Resilience

By Greg Smith, Head of Retail at Devon Funds

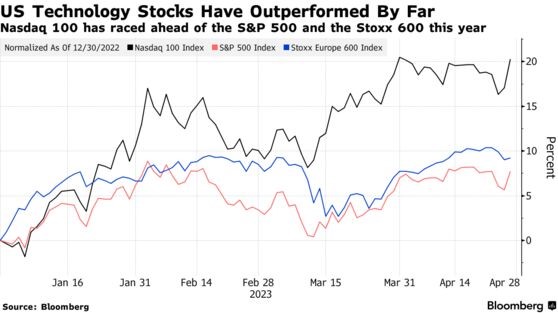

Markets globally were higher in unison over the course of the month. The NZX50 climbed back above 12,000 and rose 1.1% during April. Across the Tasman, the ASX200 posted a larger gain of 1.8%. Continuing positive global sentiment offered a helping hand to both benchmarks. The S&P500 in the US has gained nearly 9% through the first four months of the year. Confidence has been fairly broad based, although the technology sector has driven the momentum – the tech laden Nasdaq has rallied around 17% over the same period.

Optimism has been driven by signs that the global economy is holding together in better than expected fashion. Inflation is coming down, and this has added credence to the view that central banks are potentially nearing the end of their rate tightening plans.

The earnings season in the US, the world’s largest economy, has so far been encouraging. While there have been some misses (Tesla was a high profile one), the majority of companies that have reported to date (~80%) have beaten earnings expectations, which is the biggest proportion since the third quarter of 2021. This situation has not been restricted to the US - across the Atlantic, 70% of companies reporting in Europe have reported better than feared earnings.

Results from the large banks helped investors (and depositors) move on from last month’s banking crisis. Sentiment has been boosted further by the news that one of the regional banks at the centre of the crisis, Californian regional lender First Republic, has been taken over by JP Morgan Chase. While marking the second largest bank failure in US history (after Washington Mutual in 2008), the deal may draw a final line through contagion fears within the wider banking sector.

Technology stocks have propelled markets higher this year, and results from big tech names have generally been on the positive side of the ledger. Microsoft shares (held in the Devon Global Sustainability Fund) hit a one year high after quarterly revenues and earnings comfortably beat expectations, with its cloud business performing strongly. Facebook owner Meta Platforms also surged after the company reported an unexpected increase in quarterly revenue after three straight periods of declines. The advertising market seems to have plenty of life in it, which was also seen in earnings from Google owner Alphabet.

Amazon sent a similar message about the advertising market, although the tech titan’s cloud business is slowing down from very robust levels of growth. One of the tech names cutting costs is Intel, which reported the biggest quarterly loss in its history. Investors were however enthused by reports that the slow-down in the PC market is starting to plateau.

The global economy is clearly slowing down, but there are also bright spots. US first quarter GDP numbers came in below forecasts, but strength in consumer growth, a big economic growth engine, surprised on the upside. Inflation is coming down, but possibly not at a quick enough rate. A key inflation gauge followed by the Fed, the Core Personal Consumption Expenditures Index, fell only slightly in March to 4.6%, from 4.7% the previous month. It was little surprise therefore that the Fed this week put through another 25bps rise to take interest rates to a range of 5-5.25%. Officials though also left the door open to a rate pause.

Somewhat persistent inflation in Australia also drove the RBA to increase interest rates by 25bps this past week. This was a surprise to markets, with the central bank having hit the ‘pause button’ in April. In addition to inflation (6.6% at the ‘core’ level) being higher than they would like, officials have noted that the jobs market remains very tight, wage growth is elevated, and the property market had pushed higher since the central bank’s last meeting. Ultimately it looks like Governor Lowe and his colleagues are wanting to maintain ‘optionality,’ and make decisions on “all available data.”

It appears to be a similar story for the RBNZ which has released its financial stability report, a six-monthly health check on the state of the financial system. The central bank’s leading line is that New Zealand’s financial system is “well placed to handle the higher interest rate environment and international financial disruptions,” even if the full extent of the impact of previous tightening is still to be seen.

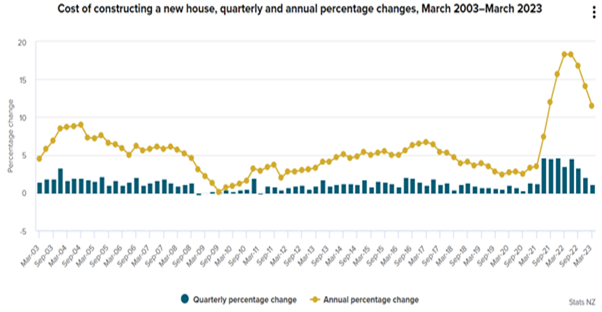

While inflation has remained high, it is declining, and the central bank has recognised that parts of the economy have already cooled. This is particularly true of the property market, with prices now back at February 2021 levels. The Reserve Bank’s recent decision to ease loan to value restrictions (from 10% to 15% of bank’s lending books for owner occupiers with a 20% deposit or less) was a significant acknowledgment here. Construction prices meanwhile have fallen sharply.

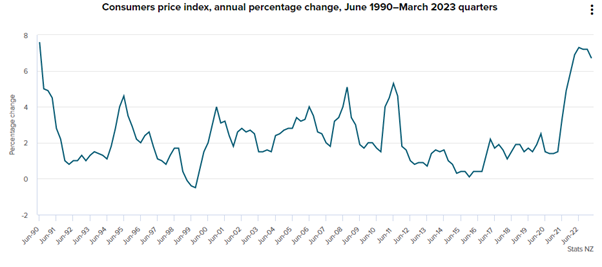

Inflation generally is coming down in New Zealand, and much quicker than expected, at the headline level at least. The CPI rose 6.7% in the year to March, back at levels we last saw at the end of 2021. Few, if any, had predicted a 6 out front as opposed to a 7. Inflation slowed more than expected over the quarter, rising 1.2%, compared to average consensus views of around 1.5% and well below the RBNZ’s forecast of 1.8%.

Inflation is past its peak in New Zealand, as it is globally. But before getting too excited about “twin peaks” it is worth noting that domestic inflation (non-tradeables) remains persistent, and at 6.8% is the highest since the CPI series began in 1999. Inflation is shifting from goods to services – which means the cost of labour comes into focus.

The stability report back in November flagged the pain that was to come as rising global interest rates had an impact on individuals and businesses. The latest report appears to strike more of a reassuring tone, noting that the central bank is not seeing significant levels of financial stress, and that the financial system is displaying resilience.

The fact remains that there will be some challenges ahead for many, particularly individuals that bought properties in 2021 – a quarter of existing mortgage lending was initiated in that year, with around 20% to first home buyers. With effective average household lending rates currently at 4.5%, and set to rise to 6% by the end of the year, an estimated 22% (from 9% currently) of an average household’s monthly disposable income is set to be spent on mortgage interest payments alone by the end of 2023.

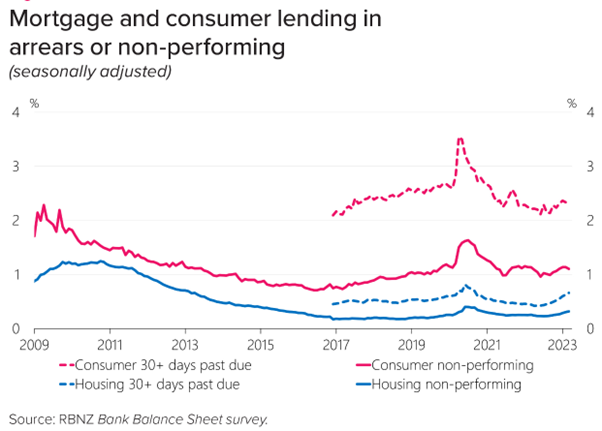

There are some bright spots, however. Households built up significant financial buffers during the pandemic, and incomes have risen. A tight jobs market has kept unemployment around historic lows at 3.4%. Annual income growth has not quite kept up with inflation, but is running at a record 4.3%. Households have also coped by cutting back on discretionary goods expenditures (not travel and services though) amid wider cost of living pressures. Arrears generally are running at very low levels.

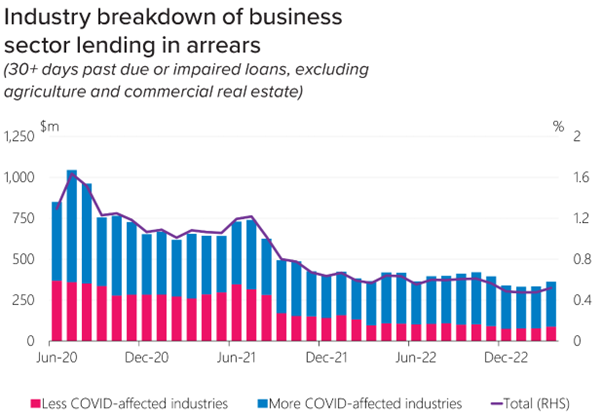

Businesses have also had to deal with higher interest rates, although most have coped so far, particularly those with pricing power. With shorter dated loan tenures, many businesses have already had their debt repriced. The RBNZ sees around 80% of businesses as being on floating, or coming off existing fixed rates in the next three months. While businesses are also dealing with some uncertainty over the outlook (and being an election year), the encouraging point is that on the whole, businesses are still hiring and investment intentions have remained relatively firm.

Plenty for the RBNZ to consider. We will get detailed projections, along with a decision on rates, at the next Monetary Policy Statement in a few weeks’ time, on May 24th. A silver lining for borrowers is that the RBNZ may be just about done with its rate tightening program. Depending on how the economy is placed, the central bank may even be cutting rates by the end of the year. Time will tell.

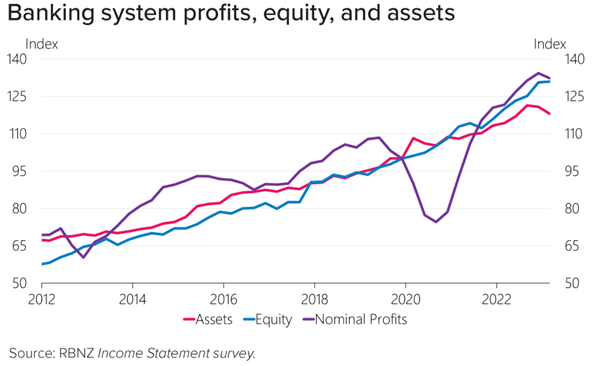

The RBNZ has also attested to the resilience of the wider banking system, amid a number of economic scenarios, with the level of underperforming loans remaining low in historic terms. While recent weather events have affected the profitability of insurers, the RBNZ also noted that New Zealand’s banks are not materially exposed to the same interest rate risks which have contributed to some recent bank failures in the United States. Officials see that the New Zealand banking system’s capital and liquidity positions are strong, with profitability and asset quality remains high.

We will have half year results from ANZ and Westpac in the coming days, as well as a first quarter update from BNZ owner, National Australia Bank. The results are likely to reflect a very strong period for earnings, with bank margins having benefitted from rising interest rates. Perhaps this time, more than ever in recent times, there will be significant interest in outlook statements, and to see whether the commercial banks are on the same page as central bankers.

Better than feared scenarios continue to emerge on a regular basis as it relates to the macro-economic and corporate environments. That said, investors are also continuing to deal with a still significant degree of ambiguity in terms of data and financial projections, both globally and domestically. This continues to create a highly productive environment for Devon’s active, valuation aware, investment approach.