Special Report

By Greg Smith, Head of Retail at Devon Funds

The month was a strong one for markets again. The S&P500 gained 3.2%, to record the fifth consecutive month of gains, the longest such run in two years. The Dow notched up a sequence of 13 consecutive daily gains during the month, which was the longest winning streak since 1987. In New Zealand and Australia, the indices firmed as well, with sentiment helped by both the RBNZ and RBA leaving interest rate settings alone at their respective meetings. The NZX50 added 1.2% while the ASX200 was not far behind the S&P500, rising 2.9% during the month.

Market momentum globally was fuelled by a robust results season in the Northern Hemisphere and retreating levels of inflation, as well as acknowledgement of the latter by many central banks looking to wrap up rate tightening programs. Other economic data has also been supportive of the narrative that a soft economic landing can be achieved in the US, the world’s largest economy (and elsewhere too). Oil prices (consumption of which is correlated with global growth) were also sending a signal during the month – rising 15% for the best July in nearly two decades.

While there has been plenty of debate amongst market participants, Fed Chair Jerome Powell has maintained for some time that a recession will be avoided. The equity market is buying into the soft-landing scenario as is the bond market. The gap between yields on US junk bonds and equivalent Treasury notes saw one of the biggest two-month drops since 2020.

While those in NZ and Australia paused, several major central banks raised rates during the month. The Fed added 25bps to go to a 5.25-5.5% range, the highest in 22 years. Jerome Powell noted that the Fed remained in data-dependent mode, but was encouraged that cost pressures were easing, and parts of the economy cooling. He was clear that future decisions on rate moves would be based on “incoming data” rather than being on a pre-set course, and that although acknowledging the lag of monetary policy, inflation would not need to get to 3% before the Fed went on hold.

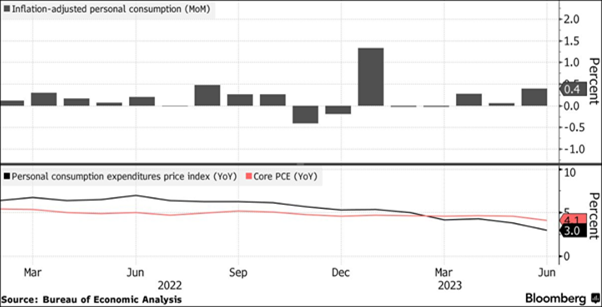

US officials are clearly encouraged that inflation continues to ease in the US. The headline PCE index increased 0.2% in June and rose 3% on an annual basis. The yearly rate was the lowest in 27 months, and there are now pockets of deflation. Particularly encouraging was the annual Core PCE (the Fed’s preferred inflation gauge which strips out food and energy prices) of 4.1%, the lowest annual increase since September 2021. On a monthly basis, PCE was just 0.2% higher.

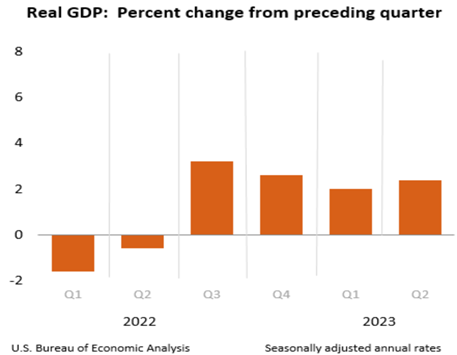

Stronger-than-expected US quarterly GDP numbers disturbed the market slightly, but the main concern for investors over the past 18 months has more been about whether inflation would come down with rising interest rates without adversely impacting the economy.

This appears to be playing out and was also evident in the US earnings season. While there were some prominent beats in the technology sector (Alphabet and Meta for example), many big old economy names also did well. Market gains in the initial months of 2023 were driven by “The Magnificent Seven” (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla). However recent months have seen more attention focused on “the other 493” components of the S&P500. Older economy stocks have also come to the fore – in the Dow, Boeing gained 13%, and industrial company 3M was up 11% – bettering all of the ‘M7’ during the month. The banking sector has been robust following strong earnings reports - Bank of America shares soared 12%.

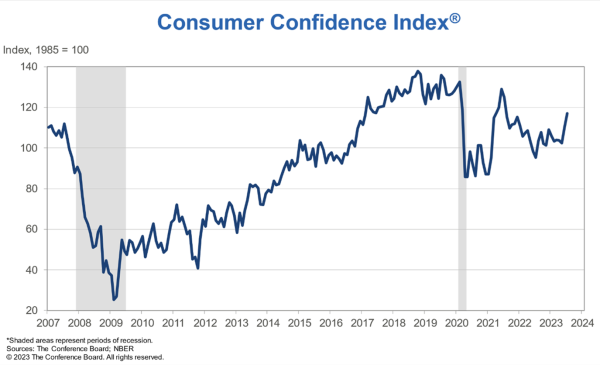

A weaker-than-expected retail sales print (which barely rose) surfaced during the month, but the US consumer has still appeared resilient in the face of rate hikes. The Conference Board’s Consumer Confidence Index rose in July to the highest level since July 2021. The Expectations Index notably improved to 88.3 – this is some way above 80, a level that historically signals a recession within the next year. Fears of a recession have clearly eased relative to earlier this year.

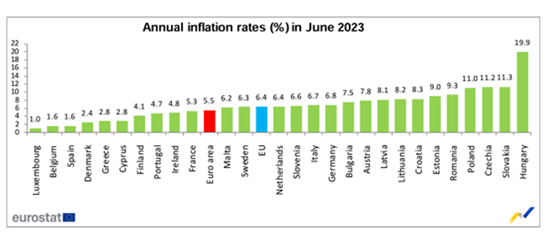

It was a similar story in Europe. The ECB raised rates for the 9th consecutive time, by 25bps to 3.75%, the highest level since 2001 (when officials were trying to boost the value of the freshly launched euro). ECB president Christine Lagarde acknowledged some new wording in the accompanying statement was not “irrelevant” and that policymakers had “an open mind as to what decisions will be made” in September and subsequent meetings. A pause is now a possibility given inflation has been coming down in Europe.

Europe’s annual inflation was confirmed at 5.5% in June, down from May’s 6.1%. It is forecast to be 5.3% in July. This is the lowest level since before Russia invaded Ukraine, contrasted with the 8.6% recorded in June last year, and is nearly half of its peak in October. UK inflation has also fallen to pre-invasion levels.

In parts of Asia, there are slightly different dynamics at work. The Bank of Japan remains something of an outlier. Officials talked up the prospect of “flexibility” but ultimately left rates in negative territory during the month. The Bank of Japan is more worried about deflation reasserting itself, even though inflation is above target. Japan’s CPI rose 3.3% year on year in June in line with expectations. This is the 15th straight month that the inflation rate is above the Bank of Japan’s 2% target.

BOJ governor Kazuo Ueda has said there was still some distance to sustainably achieving the central bank’s inflation target. The Nikkei, while one of the few major indices lower in July, has been one of the best-performing indices in 2023, up around 27% year to date.

The CSI300 in China gained 4.5% in July, but China’s renaissance post-Covid continues to be a patchy one. Factory activity contracted for the fourth straight month. An uneven economic recovery led investors to expect more stimulus and this appears to be forthcoming. The ruling 24-member Politburo vowed to lift employment and revive what they frankly called a “tortuous” economic recovery.

While the measures were relatively light on detail, it was more about the signals, with Beijing sending a message that it wants to get growth back on track. This would provide a further boost to global economic growth. The IMF has raised its global growth forecasts to 3%, up 0.2% from its April prediction, despite China’s recovery ‘losing steam.’ The latter may now be in for a boost. The IMF sees headline inflation reaching 6.8% this year, falling from 8.7% in 2022.

What is good for China is also good for Australia and New Zealand, with the country being our largest customer.

The RBA left interest rates unchanged during July (and again on August 2nd). Officials are adopting a “wait-and-see” approach to further rate hikes. Officials have noted that the Australian economy is experiencing a “period of below-trend growth and this is expected to continue for a while.” The central bank sees GDP growth of around 1.75% over 2024, and 2% the following year.

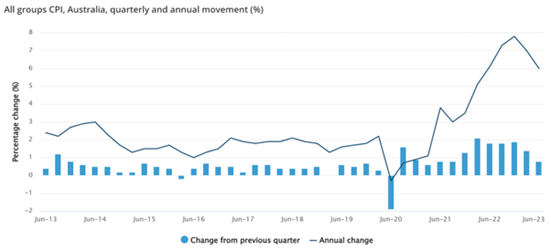

But as is the case in much of the world, central bank officials acknowledged that inflation is coming down (and that the economy has cooled– there was a soft retail sales print during the month). Headline inflation fell from 7% in March to 6% in June. This was below expectations of 6.2%. The quarterly rise of 0.8% was the slowest pace since September 2021. Annual inflation for goods was 5.8%, down from 7.6% in March - price pressures have eased across discretionary consumer goods like clothes, furniture, and appliances.

Source: ABS

There were still pockets of strength, with international travel and rents recording the strongest quarterly rises since 1988. Food price inflation remains sticky. Services inflation remains very high as well (and is higher than goods inflation for the first time since September 2021). Annual inflation for services hit 6.3%, the highest since 2001.

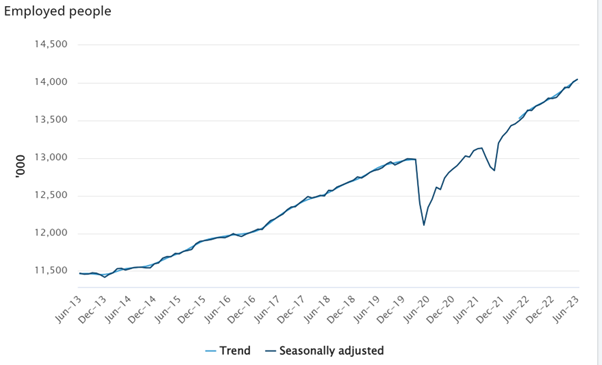

Nonetheless, the figures were likely well received by the RBA. Trimmed mean inflation, the RBA’s preferred measure of underlying price pressures, eased from 6.6% to 5.9%, and below expectations of 6.0%. Officials have though indicated that they want to leave optionality in case the trend of lower inflation subsides. The RBA like other central banks remains in data-dependent mode but will be comforted that the employment market has remained resilient. The Australian economy created 32,600 jobs in June, more than double consensus expectations. Australia’s jobs market is on a big streak, with a much higher share of the population employed than before the pandemic.

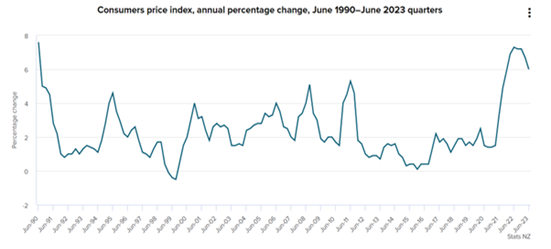

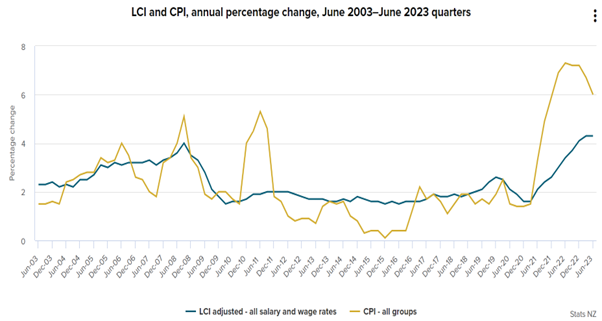

Inflation is also coming down in NZ. The June quarter CPI came in bang on 6% annually, down from 6.7% previously. Inflation is now the lowest since late 2021. Quarterly inflation though was 1.1% (above forecasts of 1%), with food prices up 2.2%, housing-related costs up 1.2%, and transport down by 1.9%. Food inflation is however still very high, running at 12% annually. The cost of building a new house is coming down but still up 7.8% annually.

The fact that headline inflation is falling is good news but there are some moving parts. Tradables (imported) inflation is coming down and is now 5.2% from 6.4% in the last quarter (international airfares are falling which is good news for travellers). However domestic inflation remains ‘sticky.’ Non-tradeable inflation is still very high at 6.6% (the RBNZ forecast would be 6.3%), negating the argument that our inflation is being driven by offshore factors.

In any event, headline inflation is slightly lower than the 6.1% which was forecast by RBNZ, and helps the idea that rate hikes are coming to an end. The RBNZ left rates on hold during the month.

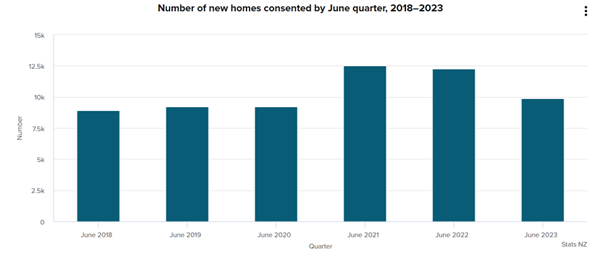

The Kiwi economy has clearly cooled. Building consents in June were down 20% from the same quarter a year ago, and down 2.6% on the March quarter seasonally adjusted. This was an improvement on the 8.8% decline seen in March in the previous quarter. Time will tell if things are bottoming out, given the shortage of housing in NZ and population growth.

The employment market has also softened if only a tad. Labour market statistics showed that unemployment increased to 3.6% from 3.4% in the June quarter, slightly above forecasts of 3.5%. Employment growth though of 1% was stronger than the expected 0.6%. The participation rate was also higher than expected, with inward migration playing a role. It was interesting that wage growth was below forecasts. While recent wage agreements could fuel more wage inflation, there may be a broader turning point at hand. Certainly, the worm has already turned with respect to the CPI.

While New Zealand eked out a small trade surplus for June 2023 of $8.8m (against expectations of a sizeable deficit), a weaker Kiwi dollar would meanwhile be helpful to our exporters, some of which are now seeing pricing and volume tailwinds subside. This includes the dairy sector (whole milk powder prices dropped 8% at the latest auction). A pandemic beneficiary in this camp is Mainfreight which updated at its annual general meeting that June quarter trading was down 19% revenue-wise and 43% lower in terms of profit before tax.

All that said, Kiwi businesses are slightly more upbeat. In contrast to a fairly uninspiring print on consumer confidence, ANZ reported that business confidence lifted five points in July to -13, the highest since September 2021 (although note this is still a negative number overall). A key point was however that while the economy is slowing it is certainly not coming to a complete stop.

Around 13% of businesses now expect economic conditions will weaken in the year ahead. Expected Own Activity fell two points to +1. The economy is slowing but not cratering. Overall activity and confidence are heading in positive directions but are still weak from a historical perspective. The question is whether there is enough weakness for the RBNZ to pass on another 25-basis point hike. The RBNZ meets next on August 16th.

Corporate announcements have been in a very quiet period. This will change this month with the earnings season getting underway on both sides of the Tasman. Investor expectations vary from sector to sector, and as always need to be measured up against share price performances/valuations. While inflation is clearly falling, there remain several other uncertainties concerning the business climate. Statements around the outlook will be in focus as ever.

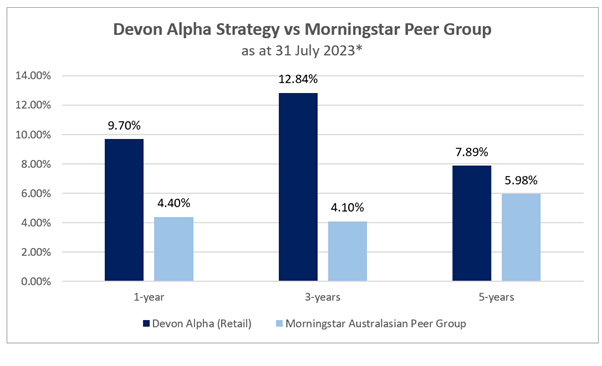

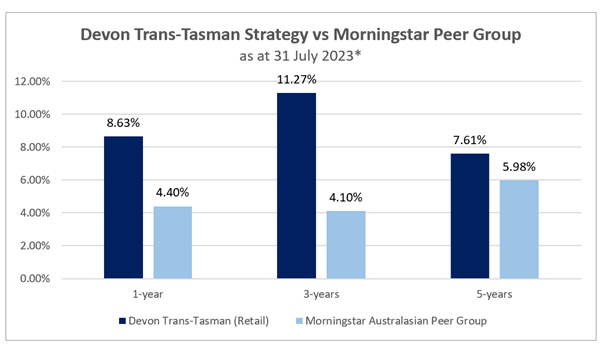

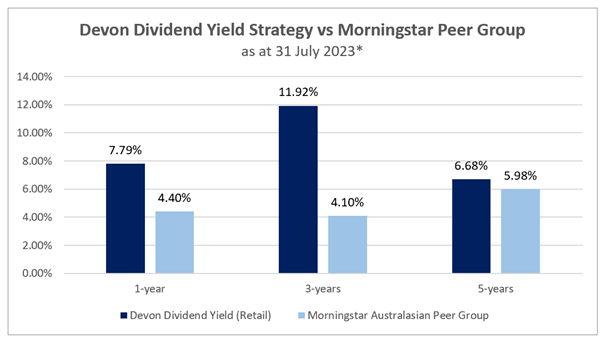

The Devon funds meanwhile continue to perform strongly. Notable performers across some of the portfolios include James Hardie which rallied more than 9% during the month, while Seek climbed more than 14% during July. Determining which stocks (and the weighting of) to be in, and which not to own, is generally more fruitful for active stock pickers such as Devon. Volatility (and uncertainty) in markets continues to be very productive for this approach.

Source: Devon, Morningstar

Source: Devon, Morningstar

Source: Devon, Morningstar

*The figures provided above are based on rolling 3-year returns (net of fees, inclusive of imputation credits but before tax) sourced from Morningstar to 31/7/2023. ‘Peer Group’ is based on the average performance of a grouping provided by Morningstar of New Zealand-based Fund Managers, Australasia Region. Past performance does not represent future performance. Returns are based on a PIR rate of 0%.