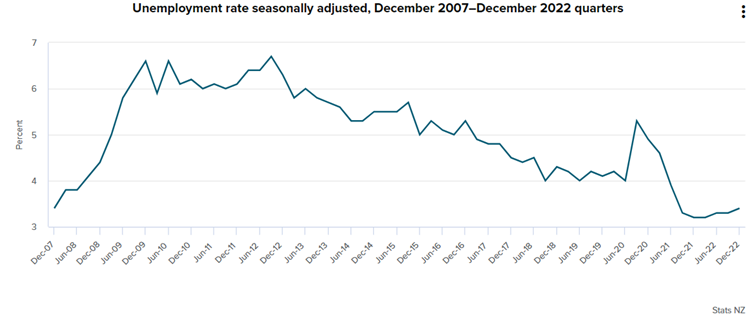

It is unquestionable that external/offshore inflationary drivers are moderating. In NZ, domestic inflation has remained sticky. The jobless rate however has ticked up (to 3.4% in the December quarter), which may signal that labour market tightness is easing, and alleviate current wage inflation pressures. Will the RBNZ see the bigger picture and side with a 50bps increase as opposed to a 75bps lift? Time will soon tell.

There will, in any event be some silver linings from the flood. The construction industry (think Fletcher Building) will benefit as homes (and infrastructure) will need to be repaired or replaced, driving up activity. Events such as these, while distressing, can be a net benefit to the broader economy, with construction activity factored into GDP.

The upcoming kiwi earnings season will also be looked at for signs of better-than-feared outcomes. Certainly, this has been the case in the US, with the quarterly results season there showing that many companies are coping better than expected with high inflation and a recessionary outlook. Executives at several bellwether companies, such as General Motors, have been relatively upbeat.

Growth though is certainly slowing down. These conditions have necessitated responses in many cases, either in the form of cost cutting (many blue chips, and tech firms in particular, have announced job cuts) or initiatives to increase demand.

The theme emerging from the earnings season continues to be that while there are challenges ahead, these may not be as bad as feared. A similar message is coming out on the economy. The IMF now expects the global economy to grow 2.9% this year, a 0.2 percentage point improvement from its previous forecast in October. This is down from a 3.4% expansion in 2022, but not cataclysmic. Encouragingly the IMF calculations see around 84% of nations facing lower headline inflation this year compared to 2022.

Added to the improving global picture, and particularly relevant to New Zealand and Australia, is that China is reopening. The benefits are already being seen in key data points. Chinese factory activity has expanded for the first time in four months in January. China is of course New Zealand’s and Australia’s biggest customer. Signs the trade tensions are easing between China and key trading partners, particularly Australia, is a big plus. China will need a lot of commodities as officials look to play catch-up on economic growth targets.

So, can the strong start made by markets continue? There is some evidence to suggest it can over the course of the year, although it pays to remember that markets by their nature are never linear.

To close, it is worth finishing with a recap on our first prediction for the year, from our ‘Top Predictions for 2023’ released in last month’s report.

We suggested that a soft-landing scenario could set the stall for a significant snap back in equity markets in 2023, “given considerable negativity has already been priced in.” We noted with “global supply chains opening up and growth moderating (but not collapsing), it is entirely possible that two primary levers of inflation work together in a conducive manner.” Ultimately inflation would need to moderate more quickly than expected. Recent central bank acknowledgments and market reaction suggest this scenario may already be unfolding.