Cutting to the chase

An interest piece written by Greg Smith, Head of Distribution at Devon Funds.

The month of July was a notable one for investors both at home and abroad. Inflation continued to fall globally, and central banks for the most part became more open to an easing of monetary policy. This included New Zealand where the eagerly awaited quarterly inflation print surprised on the downside, and came hot on the heels of what was seen as a more dovish Monetary Policy announcement from the RBNZ. With the economy continuing to face headwinds, interest rate cuts by the central bank before the end of the year looked increasingly probable.

The NZX50 market responded positively to this scenario, hitting a 30-month high during the month, with a 5.9% gain in July, which outperformed the 1.2% rise in the S&P500 and the 1.8% rise in the MSCI World Index. The month was also notable for another evolving thematic with positive ramifications for the Kiwi market which has lagged many other benchmarks this year. Globally, there was a rotation away from super-cap technology, towards older-economy names, and smaller capitalisation companies on the view that they offer better leverage to a soft economic landing. The tech-laden Nasdaq has led the market this year but closed down 0.75% during the month.

As we enter August the notion of a soft landing has been somewhat disrupted by the view that rate cuts by the Fed in September may come too late to prevent a hard landing in the world’s largest economy (despite the monthly jobs numbers being severely impacted by the weather). The multi-trillion dollar yen-carry trade (where investors borrow yen to invest in the US technology sector amongst others) has meanwhile started to unwind as the Bank of Japan began a rate-tightening journey, and US tech stocks became less of a one-way bet.

Time will tell how this plays out, and if the early August sell-off is just a blip, or the start of a “healthy correction” following an 18-month bull-market run in the US and Japanese indices, amongst others. Some comfort can perhaps though be taken from the perspective that “nothing has changed” overnight in the bigger picture. Various economic metrics and the global earnings season (some big super-cap misses by technology names aside) continue to point to a picture of resilience. Some areas of the market have run faster than others, and have become overextended in some cases, but this can also be addressed by ongoing rotation, rather than a sustained broader market sell-off.

In any event, after a sustained period of monetary tightening, investors in many markets now need to consider what life may look like as the next stage of the cycle sees interest rates head back down.

Certainly, in New Zealand, a rate cut in the coming months (if not weeks) appears probable.

In our 2024 predictions at the start of this year, we suggested that interest rate easing by the RBNZ would occur much sooner than consensus expectations (which at that stage were for rate cuts not to occur until 2025). Last month firmly crystallised the notion that the RBNZ may be “cutting to the chase” sooner rather than later.

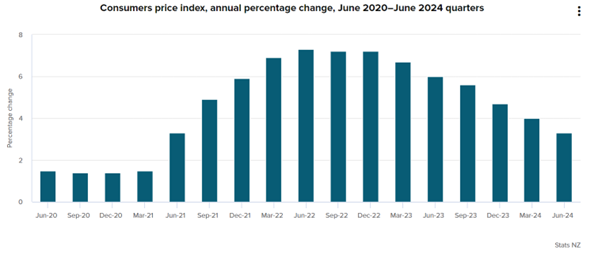

June quarter inflation came in at a three-year low of 3.3%, which was down from 4% in the March quarter, and less than half of the peak of 7.3% in 2022. On a quarterly basis, it fell to 0.4% from 0.6% in March. Most people were expecting a fall, but this was right down at the bottom end of expectations and is also materially below the 3.6% that the RBNZ had pencilled in at this stage. This is good news for people looking for a glimmer of positivity around cost-of-living pressures, and also as local investors seek tailwinds for our market.

At 3.3%, inflation is still above the RBNZ’s 1-3% target range, but only just, and (just like the Fed has made clear) officials won’t need to see it there before they start easing rates. Officials will just want to see it heading in the right direction.

That said, there are elements of inflation that remain “sticky”. While tradeable inflation is down to 0.3%, non-tradeable (domestic) inflation is still persistent at 5.4%, albeit down from 5.8% in March. Rent inflation is running at 4.8%. Rates are up 9.6% annually. Then there’s insurance premiums, up some 14%, the same as the March quarter. That’s nearly double what it was at the previous peak back in 2009. So still some pain points in inflation, but also as we have previously pointed out, these areas are not ones that the RBNZ can necessarily influence through the OCR.

The RBNZ had met only a week earlier and appeared to pivot towards rate cuts this year in the event of favourable inflation readings – the CPI duly obliged. A rate cut (or two) by the end of this year is all but locked in. A 50bps move lower at one meeting as opposed to the standard 25bps, is also a distinct possibility.

While the NZ economy is out of technical recession (not though in per capita terms), officials have acknowledged the weaker economic data that has been forthcoming in recent months, and the warning bells regarding the outlook.

The RBNZ made its view clear at the meeting, saying that “tight monetary policy is feeding through to domestic demand more strongly than expected.”

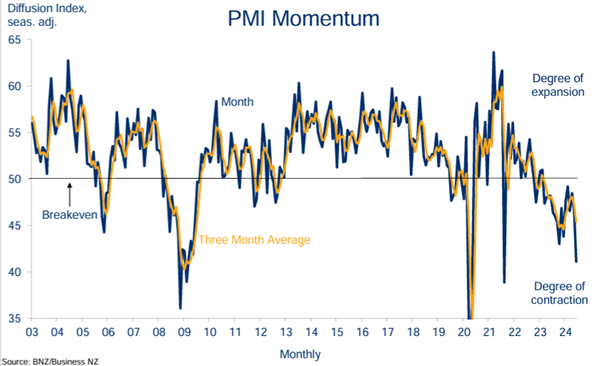

We saw other similarly weak prints during the month in the form of a range of business and consumer surveys, and card spending data, all pointing to declining activity. The Quarterly Survey of Business Opinion also pointed to a further decline in business confidence in the June quarter. New home consents are back at the levels of 10 years ago.

Weakness in retail is also having a knock-on impact on the manufacturing sector which is struggling, with one survey showing that the sector fell significantly into deeper contraction territory during June, and has been in contraction for 22 consecutive quarters. The downturn has not reached the depths of the Global Financial Crisis yet, but the weakness has gone on longer. The services sector is also doing it tough and is also in contraction.

With inflation getting under control, the New Zealand economy is in need of a boost. Whilst not a magic bullet overnight, the reality of lower interest rates will do much for consumer as well as business sentiment. Indeed, surveys towards the end of the month showed that both had picked up slightly following the RBNZ meet and inflation print.

Markets are forward-looking, so the question is now how might investors react?

Certainly, retail investor appetite domestically has been somewhat lukewarm for much of this year with the backdrop of elevated inflation, a hawkish RBNZ, and an economy that was in technical recession. The lack of technology exposure in our market has also been a headwind, with this sector running hot in 2024, propelled by the AI thematic.

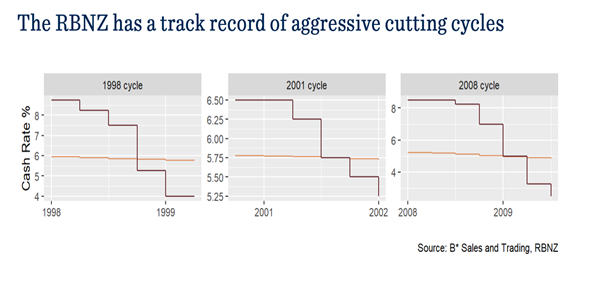

High deposit rates have also provided a reason for investors to sit on the sidelines. A fertile environment for savers though is turning – it is now much more difficult to secure a standard 1 or 2-year deposit rate above 5.5%, much less with a “6” out in front of it. The current deposit rates on offer could fall further in a relatively rapid fashion once our central bank presses the monetary easing button. While the RBNZ was one of the first central banks in the world to raise rates, it also has a history of moving quickly once it starts to ease.

Lending rates are also set to fall, which is good news for borrowers, many companies, and many sections of the economy. The question though might be whether this also makes residential property (which has been falling since December 2021) an attractive option again. The reality is though that on OECD standards at least, New Zealand remains one of the most expensive property markets around, even after the shake-out of the past two years.

There are meanwhile some positive indicators that the value inherent in some corners of the Kiwi market is being recognised, and that also a re-rating of many others can be sustained, particularly amid a lower rate environment. This is not least because the Kiwi market is a high-yielding one (which holds more relative appeal as rates fall), but also as a period of catch-up is overdue, helped by a rotation back towards value.

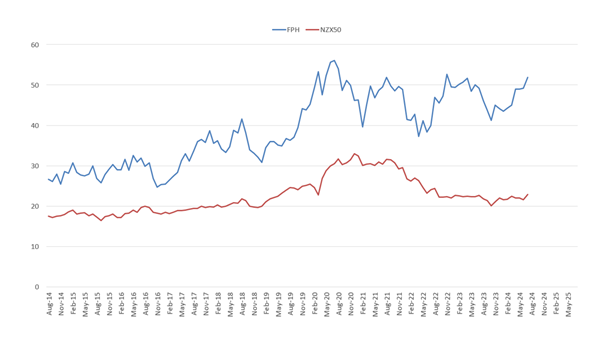

It is also worth pointing out that the broader valuation appeal of our stock market is somewhat masked by the presence of Fisher & Paykel Healthcare which accounts for around 15% of the index. The healthcare name is a great company, but also trades at a higher valuation compared to other locally listed peers.

Recognition of the value on offer has already been seen with acquisitive moves in two fairly beaten-up sectors, which could both turn upwards as the economy improves.

Retirement and aged care operator Arvida recently received a $1.2 billion offer from US-based alternative investment firm Stonepeak, at a 65% premium to the previously traded closing price. Although the company is smaller than Ryman and Summerset, it is still one of the largest aged care providers in NZ with around 35 communities.

The aged care sector has been tough going for shareholders, with a contributing factor being the weaker residential property sector. Share prices have been under pressure, which is presenting opportunities for acquirers with capital to spend. The interesting aspect is that while the offer is at a chunky premium to the recent undisturbed share price, it was still pitched at a ~15% discount to its net asset value. It will be interesting to see whether this sparks more interest in other retirement names.

Also in the eyes of a suitor was The Warehouse which received a takeover offer from buyout firm Adamantem Capital Partners, accompanied by founder and majority shareholder Sir Stephen Tindall. The Warehouse has had its fair share of problems, but the bid (at $520-590m) was still regarded as very opportunistic, and only pitched at a level that the shares were trading at late last year.

The offer of $1.50-$1.70 fell at the first hurdle and did not secure critical shareholder backing. Shareholders (including those bidding) may have come to the conclusion that it would have been a case of selling at the bottom. The board though did appear open to taking an improved offer back to shareholders. Stay tuned.

It will be also interesting to see whether there are other acquisitive predators considering these or other sectors in New Zealand.

Another broader indicator of the improving sentiment for our local market came with a strong response to the $1.15b capital raise by Infratil. This may in part have been because this was centred around the expansion prospects of one of the real success stories in their portfolio, being the CDC data centres, which have been riding tailwinds from the AI thematic.

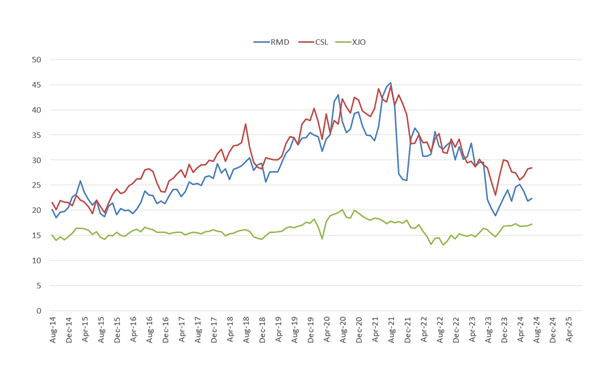

At Devon, our approach continues to be buying high-quality names, for the best value possible and despite the likelihood of more accommodative policy settings in New Zealand, our portfolios continue to have strong weighting towards Australia. This has served our funds well from a performance perspective in recent years – the ASX200 hit a record high last month. It is worth noting though that despite there being some very attractive investment opportunities across the Tasman, the RBA seems to be at a different stage of the policy cycle with Governor Bullock this week ruling out a rate cut in the next six months.