The Outlook for China and Commodities

10 February 2020

In managing our clients’ New Zealand and Australian investments it is critical for us to have a view on what is happening in China. China is not only the world’s second largest economy, it is also Australia’s and New Zealand’s largest trading partner (c. 20-30% of both countries’ exports) and its economic performance directly influences investor sentiment across local stock exchanges.

As we entered 2020 there were signs that the Chinese economy was showing signs of stabilising its growth rate. This followed a five-year period where their real GDP growth rate had slowed from 8% to 6% per annum. If this growth had stabilised it would have brought with it important investment implications, particularly for the Australian commodities sector. Broader global indicators also suggested we were nearing an inflexion point for growth, following a soft patch in mid-2019. The key risk to this thesis though is the recent outbreak of the Coronavirus. This is now likely to weigh on any short-term growth recovery with longer-term economic disruption contingent on the severity and duration of the outbreak.

As we concluded 2019, we were encouraged by Chinese growth prospects, in large part due to progress on the US-China trade dispute. On 11 October last year there was agreement on the broad outline of a trade deal and this was subsequently signed by key officials on 13 December. The agreement marked the first real breakthrough in close to a two-year trade war that has reduced growth rates in both economies. As part of the deal, China is to significantly increase its agricultural purchases from the US over the next two years. In exchange, the US will reduce tariffs on $120bn of Chinese imports from 15% to 7.5%. Whilst risks remain around the durability of the deal it was expected to provide some respite for key manufacturing sectors in both countries.

Additional Chinese government stimulus over the past year has also helped support GDP growth. It is difficult to precisely gauge the exact level of stimulus, but economic research house Alpine Macro estimates it at around 1.5% of GDP. They cite large infrastructure projects and tax cuts as the key drivers while the People’s Bank of China has injected significant liquidity in recent quarters.

The combined effect of trade war resolution and government pump priming saw industrial production growth lift 6.9% year-on-year in December (compared to 6.2% in November and consensus expectations of 5.8%), further assisted by restocking and rising output ahead of the Chinese New Year. Fixed Asset Investment also grew 11.8% year on year in December, up from 5.2% in November, in part due to strong property investment. Outside of China macro data has stopped surprising negatively. Indeed, the January OECD leading indicator (which is designed to pick turning points in economic activity 6-9 months ahead) points to growth stabilising in most advanced economies.

However, all of this analysis is today significantly caveated with respect to the Coronavirus outbreak. In late December the Chinese authorities confirmed that a new virus originating from the city of Wuhan had emerged that is from the family of viruses that include the common cold, SARS and MERS. Although the data surrounding this situation is evolving quickly, at the time-of-writing there have been over 40,000 confirmed cases across 26 countries and territories. There have been over 904 deaths from the virus. In response to the emergence of the virus, the Chinese government has locked-down cities with a combined 60 million inhabitants, placed limitations on other travel between provinces, has suspended all schools and universities in Beijing, and the Chinese New Year holiday has been extended (by two working days, although many employers have requested that employees extend their holidays further). Encouragingly, government action has occurred far more quickly and aggressively than during the SARs outbreak in 2003. However, in the short-term there will likely be a larger economic impact given the unprecedentedly aggressive nature of the measures undertaken. UBS have estimated that if the outbreak is successfully controlled during the first quarter of 2020, Q1 growth will drop to 3.8%. Not unexpectedly, consumption is likely to be severely impacted with the most affected sectors including travel and tourism, as well as transport. At this stage though, the expectation is that subsequent quarters should see a rapid recovery in activity due to tax relief being provided for affected businesses and additional infrastructure investment being made. It is worth noting that the impact globally will also be larger than it was with SARS because the Chinese economy is today a much larger part of world GDP than it was in 2003.

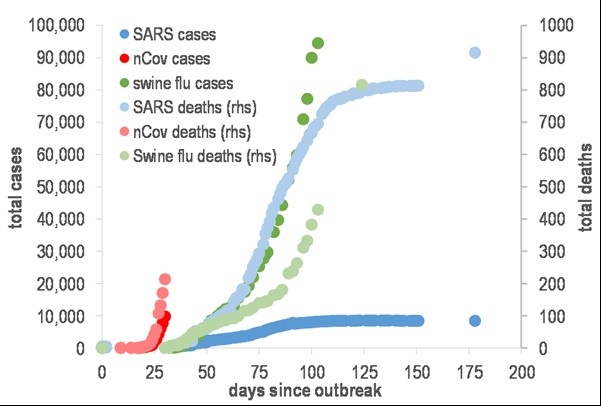

There is still a shortage of facts about the virus but looking at past episodes like SARS can be instructive. The first SARS case was found in November 2002 and the infections peaked in late March 2003. Equity markets outside of Asia came though relatively unscathed. According to Credit Suisse, during other public health scares (Ebola, swine flu and bird flu), any market declines were quickly recovered once the virus was under control; specifically, markets began to recover as soon as the growth rate in the number of infections showed evidence of peaking. One of the key differences though between Coronavirus and those previous examples lies in the rate of contagion. As the chart below from J.P.Morgan highlights, even though the mortality rate is lower this time, the speed of communication of this particular virus is much higher than seen with SARS or swine flu.

At this stage the key risks to New Zealand and Australia appear to be tourism-related (several global airlines have suspended all flights to China), although extended restrictions on people movements and transportation in China could limit consumption and therefore impact our export levels. As potentially frightening as a novel virus pandemic is, it is worth noting seasonal influenza results in 3-5 million cases of severe illness and between 290,000 and 650,000 deaths each year.

In Australia, commodities-exposed sectors represent over 25% of the ASX200, and for commodities, China is all important; the country is the world’s largest consumer and represents around 70% of the world’s seaborne iron ore demand and around 50% of base metals demand. Iron ore is the most important for Australia, with around 800 million tonnes exported to China each year at a market value of over US$70bn on current prices. The iron ore market has been strong in recent years due to robust Chinese steel output, which rose to just shy of 1 billion tonnes in 2019, and iron ore supply outages in Brazil. Since the Coronavirus outbreak, iron ore and base metal prices have fallen sharply. With Chinese New Year extended and activity levels to expected to remain subdued over the coming months, demand conditions will most likely be very weak and commodity inventory levels will rise. But if the situation is successfully addressed Macquarie’s China economist sees the potential for the government to introduce significant stimulus which would translate during the year to an environment which would be very supportive for commodities.

In summary, there is heightened uncertainty surrounding the outbreak of the Coronavirus and the situation is evolving quickly. At this stage we have limited exposure to travel and tourism-related businesses in our portfolios. Historic outbreaks of infectious diseases have typically proven to be a buying opportunity and we expect this situation will develop in a similar way. We will continue to exercise caution whilst high levels of uncertainty surrounding the virus and growth outlook remain and will look to ensure that our portfolio positioning is carefully managed.