Half-way predictions scorecard

An interest piece written by Greg Smith, Head of Retail at Devon Funds.

We are at the halfway point in the year, and to say markets have been “interesting” over the past six months is an understatement. After soaring on optimism around Trump’s pro-business policies, investor enthusiasm was given a cold hard reality check by the President’s tariff policies. Markets then made a stunning comeback as tariffs were paused, rates were dialled back, the US began negotiations for trade deals (and even agreed one – with the UK) and there was some progress on the stand-off with China.

The escalation of hostilities in the Middle East has provided an added risk to consider, particularly around the impact to oil prices, but that has also subsided. Oil prices rose 20% from the onset of Israel’s bombing campaign, but the entrance of the US and a ceasefire has seen prices fall by nearly the same magnitude from 5-month highs. The easing of oil prices has also soothed fears around the global economy, along with inflation, and also increased the prospect of rate cuts by a data-dependent Fed (and other central banks) in the coming months.

Time will tell how this all plays out in the coming six months, and what it means for the top 10 predictions that we made at the start of this year. With this in mind, we thought it timely to check in on how these are tracking – the answer at this point would seem to be somewhat well, as dissected below.

1. Markets grind higher in 2025 but are punctuated by higher volatility as investors digest the implementation of protectionist policies, and changes to central bank positioning.

Our first prediction has hit the mark, with the stock market enduring one of the most volatile periods on record (including the Covid ‘crash’ and subsequent rebound in 2020). At the post-Liberation Day lows in April, the S&P 500 was down 18% for 2025. An upward roller coaster ride has since seen the broad benchmark eclipse the February record highs, and soar over 20% since reaching a nadir on April 8.

Investors are taking a glass-half-full approach, it seems, and are expressing relief that the worst-case scenarios are possibly not going to eventuate. Trade frictions have been the main focus, with associated concerns around ballooning US debt, inflationary pressures, GDP downgrades, and uncertainty around central bank positioning – but these, along with geopolitics, have ultimately been put to one side.

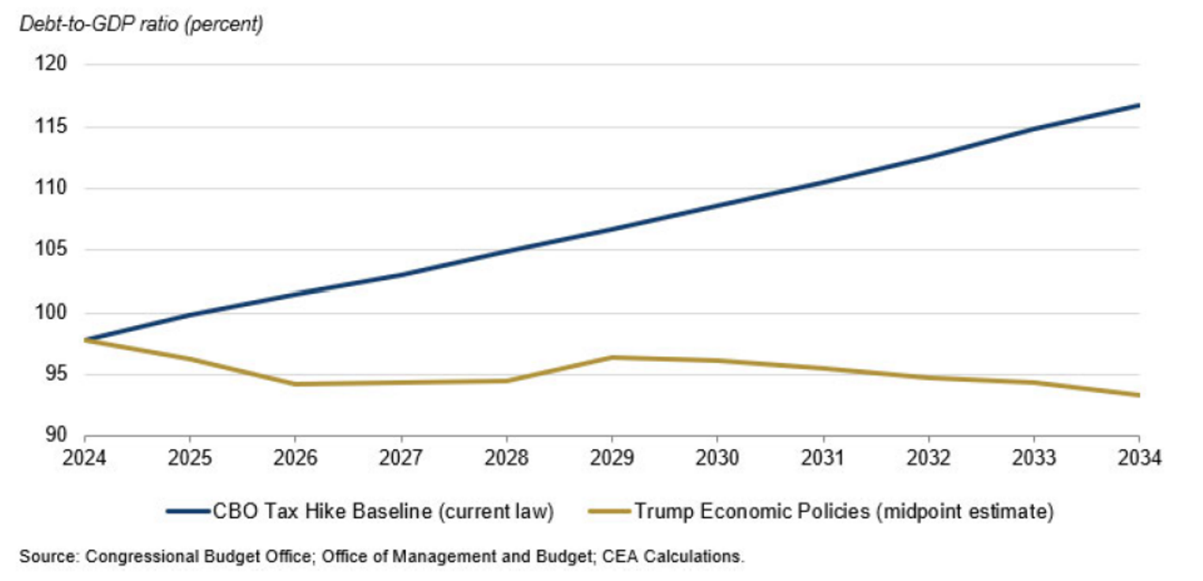

A “wall of worry” has crumbled, with investors siding with the brighter side of almost everything that has been thrown at markets. Donald Trump’s “One Big Beautiful Bill” is yet another example. There have been questions about who will pay for the massive spending package, which could add over US$3.9 trillion to the national debt, according to a Congressional Budget Office analysis. Investors, though, appear to be comfortable that this all fits with the pro-growth policies of the Trump Administration, and that the combination of lower deficits and higher growth will push America’s debt-to-GDP trajectory downward.

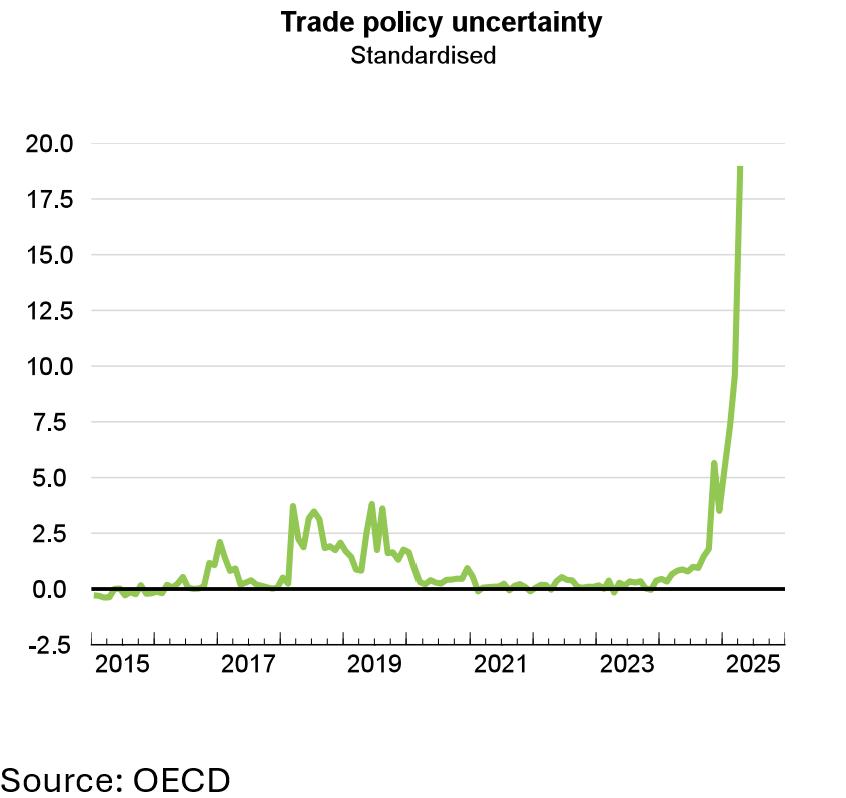

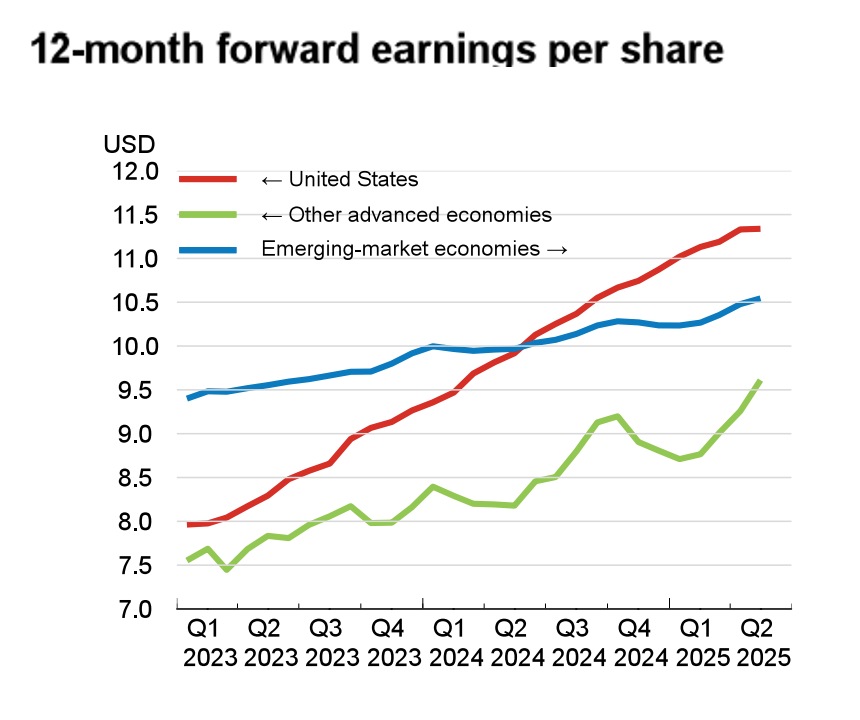

The introduction of tariffs has clearly added stickiness (or at the very least uncertainty) to the last mile of inflation (particularly in the US) and has also provided a complicating factor for central bank positioning. However, markets continue to see a global soft economic landing scenario as intact and with it a largely positive environment for equities and a general outlook for earnings growth across the corporate sector.

Source: OECD

As part of this prediction, we also suggested that Trump’s tariff policies, particularly towards China, would provide a stern test of Trump’s relationship with many leaders, including that with Elon Musk. That has certainly proven true, although with respect to the latter, it has been more about Trump’s “One Big Beautiful Bill”, which Musk has labelled as an abomination. We said the “bromance” would remain intact, but there has clearly been a huge falling out – that said, there have been some olive branches extended by Trump. Time will tell if this drama has another twist.

We also said that geopolitical risks would remain highly relevant, and with the high tensions in the Middle East, this has certainly been the case. Progress towards peace in Ukraine also remains elusive, but a recession in Russia might provide further compulsion for a peace deal in the second half.

2. Despite the uptick in inflation, less dovish tendencies by the Fed, and increasing trade frictions, the global economy still lands softly.

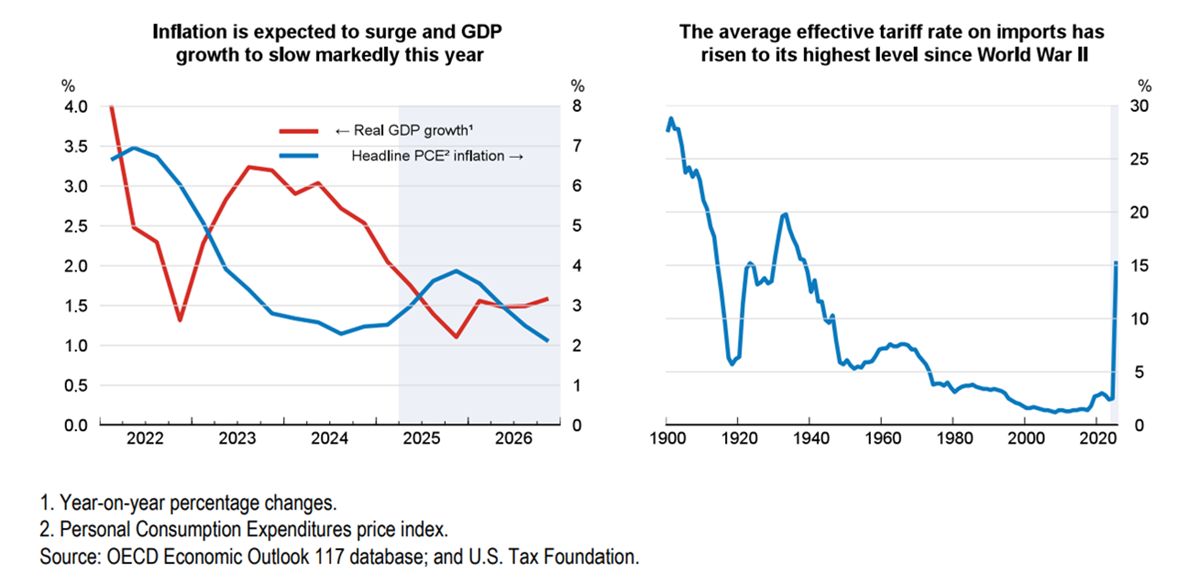

Our second prediction remains an evolving story. Near-term economic activity in the US appears to be slowing amidst the White House’s polices on tariffs, but also immigration and the DOGE initiative. The Organisation for Economic Co-operation and Development recently downgraded growth forecasts, citing elevated economic policy uncertainty, a slowdown of net immigration and a smaller federal workforce as drivers.

The impact is not confined to the US. The OECD sees global growth as slowing from 3.3% in 2024 to 2.9% this year and in 2026. It had previously forecasted global growth of 3.1% this year and 3% in 2026. The body said that the slowdown would, however, be concentrated in the US, Canada and Mexico. The OECD noted that frequent changes regarding tariffs have led to “uncertainty in global markets and economies.”

The OECD also sees a higher impact on inflation in the US than in other countries. While G20 countries are now expected to see 3.6% inflation in 2025 (down from a 3.8% estimate in March), the projection for the US has risen to 3.2%, up from a previous 2.8%. The OECD said US inflation could even be closing in on 4% toward the end of 2025.

OECD US growth and inflation forecasts

There are clearly a lot of moving parts to deal with in what remains an “evolving” trade environment. The OECD assumes that “tariff rates as of mid-May are sustained despite ongoing legal challenges.” Time will tell whether this proves correct, and also whether trade deals (which we are still awaiting) see the ultimate tariff rates come down further.

Uncertainty here is also something that the Fed is having to take a view on. We said in this prediction that interest rates wouldn’t come down as much as expected in the US, with the Fed putting through just two rate cuts this year, and that this would help the world’s largest economy to glide down gently. This appears to be in play, although Fed Chair Jerome Powell is amongst those who have expressed uncertainty on how tariffs will land, and their impact on inflation and the economy. For now, markets continue to look at the brighter side of the equation and are pricing in two more rate cuts this year (compared to four back in April).

The inflation outlook, though, remains somewhat “messy”. A recent print had the Personal Consumption Expenditures price index rising a seasonally adjusted 0.1% for May, putting the annual inflation rate at 2.3%. However, excluding food and energy, core PCE posted respective readings of 0.2% and 2.7%, which were slightly higher than expected. The latter is the Fed’s primary inflation gauge.

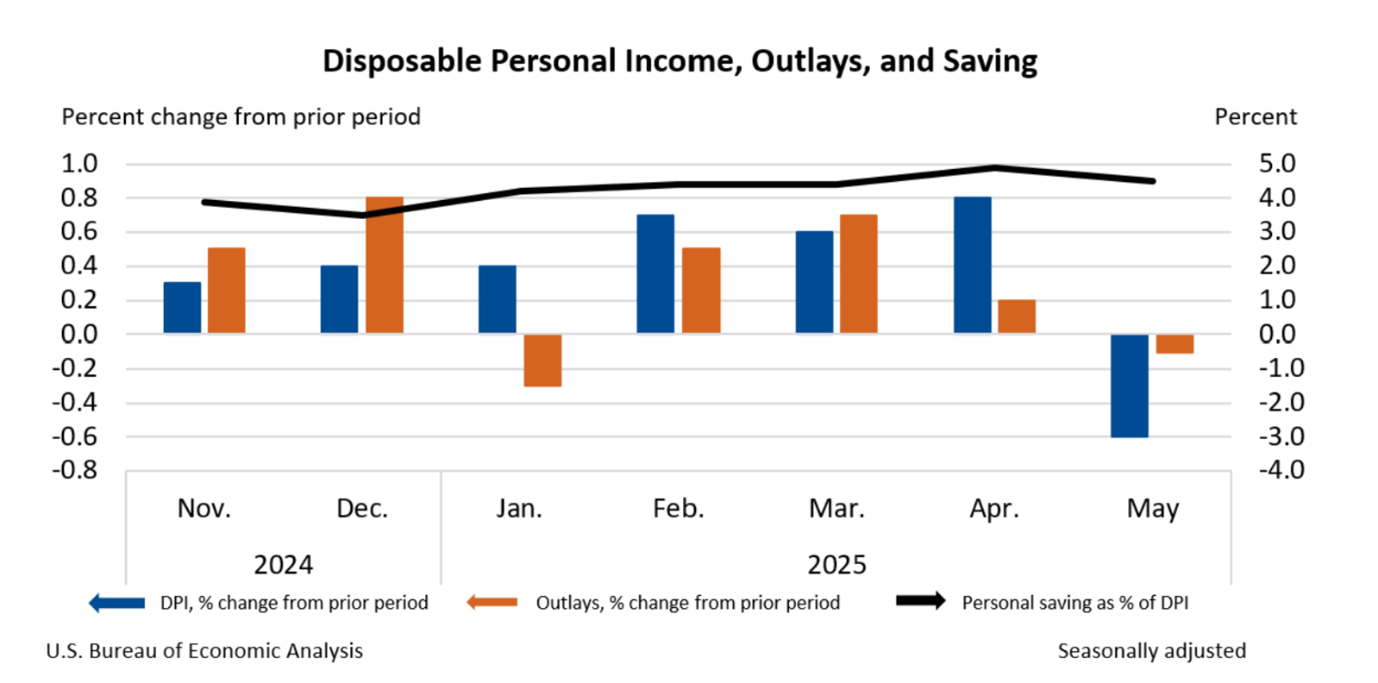

Weaker consumer spending and income (down 0.4% and 0.1%, respectively, in May against expectations for modest growth) do, though, provide further support for rate cuts in the near term.

As for the US labour market, this has generally remained resilient as we suggested it would. Corporate hiring also continues to adopt a glass-half-full approach. It remains to be seen whether unemployment will pick up with AI-driven productivity improvements.

Looking across the Atlantic, the European Central Bank and the Bank of England have indeed maintained an easing bias given economic challenges. A seismic shift towards much higher levels of defence spending, however, looks set to provide an ongoing economic boost. A change of government in Germany has also taken place, and in the second half of the year will provide clues around what this means for the growth prospects of the largest economy on the Continent. Investors seem confident – the German DAX has been trading around record highs.

3. Super-cap US tech stocks remain in demand, but there is an increasing rotation away from some of the high-growth names towards older economy companies as interest rates fall less than expected. US small caps do well.

This prediction has not come to fruition in the first half of the year. Super-cap technology stocks had a huge run last year, and have continued in that fashion this year, albeit punctuated by occasional periods of extreme volatility. There remains tremendous enthusiasm around AI, and what it means for demand for semiconductors, and associated cloud infrastructure. This is captivated by Nvidia, with the world’s most valuable company the poster child for the AI thematic.

The experience of the super-cap tech sector amidst the broader market volatility this year is a reminder of how quickly, though this high-growth area of the market can lose favour, and the consequences to investors. At the lows in April, Nvidia was down 30% year to date. The stock went onto to rebound more than 65% to be currently sitting over 15%so far in 2025.

Interest rates and inflation have remained higher than many expected, as we predicted, but this has yet to have an impact on investor appetite for super-cap tech stocks. This is not to say that it will not, in the event that there is any interruption to the AI growth story. For now, however, the MAG7 have momentum on their side, but this also creates a high bar of expectation in many ways for the second half of the year.

The opposite is arguably true of many older economy stocks. While names such as JP Morgan Chase and Netflix have been trading at record highs, and defence companies have soared, many companies at the pointy end of the economy have lagged – the small-mid cap Russell 2000 is flat year to date. Does this set up a better second half for older-fashioned names? Time will tell.

4. Interest rates continue to fall in NZ as the Reserve Bank lowers the neutral rate band for the OCR, amidst a stuttering economy and as trade frictions deliver deflationary outcomes with a flood of cheaper goods from China.

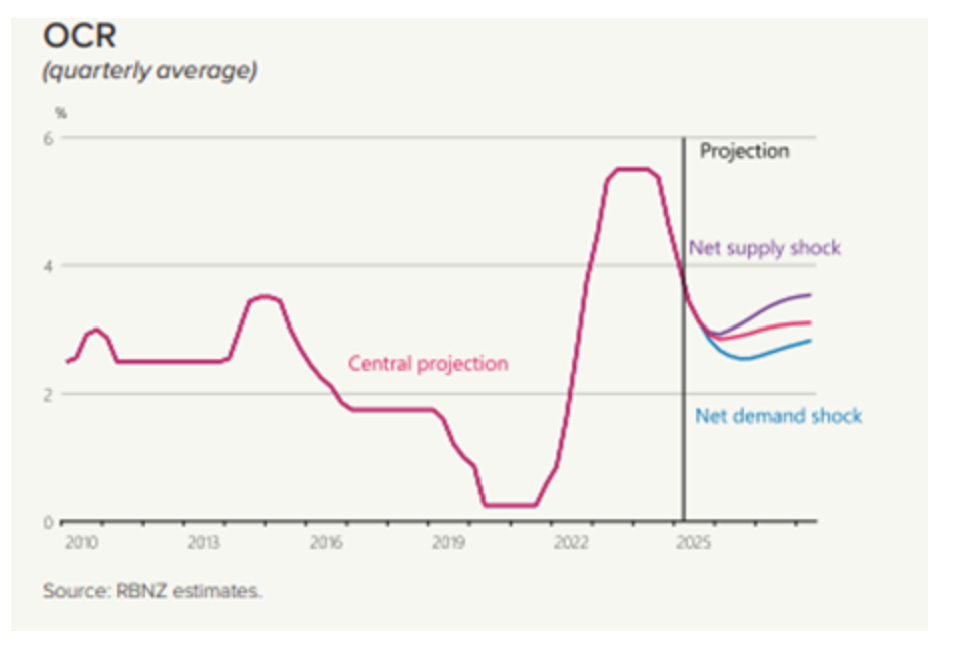

The RBNZ has delivered on rate cuts in the first six months of the year, amounting to some 100bps to take the OCR to 3.25%. The story around the economy hasn’t been particularly upbeat, even as officials have retained full optionality and no bias around their next move at their last meeting at the end of May. We did, though, get a slightly lower track for the OCR. The last quarter of this year has the OCR bottoming out at 2.85% as a quarterly average.

On balance, the RBNZ expects the increase in global tariffs to result in less inflationary pressure in the NZ economy, which is what we suggested would transpire.

The MPS gives different scenarios with different outcomes (demand vs supply shocks), giving the Bank optionality, which in turn creates some uncertainty. So even though the Bank’s May Statement was dovish in that the OCR track is lower than the February statement, it’s probably hawkish in that market expectations were more dovish than has been stipulated. What it means for mortgage rates depends on which scenario plays out, it would appear.

5. Dividend stocks do well, helping the Kiwi market to perform strongly amid falling deposit rates. The retail sector recovers, but house price gains are modest due to an increase in supply.

The OCR cuts seen this year have certainly made cash in the bank less appealing, with 1-year deposit rates now generally less than 4%. The higher relative appeal of the dividend-centric Kiwi stock market has yet to filter through, with the NZX 50 currently down nearly 4% year to date at the halfway point. The underperformance relative to the US (and the likes of Australia – the ASX200 is +4%) perhaps owes much to the tepid recovery of our economy to date this year (notwithstanding 0.8% GDP growth in the March quarter).

The narrative that our economy will perform better in the second half of the year continues to have credence, in part due to the transmission effects as Kiwi mortgage holders come off higher fixed rates. The latter should also be a tailwind to the retail sector as the year goes on. It remains to be seen whether this will also filter through to the housing market, which remains expensive on a global view, and is being challenged by falling levels of net migration.

6.M&A activity steps up globally, with NZ also a beneficiary.

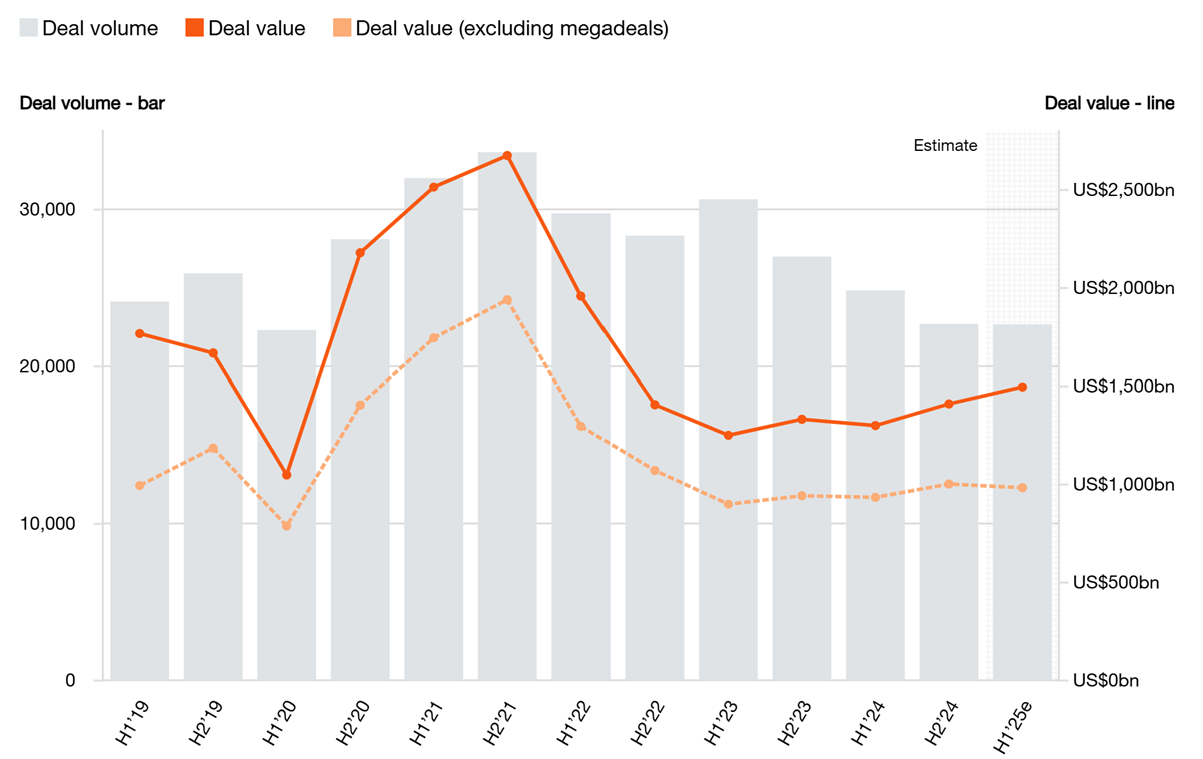

Another tick in the box here. Liberation Day may have been a fly in the ointment, and caused some delays, but merger and acquisitions activity has already stepped up in 2025. Donald Trump’s tariff board has not scared away the animal spirits, with LSEG data showing that there was around US$1.89 trillion of global M&A activity announced in the first half of 2025 - a 30% increase over the first half of 2024. The second quarter has seen a bounce, given that at the end of the first quarter, the year-over-year figure had been negative 11%. This is amidst a growing confidence that the worst of the market turbulence is over, and the global economy is still headed for a soft landing (despite the fact that rates in the US have not come down as quickly as some would have thought). A recent report from PWC shows similar trends.

Global M&A Deal volume and values

Source: PWC

Transaction values are up, although deal volume also rebounded in the second quarter; it remains down 11% YoY for the first half and is at a decade low. Deals have been fewer, but bigger. There has been a 74% year-over-year increase in the number of deals worth at least US$10 billion and a 24% surge in the number of deals worth between US$5 billion and US$10 billion.

US dealmaking was at US$821 billion, up 10.8%. The year's largest deal announced so far was Charter Communications' US$35.5b acquisition of Cox Communications, followed by the proposed privatisation of Japan's Toyota Industries. Deal-making activity in Asia has more than doubled to US$583.9 billion. Closer to home, Abu Dhabi's National Oil Company’s US$18.7 billion bid for Australia's second-largest oil producer, Santos, was another very positive sign.

New Zealand has not been left out, with one name disappearing from the boards, and another looking set to follow suit. Contact’s takeover of Manawa Energy was announced last year, but we have also seen a takeover bid for campervan operator Tourism Holdings, from a consortium involving Aussie private equity house BGH Capital and members of the Trouchet family. The transaction also highlights that the unlisted space can see value in listed companies that have solid businesses that are unloved by stock market investors. There are also plenty of other examples that are, in theory, trading cheaply. Time will tell if these also see approaches before the year is out.

7. China delivers on more stimulus, which proves positive for the domestic growth story there, even as US trade tensions escalate.

As suggested, Beijing has already come through with additional stimulus this year.

Tensions have certainly oscillated between the US and China this year, with tariffs on both sides ramped up to extreme levels before a truce was put in place. A resilient economy has arguably afforded China a degree of confidence in trade talks, with its economy continuing to outperform the US in many metrics.

Beijing has maintained a 5% growth target for this year, but the confidence to do so amid trade frictions has arguably been helped by the injection of further stimulus to shore up the domestic economy. There has been monetary easing (the Required Reserve Ratio has been cut by 50 basis points, releasing one trillion yuan in liquidity), and fiscal expansion (the country’s deficit target was raised to 4% of GDP, 1.3 trillion yuan in ultra-long-term bonds issued for infrastructure and tech investment, and 4.4 trillion yuan in local government bonds to stabilize real estate and fund public projects). The China Securities Regulatory Commission has also launched measures to support the stock market directly.

It is possible that more stimulus will be needed yet. China’s factory activity in June improved for a second month but remained in contraction.

It remains to be seen whether China can meet its 5% annual GDP growth target, or get close, which would be positive for NZ, given the country is our largest customer.

8. Major elections in Canada and Germany usher in right-wing governments and reforms as their economies stutter.

This prediction was half right (or half wrong, depending on your perspective). The right-wing Christian Democratic Union and its sister party Christian Social Union won the most votes in the German election.

However, while PM Justin Trudeau resigned due to record-low approval rates, the Liberal Party, led by former Bank of England Governor Mark Carney, staged a revival in the polls. Amidst rising frictions with the US (and Trump’s claim he wanted to make Canada the 51st state of the US), Carney gained voter favour from positioning himself as a defender of Canadian independence, which appealed to moderates and centrists.

9. AI becomes more immersed in our daily lives and leads to some powerful advances in biotech.

Advances are continuing at pace in AI on a daily basis, and continue to command significant investor attention. AI remain a big driver of the MAG7 (with a market cap of over US$3.8 trillion, Nvidia has firmly established itself as the world’s most valuable company), and the tech industry generally, while also being a regular feature of investor calls across a host of other sectors. Over 30,000 new AI assistants are created every day around the globe.

AI enhancements are commanding huge levels of investment, including in the infrastructure to support them. The "Stargate" project, a joint venture led by Oracle, OpenAI, and SoftBank, will invest up to US$500 billion in AI infrastructure in the United States by 2029.

There have also been significant breakthroughs already in the biotech space. AI models are now being used to analyse large-scale datasets to predict survival outcomes, especially in cancers. AI-enhanced imaging tools are meanwhile improving diagnostic accuracy in radiology.

It also would seem we are getting very close to the emergence of machines capable of thinking like people.

On the negative side, as AI's influence grows, so do the challenges in cybersecurity. ‘Deepfakes’ for one have also become highly prolific already this year, and one involving Taylor Swift has contributed to the establishment of a new bill which has become federal law in the US.

10. The space race heats up. Starlink becomes a major disruptor to the business models of broadband providers, satellite TV and telephony businesses.

Our prediction that the space race will intensify, possibly, wasn’t a huge call, but it is one that is powering ahead. There are now nearly 8,000 Starlink satellites in orbit above Earth, and Elon Musk’s company (the parent is SpaceX) has continued to expand its footprint into other countries – the company was granted a license in India. The US also remains committed to Starlink, despite Trump’s spat with Elon Musk.

Starlink is the only satellite internet provider to offer speeds up to 220Mbps with low latency, although competition is coming. Amazon is trying to play catch-up (55 satellites currently), and Eutelsat has received a boost from the French government, which is now its biggest shareholder following a €1.35 billion investment.

Meanwhile, SpaceX has competition on another front. Rocket Lab shares are at record highs and are up around 40% year to date. The Peter Beck-founded company has made eight successful launches this year. SpaceX uses heavier payloads, but Rocket Lab could be a challenger here in the medium size (and to the Falcon 9) with the Neuron rocket set to launch later this year.

And as for the sporting one….

11. Liam Lawson podiums for Red Bull.

We were on point that Liam Lawson would gain plenty of attention in F1, albeit it has not been in a winning way. Dumped from the main Red Bull team, our prediction of a podium finish, albeit for the Racing Bulls, is still live. Lawson recently recorded a career-best finish of sixth in the Austrian Grand Prix, and was the only Red Bull-associated driver to claim points. With a much slower car, it seems it will be a big ask, but stranger things have happened than Lawson pushing on even further to a podium finish before the year is out.