Devon Funds 2026 Predictions

As we turn the page on 2025, it’s time once again to gaze into the future and assess the key themes, risks, and opportunities that are likely to shape global markets and investment portfolios in 2026.

Looking back on 2025, global markets delivered solid, albeit more varied, performance. The US remained a leader, with strong contributions from the mega-cap technology stocks that had driven growth in recent years. While AI optimism continued to be a dominant market driver, investors became more selective, rewarding companies that delivered tangible earnings over those riding on speculative potential. Periodic volatility, particularly driven by geopolitical tensions and inflation concerns, marked the year, but the overall sentiment remained constructive, supported by steady economic growth and recovery across multiple sectors.

Central banks continued easing policies, though the pace and magnitude of rate cuts varied by region. Inflation proved more persistent than expected, but global growth largely held up, exceeding the more pessimistic forecasts. New Zealand emerged from recession as interest rate cuts began to work through the economy, with the NZX posting a modestly positive year. The performance of dividend-paying stocks and improving domestic sentiment supported this rebound, though the local index still lagged the MSCI All World Index.

Reflecting on our 2025 predictions, we again had more successes than missteps. Markets trended higher, volatility indeed returned, and global growth landed softer than anticipated. The US rate cuts were fewer than expected, China’s stimulus measures were effective, and M&A activity did pick up. AI continued to infiltrate daily life, and geopolitical risks remained a key concern. However, we overestimated the rotation from mega-cap tech stocks into older economy companies, and while M&A activity did accelerate, it was more modest than anticipated. Finally, no large-cap New Zealand companies fell victim to hostile takeovers, as we had predicted.

So, what does 2026 have in store? Below is our view on how the key themes may play out.

1. Global equity markets advance again in 2026, but returns are more moderate and increasingly differentiated.

After several strong years, markets continue to move higher, though gains are harder fought. Valuations, particularly in the US, leave less room for disappointment. Investors become more selective, favouring quality balance sheets, pricing power, and dependable cash flows. Volatility remains elevated as markets react to policy shifts, election outcomes, and geopolitical developments.

The US retains its leadership position, supported by innovation and productivity gains, but returns are less concentrated than in prior years.

2. AI continues to dominate as a theme. The biggest question going into 2026 is whether AI companies can generate a reasonable return on investment.

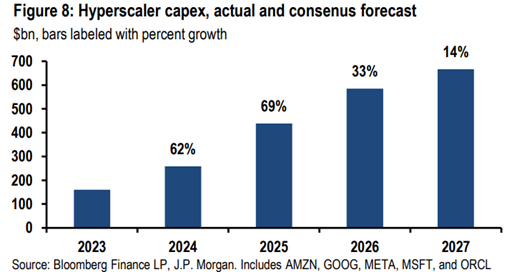

We see the adoption of AI continuing to accelerate in 2026, driven by a wide variety of industries, including healthcare, professional services, education, and manufacturing. However, we remain uncertain if, in the short term, investors will gain clarity on the returns from global AI investment. Parallels to the internet build-out will persist, where short-term adoption was overestimated, but longer-term impact was underappreciated. We also expect AI regulation, ethics, and cybersecurity to remain at the forefront as societies adapt to rapid technological change.

That said, we continue to expect US tech companies to deliver strong earnings growth in 2026, with consensus expecting 10-20% earnings growth. Most of this growth is driven by core operations, not AI monetisation. As examples, this includes Microsoft, Google, and Amazon’s core cloud offerings, Meta and Google’s market-leading advertising businesses, and Apple’s hardware business.

3. The global economy avoids recession and settles into a slower, more sustainable growth path.

The long-feared hard landing fails to materialise. Instead, the global economy enters a phase of modest but stable growth. Inflation continues to trend lower, though services inflation remains sticky in some regions. Unemployment rises only marginally, aided by continued productivity gains from automation and AI.

Central banks maintain a cautious easing bias, conscious of past policy errors. Monetary conditions become less restrictive but do not return to the ultra-loose settings of the previous decade.

4. Leadership broadens beyond US mega-cap tech.

AI remains a transformative force, but investors increasingly differentiate between enablers, adopters, and beneficiaries. Some of the largest technology companies deliver more modest returns, while opportunities emerge across industrials, healthcare, financials, and energy transition themes.

We double down on our view from 2025 that returns will broaden away from the Magnificent Seven companies, as recent inflation data in the US supports further rate cuts into the new year—traditionally benefiting small- and mid-cap companies.

5. New Zealand outperforms the MSCI All World Index as the economic recovery gathers momentum with rate cuts fully feeding through.

By 2026, the impact of lower interest rates will be felt more clearly across the New Zealand economy. Consumer confidence improves, business investment picks up, and GDP growth accelerates from subdued levels. The Reserve Bank maintains an accommodative stance, with the OCR settling near its revised neutral range. The lagged effects of earlier tightening fade, allowing the economy to grow again without reigniting inflation.

On a relative growth basis, we believe the NZ equity market is looking attractive relative to peers, with 1-year to 2-year forward EPS growth for the median stock at +19%, compared to 8% for Australia and 15% for the US. The NZX50's EPS growth sits +9% above its 20-year average, while the US market is +2.5% above and Australia +1.5% above. Despite this, the median market multiple has materially de-rated over the last three years compared to both Australia and the US. This backdrop sets the stage for NZX50 outperformance vs peers.

6. Global inflation remains sticky and somewhat elevated but mostly within central bank target bands

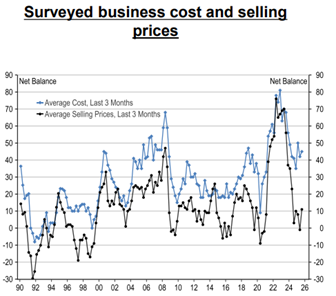

In 2026, global inflation is expected to moderate compared to previous peaks, though challenges persist. Inflation in the US is anticipated to stabilise at around 2-3%, as the Federal Reserve’s policies and tightening measures start to take effect, alongside easing supply chain disruptions. However, inflationary pressures could remain in key sectors like housing and wages due to tight labour markets and high demand for services. In Australia, inflation is expected to be elevated relative to other global markets, within a slightly higher band of 3-4%, with pressures from housing costs and energy prices as the country deals with structural imbalances in the housing market. For New Zealand, inflation should stabilise closer to 2-3%, with the Reserve Bank of New Zealand expected to maintain a neutral cash rate. The risk will be pricing pressures, particularly in services and construction, as the economy recovers and businesses begin to build confidence after low margins over the past couple of years. This is well illustrated by the chart below.

Overall, while inflation globally is likely to remain more controlled than in the early 2020s, supply-side pressures and wage growth could keep inflationary risks on the radar for many advanced economies.

7. NZ dividend-paying equities continue to attract capital as yield remains scarce.

With deposit rates materially lower than their peaks, income-seeking investors increasingly turn to equities. The New Zealand market, with its attractive dividend yields and improving earnings outlook, performs well.

Retail and discretionary sectors benefit from improved household cash flows, while the housing market experiences steady but unspectacular price growth, constrained by supply and affordability considerations.

8. Corporate activity continues to increase, with New Zealand firmly on the radar.

Global merger and acquisition activity is strong in 2026, supported by more predictable economic conditions and lower borrowing costs. Private equity returns to the fore after a quieter period.

New Zealand continues to attract offshore interest, aided by a competitive currency and high-quality assets. Further consolidation occurs in several sectors, and a prominent company exits the NZX.

9. China stabilises and contributes positively to global growth.

China’s recovery in 2026 is slower than expected, with an aging population, structural reforms, and trade tensions weighing on growth. The property sector struggles, and the shift towards a consumer-driven economy is gradual. While government stimulus helps, it’s less effective due to high debt. However, China’s tech push and focus on sustainability provide opportunities, especially in green energy and infrastructure. Though growth is weaker, China continues to play a crucial role in global trade, including for New Zealand.

10. New Zealand’s 2026 election plays a crucial role in the outlook for economic growth.

In 2026, New Zealand’s general election will be a pivotal moment, focusing on economic recovery, housing affordability, and social inequality. The election could see a shift in power, with the Labour Party and National Party battling for leadership, while smaller parties like the Green Party and ACT play key roles in coalition-building. Policy debates will centre around how best to stimulate economic growth, address inequality, and navigate New Zealand’s role on the global stage, particularly in relation to trade.

While we won’t predict the outcome, we believe stability in policy post-election will dictate our medium-term economic outlook, particularly regarding infrastructure investment. The country can’t afford delays from a new coalition re-shaping infrastructure to meet its own agenda. Bipartisan support for existing projects will be crucial.

And finally… a sporting prediction

11. We double down on Liam Lawson securing his first podium win and Ryan Fox claims another PGA Tour victory in 2026.

In 2026, Liam Lawson takes his motorsport career to new heights, securing his first-ever podium finish. Building on his previous performances, Lawson seizes key opportunities, making a bold statement in the world of Formula 1. Meanwhile, Ryan Fox continues his stellar golf career, notching another PGA Tour victory, further cementing his place as one of the country’s top athletes on the global stage.