Meeting half-way

An interest piece written by Greg Smith, Head of Distribution at Devon Funds.

June saw a continuation of this year’s themes, with US equity markets continuing their 20-month bull run, led by the technology sector, and AI-related names in particular. It was another month of milestones. The S&P500 (+3.6%) made a new record high, as did the Nasdaq (+6%). Nvidia powered on, surpassing US$3 trillion in market cap, and becoming for a brief period the most valuable company in the world. Microsoft and Apple both though quickly regained their spots, again driven by AI themes.

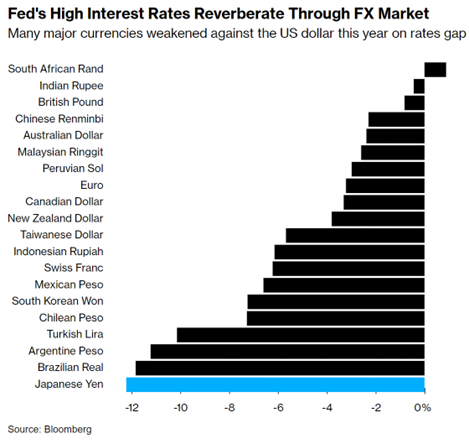

However, central banks started to diverge, with inflation proving less persistent in some large economies than others. The Fed continued to promote a line of “patience” with respect to monetary easing, but the European Central Bank cut interest rates, as did officials in Switzerland and Canada.

Rates might meanwhile be going the other way in Australia, with monthly CPI numbers surprising on the upside. Kiwi investors were left guessing to a certain extent on how inflation is tracking but had cause to celebrate, with a 20-year power deal at Tiwai, and the economy emerging from technical recession. Some more fundamental challenges remain. The NZX50 was 1.3% lower for the month, while the ASX200 performed better with a 1% gain in June.

AI has been a dominant theme this year and has arguably driven the Fed to the back seat of investor considerations, even if the market strength has been concentrated in a few super-cap names. At the start of 2024 markets were pricing in 5-6 rate cuts by the Fed. This has narrowed to the prospect of two, one or even zero rate cuts this year, but has been easily digested by markets. A somewhat resilient economy, despite elevated interest rates, has also acted as a calming influence.

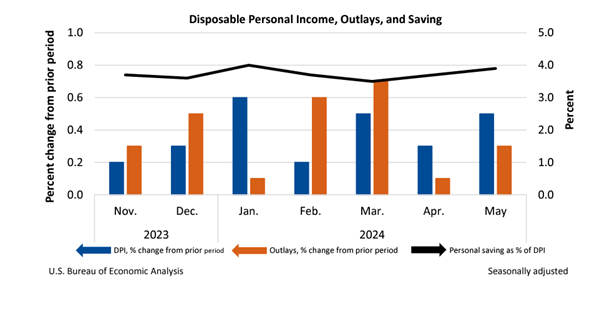

The Fed held key interest rates steady at 23-year highs for the seventh consecutive meeting, noting merely that there had been “modest further progress” towards inflation objectives. Jerome Powell said at the press conference afterwards that core inflation had come down from peak levels of 7% but was still “too high.” The Fed’s dot plots also remained divergent and open to various rate-cut scenarios. Towards the end of the month, the Fed’s preferred measure of inflation fell to 2.6%, its lowest annual rate in more than three years. Markets are now pricing in a 60% probability of the first-rate cut coming in September.

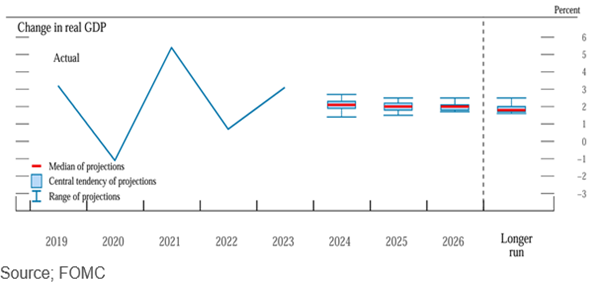

The “Goldilocks” scenario still remains a real possibility for the world’s largest economy. The US employment market has loosened (job openings to available workers have eased from a peak of 2-1 during Covid to 1.2:1), but has remained robust in relative terms. GDP growth is expected to glide to 2.0% in 2025 and 2026. This would be some feat, given the last time a soft landing was achieved after a period of sustained rate tightening was in 1995.

That said, policymakers do have other matters to contend with. The US trade deficit is at an 18-month high and may deteriorate further should the Fed keep rates where they are while large trading partners such as Europe and Canada (around 20% and 17% of US exports respectively) are cutting them. Ongoing weakness in the euro and Canadian dollar against the greenback would have an impact on US trade competitiveness. During the month the ECB cut rates for the first time since September 2019. The Bank of Canada also cut rates (the first in the G7 to do so).

It is also an election year, and while politically agnostic in theory, the implications are unlikely to be lost on policymakers. After a poor showing by Biden in the first presidential debate, there is a real prospect (further aided by a grant of immunity by the Supreme Court) that Donald Trump will be back in the White House. Many see a potential second Trump presidency as having inflationary (amongst other) outcomes.

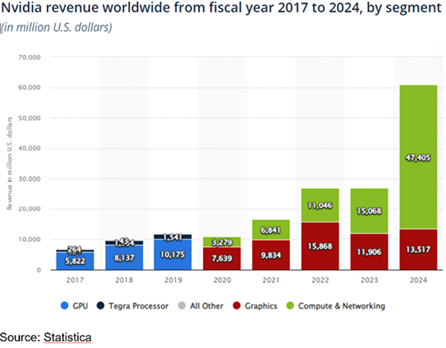

Stock-wise, it was pretty hard to keep Nvidia, and AI generally, out of the headlines.

Nvidia has made up ~30% of the S&P500’s 15% rise so far this year. With around 80% market share in high-performance chips, the AI darling has rapidly achieved cult status amongst investors. The stock passed US$3 trillion in market cap, and at its peak had risen 180% year-to-date and ninefold over the past 18 months.

Some view that Nvidia’s rally has been justified on an earnings basis (with a knockout result during the month). A 10-1 stock split has also opened up the name to more retail investors. A question now may be whether the company is vulnerable to disruption. Intel (which has just 1% market share) is getting ready to ship chips that are specifically designed for AI PCs and claims to have US$2 billion in order backlogs. Cloud providers making up over 40% of Nvidia’s revenue are building processors for internal use.

Nvidia did actually see a big drawdown in the month, where it lost around US$500m market cap in a few days. Some drew comparisons with Cisco, which approached similar territory (briefly the world’s most valuable company at the height of the dot-com bubble) before a substantial decline. Any downward rating in Nvidia would certainly have an impact on the S&P500, and could drive flows elsewhere in the market and to areas that offer better relative value and are not as “over-owned.”

Optimism around AI growth also drove Microsoft back to the top market cap spot. The company (one of Nvidia’s biggest customers) has released a new generation of laptops designed to run its AI models. Apple is close behind as the second most valuable company, with investors taking the view that a suite of new AI features will drive the next leg of the device upgrade cycle. AI also played a part in driving Amazon past the US$2 trillion market cap during the month. The company is working on an AI chatbot to compete with ChatGPT, with “Olympus” one of the largest AI models ever trained.

Weight loss drugs have been another big theme over the past six months and were prominent again during the month. After positive trial data, Eli Lilly applied for US approval of its weight loss drug for the treatment of sleep apnea. Danish drugmaker Novo Nordisk, the most valuable company in Europe, is spending US$4.1 billion to build a 1.4 million-square-foot facility in the US to cope with demand for its GLP-1 drugs.

There also continues to be divergence in how consumer-facing companies are coping with cost-of-living challenged customers. Nike shares fell 20% in one day (the biggest decline in its 44-year listed history) after downgrading full-year sales guidance, with sales under the pump in the US and Europe, along with a softer demand outlook in China.

Across, the Atlantic, European markets also closed at record highs during the month. Pockets of weakness in the manufacturing sector, along with falling inflation, helped pave the way for a rate cut by the ECB. It was also mission accomplished for the Bank of England, with UK inflation back at 2%, less than two years after topping out at 11.1%. The BoE left rates on hold, but Switzerland was another central bank to cut rates (again) during the month. Political developments were also significant during the month, with the far right making big ground across the Continent, forcing a snap election in France. In the UK, it was more about the left-of-centre, with Rishi Sunak looking set to lose the election by a significant margin.

In Asia, Indian markets had a buoyant month as Prime Minister Narendra Modi and his alliance secured a third (and very rare) straight term in power. The Nikkei though was the star of the show, rising 3% as the yen hit a 38-year low against the US dollar with the Bank of Japan resisting tightening temptations. Japan’s stock market is up over 20% year to date. In contrast, calls for further stimulus from Chinese officials continued to grow as factory activity in the country contracted for a second straight month. China’s economic growth target of around 5% this year appears under threat while rising trade tensions have added to the challenges.

China’s economy was also very relevant to Australia, with iron ore prices weakening towards US$100 a tonne, and lithium prices (down nearly 90% from 2022 highs) correcting. The trade picture has weakened, with GDP growing just 0.1% quarter on quarter, but the Australian economy has remained resilient and is not in recession. Miners were generally weaker during the month, which provided an opportunity for Commonwealth Bank to close in on BHP as the most valuable company on the ASX.

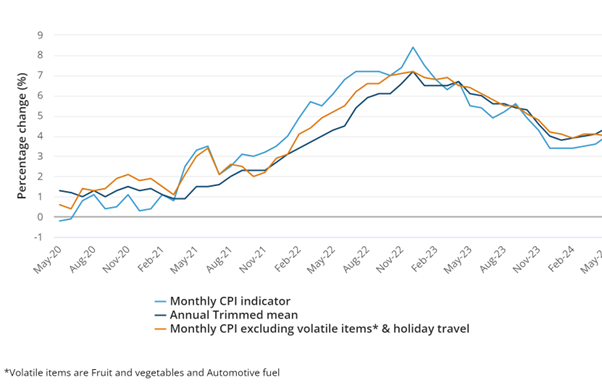

With investors focused on the next moves by central banks, the big macro event for the month across the Tasman was a super-hot inflation print. Annual inflation jumped to 4% in the 12 months to May from 3.6% in April and was the fastest rate since November.

The RBA minutes showed that a decision on whether to raise rates was already a close call, and the print means the meeting on August 6 is very much a “live” one. Markets are pricing in a ~30% chance of a rate hike and a 50% probability of a rise by September. The quarterly CPI figures due at the end of this month have now taken on much greater significance. The Aussie jobs market is softening (job vacancies are the lowest since March 2021) at a breakneck pace, but “the last mile” of inflation is proving persistent, and there are potentially more pressures coming in the form of stimulatory Government budgets and a pipeline of infrastructure projects.

Source; ABS

Some Australian healthcare names were softer due to developments around GLP-1s. For the likes of ResMed though, obesity is just one risk factor for sleep apnea, and weight loss drugs may not provide a comprehensive solution.

A big event in Australia during the month was the listing of burrito chain Guzman y Gomez. Australia’s biggest IPO in three years got off to a flying start. The market cap for the 185-store company hit A$3 billion with a similar value to (but just 5% of the store footprint of) Domino’s Pizza Enterprises. There was an element of FOMO it appears with Guzman, with investor appetite cooling notably by the end of the month.

In New Zealand, the Kiwi market also got the month off to a flying start, with the biggest single one-day rise in several years. The sentiment was electrified by the announcement that Tiwai is staying, with gentailers rallying strongly. While the deal had been expected for some time, the electricity companies now have more certainty around their future dividend paths, and investment plans. Several announcements followed around initiatives in the renewable space. On the other side, NZ electricity demand is set to rise further with population growth, as the drag of energy efficient appliances subsides and with EVs potentially ramping up from 75,000 today to 1m by 2035. Even more significantly, estimates are that data centres could potentially account for 10% of global electricity demand in the coming years.

The deal with NZAS is good news for the economy at large (and not just Southland), with the smelter accounting for around 12% of national electricity demand. One of the features of the 20-year agreement is a demand response mechanism, whereby if NZ is running low on water and therefore hydroelectricity during a dry winter, electricity usage will reduce substantially.

The other good news, at least technically, was that NZ emerged from a recession. GDP for the March quarter rose 0.2% which was slightly above expectations, and 0.2% higher than the year-ago quarter. The primary sector was a big driver and there was also a lift in tourism spend. There were still some sobering aspects of the release. Half of the 16 industries saw a fall. Growth overall is still anaemic, and the economy is 0.5% smaller than the September 2022 peak. This is also despite an unprecedented period of population growth. GDP per capita is still negative and has been so now for six consecutive quarters.

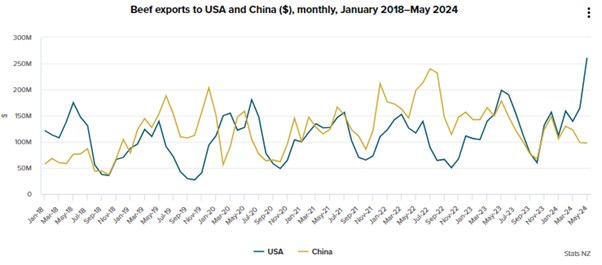

There was good news on the NZ trade picture. Monthly exports exceeded $7 billion for the first time ever. The USA has now surpassed Australia as our second-largest export market (China remains number one at $17.9 billion). Beef and wine are in hot demand in America.

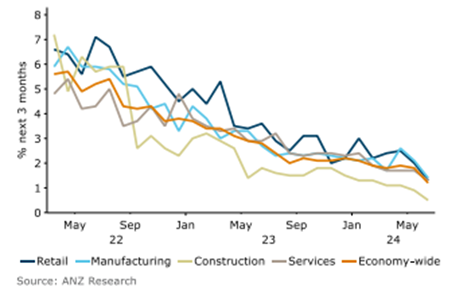

It is, however, still tough out there for many businesses, and this was reflected in several surveys. Pricing intentions are declining, which is relevant in the context of the deflationary drivers the RBNZ is looking for.

Pricing intentions by sector

The retail sector also remains a tough one, as shown by card spending and confidence numbers. It was also evident in announcements from two big retail names in NZ. The Warehouse Group (which has also been battling brand positioning challenges) issued an earnings downgrade on the back of a 6-7% fall in sales and up to a 70% fall in earnings compared to a year ago. KMD Brands came out with a similar update, forecasting a more than 50% decline in full-year earnings.

Sky City has also been feeling the pinch of tighter consumer wallets, reducing earnings guidance, and flagging that dividends are not expected to resume until 2026. The casino operator did manage to draw a line in some ways under certain regulatory matters both in NZ and Australia during the month and is also set to receive the keys to the Horizon Hotel with the NZICC project now done. Fletchers itself continues to meanwhile participate in mediation over the piping issue in Western Australia. Elsewhere building activity data (volumes the lowest in two years) confirmed the sluggish nature of the economy.

The Kiwi market also got a direct taste of the excitement around AI-driven growth. Infratil raised $1.15 billion to fund growth at the 48% owned CDC datacentres business. This was one of the biggest capital raises in NZ in recent years and was not surprisingly well supported. CDC has been a great investment for Infratil and continues to ramp up its development pipeline given the incredible growth in demand for data centre capacity on the back of increased cloud adoption and investments into generative AI. As noted, it is also a further positive read-across for the NZ and Australian electricity sectors.

The big event on the immediate horizon is the RBNZ meeting in early July. Will weak macroeconomic data and the fact that some central banks are underway with easing plans cause any change to their thinking? It seems unlikely that we are confined to seeing inflationary prints on a quarterly basis, with the next not due until July 17th. With the economy now sluggish, and pricing intentions cooling, the calls for a rate cut well before the RBNZ’s current thinking will surely grow.