Eye on the Market: A COVID-19 Update

6 April 2020 Markets such as these can be incredibly challenging for investors to navigate. To give you just one example from our local exchange in March, the broad S&P/NZX50 index returned -13%, but that return falls quite significantly to -20.6% if you take out the returns of just two stocks (Fisher & Paykel and a2 Milk). In this month’s interest piece, our Managing Director Slade Robertson revisits other major market events from his career to see what lessons can be applied to the current situation:

I remember clearly where I was the day that the World Trade Centre was attacked in September 2001. It was one of those days that you never forget, particularly as the graphic images screened live on TV sets all over the world. At the time I was working in Sydney for a funds management firm. Common consensus at the time was that the world as we knew it would never be the same again. Media headlines questioned whether we were destined for war, asked if people would fly again, and raised concerns about trade and the global economy. Planes were grounded in many places, borders were being shut and financial markets went into a tailspin because we simply did not have the answers to those questions.

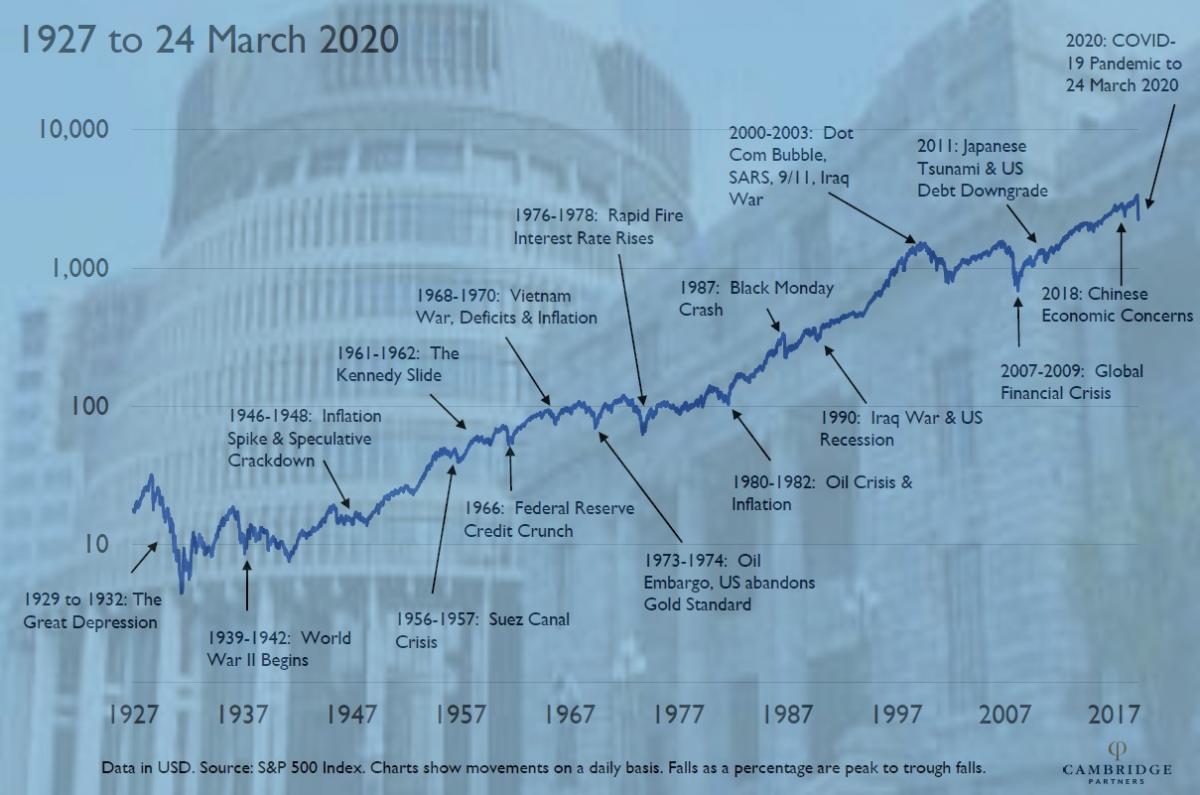

Unfortunately, every time the world finds itself immersed in a crisis, uncertainty is a defining characteristic. Whether it be 9/11, the GFC or where we are today, we face a range of possible scenarios that are unfamiliar to us. And of course, as investors we operate in a world where the financial markets, and thus the short-term value of our financial investments, are priced in real time and consequently can be very volatile.

Today, as the world grapples with the effects of COVID-19, there are many questions that we don’t have answers to. Questions over mortality rates, infection levels and which government policy is the best one. Are the economic costs associated with lockdown and extreme social distancing measures acceptable? Only time will tell. But there are aspects of the current situation that we do know with a much higher level of confidence. The world is facing a short-term economic contraction that will be more extreme than we have faced before. The peak-to-trough decline for the US and Europe will be more than twice as severe as that which we experienced in the GFC. And the decline will be much faster. Despite this certainty, we also know that there will be an economic recovery at some point, possibly as soon as in the second half of 2020. Economic indicators in China are almost already back to pre-virus levels. The rest-of-world will not enjoy such a rebound, but a recovery will happen.

As we have discussed over recent weeks this confidence is underpinned by the commitments of the world’s policy makers. This part of the coronavirus narrative is critical, and it is developing by the day. Over the past week alone we have seen the US Government sign a bipartisan $2 trillion economic relief plan and on Monday, Australian Prime Minister Scott Morrison announced an additional $130 billion to be paid over the next six months in wage subsidies. What this means is that businesses who are deemed eligible for this support will receive $1,500 per fortnight to help pay salaries. This will affect up to 6.7 million Australians for six months, and takes the total commitment by their government to more than 10% of GDP. An unprecedented amount of deficit spending. This thematic of “do whatever it takes”, globally, continues and should not be discounted by anyone for the role it will play.

In New Zealand, we have completed the first week of our Level-4 lockdown. This designation was necessary and may be sufficient, but we should all be prepared, as much as we can, for the possibility that it will be extended. In China for instance, which maintained a much stricter lockdown than New Zealand, the period lasted six weeks. The economic impact is devastating, but at this stage the country feels united in its commitment to the process.

Relative to most other nations, New Zealand is very well placed to navigate this unprecedented period. Our Government’s balance sheet is in great shape and before the fiscal response we had a Debt/GDP ratio of only 20% (compared to say the USA at 100%). There are few countries with a capital account as strong. We are also self-sufficient in food and electricity, and our most important trading partner is China which has bounced back strongly. With a single level of government (unlike again the US which has three levels and appears to be in a constant state of dysfunction) we are better placed to implement policies. Our healthcare system is of good quality and largely free and we have a social welfare system that aims to look after the most vulnerable. This is a framework that we should have confidence in. Our equity market is similarly well placed with local listed stocks dominated by businesses such as Fisher and Paykel Healthcare and a2Milk which are beneficiaries of the coronavirus, and numerous Utility businesses (such as Contact Energy and Meridian) whose operations are somewhat resilient to the current economic headwinds. Again, in a world of uncertainty these building blocks are important.

This past few weeks of global stock market performances have been extraordinary. After rapidly collapsing earlier in the month (in a record setting way) the US Dow Jones Industrial Average (one of America’s most important equity indexes) then enjoyed its largest three-day surge since 1931! This type of volatility is challenging for all investors. But where to from here? Financial markets are likely to remain very volatile in the short term as investors weigh new information. But this stage will be finite in nature. Like any other pandemic, or major event in history, COVID-19 will abate and eventually pass. Our challenge over the next few months will be to recognize this, continue to work to try to both protect capital and look for opportunities, and appreciate that in 2021 and beyond share prices will represent a world that is healing and a world where fundamental value matters.