A month of contrasts

By Greg Smith, Head of Retail at Devon Funds

The month of August was a contrasting one for markets with concerns over global economic growth, the persistence of inflation, and central bank tightening largely easing the more the month wore on. The earnings season in the Northern Hemisphere was largely positive, with the majority of companies beating earnings expectations, and outlook statements upbeat in many cases.

The earnings season down under was somewhat disparate with Australia seeing some strong earnings beats, and optimism around the outlook. The results season in New Zealand was arguably less convincing, with more caution around the economic environment reflected in the performance of the NZX50 vs. the ASX200. While not everything went to script, this was mainly to the benefit of the Devon funds which currently have a tactical overweight position in Australia relative to New Zealand. The NZX50 fell 4.2% during the month, while the ASX200 declined a lesser 1.4%.

In the US, the technology sector finished the month strongly, with AI being the acronym “du jour” for many investors. The Nasdaq still dipped 2.2% during the month, despite AI darling Nvidia hitting a record high, and reaching a market cap of US$1.2 trillion. The S&P500 and Dow were down 1.8% and 2.4% respectively. In Asia, the Chinese market staged a comeback towards the end of the month as a number of stimulus measures were unveiled by officials.

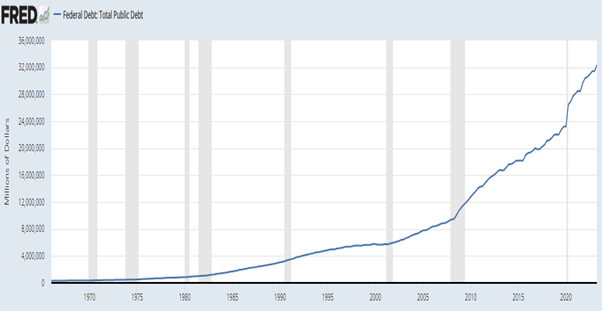

It wouldn’t be a month in markets without investors being provided with something to be wary about. Rating agencies answered the call, with Fitch downgrading US debt (albeit from the highest rating possible). Fitch said that the decision was not so much about the here and now, but more about the “expected fiscal deterioration over the next three years.” Senior Treasury officials and many prominent market participants labelled the moves as “puzzling” and outdated.

There has been a steady deterioration in the US debt picture in recent years, with debt to GDP now around 113%, compared to less than 60% 15 years ago. At more than US$32 trillion, the US has the world’s highest debt and more than the following four most indebted countries (China, Japan, France and Italy) put together. Political standoffs around the debt limit have occurred with some regularity over the years and was something we saw a few months ago. The talking point with respect to the Fitch call (and the later decision to downgrade a number of banks, as did Moody’s) was that none of the issues raised were particularly new.

Investors moved on and were more interested in the future; how the world’s largest economy was looking, how inflation was tracking, and how the Fed was going to proceed. In the weeks that followed, economic data (such as retail sales, home sales and consumer confidence) continued to point to an economy with resilience, but not excess strength.

The month arguably reached a crescendo with the “no-thrills” speech from Jerome Powell at the annual meeting of central bankers at Jackson Hole. The Fed Chair suggested that rates may need to go higher, but importantly did not sound any alarms or spring any surprises. Investors latched onto comments that the US economy was proving more resilient than expected, and that there were risks of doing “too little” but also “too much” as it related to rate tightening. Powell said inflation was still too high, but he also acknowledged that it had fallen away from peak levels.

Inflation data did not ring any alarm bells for a data-dependent Fed. The Personal Consumption Expenditures Index (PCE) increased 0.2% month-over-month in July and 4.2% year-over-year, in line with estimates. Core PCE, the Fed’s favoured inflation gauge, was also in line with expectations.

ECB President Christine Lagarde made similar comments at the central bank symposium. Lagarde said that the central bank would keep rates as high as needed to bring inflation back to target (this has proven more persistent than in the US). Skies in Europe though remained pretty cloudy - Germany’s economy has exited a technical recession, but only just.

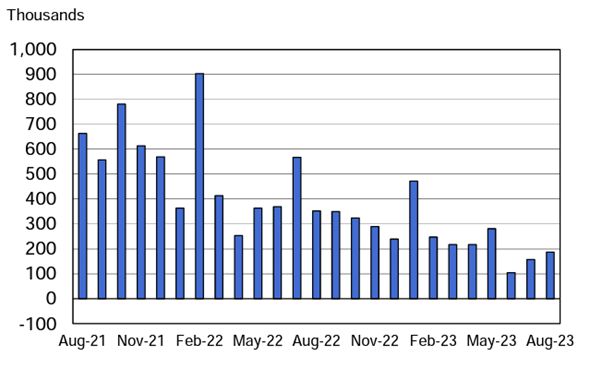

Post the month's end, the US indices rose further as the Non-Farm Payrolls report showed that the US created more jobs than expected in August, but prior months’ readings were revised lower, wage growth softened, and the unemployment rate went up. Markets are now pricing in a 95% probability of no move by the Fed this month.

US job creation

Source: Bureau of Labor Statistics

Meanwhile, longer-term bond yields continued to push higher, flattening out the yield curve, and indicating an increasing view that the US economy will avoid a recession. The yield on 30-year bonds has hit a 12-year high while the 10-year yield hit the highest level in 16 years. A soft economic landing, at the same time as bond yields are elevated, may give Fed officials the luxury of holding rates higher for longer as they look to stamp out inflation. A fly in the ointment was a push in oil prices to 9-month highs.

The US earnings season continued to be a strong one. Around 80% of S&P500 constituents beat earnings forecasts. Apple exceeded expectations (with China a bright spot) while Amazon reported the biggest earnings beat since the fourth quarter of 2020, with a robust cloud business and signs of life in the digital ad market. While ‘Barbenheimer’ was smashing records at the box office, Nvidia was doing likewise on the market boards, with results troucing expectations amid booming demand for AI chips.

Older-fashioned names delivered better-than-expected earnings, and in many cases rosier than rosier-than-expected outlooks. This included bellwethers such as heavy machinery maker Caterpillar, and tech names such as Dell and Cisco (which is held in the Devon Global Sustainability Fund and rallied circa 10% during the month). The world’s largest retailer Walmart was in a similar camp, amid signs that the consumer is coping with cost-of-living pressures, albeit they are having to modify their behaviours to do so.

China was also a big focus for investors. Economic data from one of the world economy’s growth engines was somewhat mixed. Factory activity shrank for the fifth straight month, but only just. Chinese markets picked up towards the end of the month as a series of stimulus plans were unveiled by authorities to spur confidence in the country’s property sector, the wider economy, and the stock market.

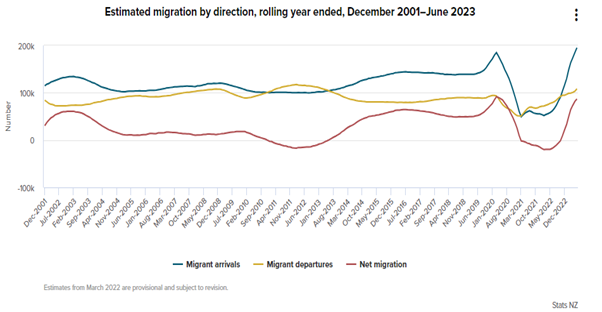

An uneven economic recovery in China was meanwhile one of the headwinds facing the Kiwi economy. July’s trade deficit of $1.1 billion was bigger than expected. Weak quarterly retail sales volumes highlighted the challenges facing the consumer sector. The key dairy industry also felt the squeeze as milk prices continued to fall (these have risen in the latest print in early September), with co-op Fonterra trimming its forecast pay-out again to the lowest level since the 2018/19 season. A tick-up in net migration was a bright spot, as was 1% employment growth during the June quarter.

The RBNZ meanwhile came through with a “hawkish hold”, maintaining the OCR at 5.5% and indicated policy would need to remain “restrictive” for some time. The prospect of a rate cut has been pushed into next year. The central bank appears confident that inflation will return to its target range, and also improved its forecasts slightly for some parts of the economy. The forecast for unemployment in Q3 has been lowered as was the peak-to-trough decline in the housing market.

The earnings season in New Zealand saw some strong results, but this was not always met with a similar share price reaction, perhaps reflecting conservative outlook statements and economic uncertainties. Companies had to go “above and beyond” to get investors excited.

The travel sector was in focus, amid the rebound in tourism, with both Air New Zealand and Auckland Airport reintroducing dividends after a hiatus since the pandemic. Auckland Airport saw its first profit in more than three years, more than doubling full-year revenues. The airport’s shares though weakened during the month as the Auckland Council sold down its stake.

Tourism Holdings was a standout performer on the upside, with its shares surging following its result. Investors warmed to the positive news around the integration and boost from the acquisition of Apollo. Revenues nearly doubled at the campervan operator, and the bottom line swung from a loss to a profit. Management was upbeat about the outlook as airline capacity returned and international tourism recovered (a weaker Kiwi dollar is a tailwind here). Tourism Holdings is held in a number of the Devon funds.

Dairy-related companies were out of favour given a weak outlook. Full-year results from A2 Milk were in line with previous guidance, but the growth outlook, and an absence of a buyback or dividend, disappointed the market given the company’s $800m cash balance.

There were solid results from the Gentailers although the share prices of Genesis Energy, Mercury NZ and Meridian all finished the month lower. Contact finished up marginally. Wet weather and strong inflows were a feature. In a similar vein, Fletcher Building met revised guidance, but their shares fell sharply on disappointment around the dividend and additional provisions for the Convention Centre project. Solid results from Spark (the mobile business a standout), EBOS (acquisitions provided a boost) and Port of Tauranga (ship visits ticked higher, but extreme weather events weighed) were not particularly well rewarded by the market.

Freightways proved one of the highlights with investors warmed by a 15% jump in full-year earnings. The company suggested that the operating environment in Australia was more favourable than in New Zealand. Operating revenues in Australia surged 143% while those in New Zealand rose 6%. Freightways announced plans to (dual) list on the ASX, reflecting the changes to the makeup of the business following the acquisition of Allied Express. The company said it was looking for more complementary M&A opportunities in the years ahead.

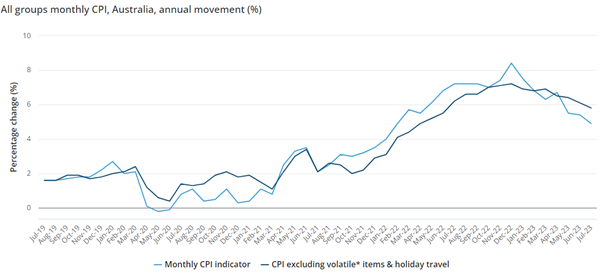

In Australia, economic data was also relatively more constructive. Retail sales rebounded more than expected in July, but jobs numbers fell more than forecast. Trade frictions with China cooled further, with tariffs dropped on Aussie barley. The RBA left interest rates unchanged and adopted a “wait-and-see” approach to further rate hikes. Lower than-expected monthly headline inflation (4.9% in July) and core inflation numbers subsequently took further pressure off the central bank to follow through with a rate rise – the RBA duly obliged and stayed on hold in early September.

Source: ABS

Optimism over the economy was also mirrored in a number of blue-chip results. Consumer-facing companies Harvey Norman and Breville both came through with better-than-expected earnings. Low levels of borrower stress were also evident in results from Commonwealth Bank and Westpac. The earnings tailwinds of higher inflation were also on display in results from insurers IAG, QBE, and Suncorp with premium rates marching higher.

Another company displaying pricing power was building products supplier James Hardie, with investors marking the shares sharply higher following its results.

Carsales was another big gainer, with the shares hitting record highs as the online vehicle classified advertising group reported a 300% jump in full-year earnings. More than half of Carsales revenues now come from outside Australia. Carsales is held in the Devon Sustainability and Australian funds.

CSL shares also rallied as the blood plasma group delivered a 10% jump in full-year underlying profit. Management cited “exceptional growth in immunoglobulin sales and record plasma collections.” CSL is held across a number of the Devon funds.

Some “defensive” companies did not perform as well post results. Telstra delivered a strong result, led by a performance in mobile, but investors were not receptive to the decision to hold onto the InfraCo Fixed Infrastructure business. Supermarket chain Coles tumbled despite posting a rise in full-year group revenue, with food price inflation continuing to fall (with related margin impacts) and rising wages and increasing levels of theft amongst the factors driving costs up.

In Resources, BHP reported a 37% decline in full-year underlying profit amid weaker prices for iron ore, copper and coking coal. Iron ore sales have also declined. Sentiment towards the mining giant (10.5% of the ASX200) picked up towards the end of the month amid Chinese stimulus measures and rebounding commodity prices.

Two excellent results during the month were from property giant Goodman Group and transport & logistics group Brambles. Goodman reported a rise in operating profits ahead of guidance, with strong rent growth and occupancy while a trend of big asset write-downs seen at other property companies was absent. Shares in Brambles surged as full-year net profit after tax jumped by 19% and the dividend rose. The company has a pool of 360 million pallets and containers globally and has been successfully passing on rising input costs to customers. Goodman and Brambles are held across a number of the Devon funds.

One of the names which continued to feature through the month was Qantas. The airline delivered a record full-year underlying profit of A$2.47 billion but came under increasing scrutiny around high airfares, flight cancellations, Covid flight credits, and was caught up in the issue around the government not allowing additional Qatar flights. The ACCC also launched a suit in the Federal Court alleging the carrier sold tickets to over 8,000 “ghost” flights that had already been cancelled. The shares fell over 10% during the month, pre-empting the early departure of retiring CEO Alan Joyce. The Devon funds do not hold Qantas but have done well on the name, selling the shares near multi-year highs earlier this year.

The last month has certainly provided plenty for investors to digest. The coming month will be quieter in comparison results-wise, but there remain plenty of important considerations for investors, not least of which is the approaching election in NZ. Pervading levels of uncertainty continue to offer a productive environment for active stock pickers.