Contrasting fortunes

By Greg Smith, Head of Retail at Devon Funds

Global markets were strong in February, led by the US with the Dow and S&P500 both hitting record highs (a feat also matched by the Nasdaq Composite at the start of March). Investors moved on from the lack of a Fed rate cut and remained buoyed by the broader trend of inflation (despite a higher than expected CPI number during the month) coming down, and the belief that the central bank will possibly ease later in the year. A number of soft data points (including soft fourth-quarter GDP figures) boosted this notion.

The US markets have remained on a roll in 2024 and have risen seven out of the past eight weeks, and 16 out of the last 18 (something not seen since the early 70's). Investors have meanwhile been betting that mega-cap technology stocks (despite them being incredibly “over-owned” from a historical perspective) are one of the best ways to play slowing inflation and the AI boom. Nvidia’s market cap has gone above US$2 trillion for the first time. The AI darling’s shares are up 65% this year.

The tech-laden Nasdaq itself has risen around 10% this year but notably has been eclipsed by an index further afield – Japan. The Nikkei is the best performing stock market so far this year, with a 20% gain, and has reached a record high stretching back to 1989, just before an asset crash kicked off decades of deflation.

Offshore investors have flocked to Japan to take advantage of the cheap yen and corporate governance reforms that have boosted shareholder returns and profits. There is also value appeal with almost a third of Nikkei companies (excluding the financial sector) having a net cash position, double the comparable figure for the S&P 500. Interestingly, Japan’s overall economy has not matched the fortunes of its stock market, with a shrinking population and rigid labour force weighing on growth. Japan’s economy last month officially entered recession and lost its spot as the world’s third-largest economy to Germany.

Turning to the corporate sector, the US earnings season has wound down to its concluding stages and has been a largely positive affair – around 80% of companies have beaten earnings expectations. This was helped by Nvidia and several other super-cap tech stocks surpassing analyst forecasts. However, beats were not confined to the technology sector and a testament to the resilience of the US economy was big retailers for example also holding up well.

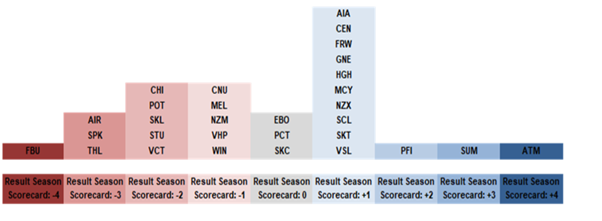

In New Zealand, the earnings season was something of a different story, with fortunes contrasting markedly between domestic facing companies, and those with offshore operations (as we suggested would be the case in last month’s special report). Domestic businesses are doing it tough in many instances, while those with a more international footprint appear to be riding a number of tailwinds. The below Quantitative Scorecard Container Stack highlights the “have’s and the have not's” from the reporting season.

Source: Forsyth Barr

A clear winner from the reporting season was A2 Milk. The infant milk producer saw interim revenues rising 3.7% to $812.1m and earnings (EBITDA) rising 5% to $113.2m. A2 grew infant milk sales in China despite challenging market conditions. A2 has been winning share in a declining market, and as it positions at the premium end of the market. The company achieved a top-5 China IMF position. English label infant milk formula sales also appear to have stabilized after several periods of decline. With new products on the way, FY24 revenue growth guidance has increased from low, to low-to-mid single-digit percent, in the prior year. A2 has a strong balance sheet with cash of $792.1m, up $34.9m on a year ago.

At the other end of the scale, Fletcher Building delivered a poor result. Revenues at the half year fell 1% to $4.248 billion, while earnings (EBIT) dropped 27% to $264 million. Margins fell to 6.2%, down from 8.4% in HY23. Fletchers reported a net loss after tax of $120 million which includes the $180 million in provisions and a $122 million non-cash write-down on Tradelink, against a net profit of $92 million in HY23. The company noted that these numbers were achieved against a backdrop of materially weaker trading conditions, particularly in the NZ residential sector where volumes declined 20%. The construction sector is facing cyclical challenges – Stats NZ reported that consents fell 10% in January.

There have been consequences for the result. There was no dividend and Tradelink is being sold. The Iplex pipe issue in Australia also remains uncertain. CEO Ross Taylor has stepped down and the Chairman is following suit. The share price sold off accordingly, although some support has come back in recently with pricing tension boosted by the takeover approach for CSR across the Tasman. CSR has agreed to an A$4.5b takeover.

Auckland Airport meanwhile delivered a solid first-half result, with passenger numbers picking up on growth in the international network. Auckland Airport is only two carriers and one destination short of their pre-COVID experience. The number of travellers increased by 22% to 9.3m. Revenue surged 53% to $440.5 million and earnings (EBITDAFI) soared 64% to $310.2 million, on a year ago.

The company noted North America was a highlight, where more people are now travelling to and from Auckland than ever before. The airport did say that growth may slow over the second half as the domestic aviation sector heads into “economic headwinds.” The airport is meanwhile looking to futureproof itself - the infrastructure development programme continues to make good progress. The airport has retained guidance for underlying NPAT of $260-280m in FY24.

In contrast, Air New Zealand (which has called for greater regulation of the airport amid the latest pricing decision) delivered a weaker results announcement. Earnings before taxation were $185 million, down from $299m in 2023, but up from $139m in 2020 pre-Covid. Passenger revenues jumped 21% to $3.1 billion, driven by a significant ramp-up in capacity across the international network. The Kiwi carrier said that the trading environment would be tougher going forward. There are signs of softness in domestic corporate and government demand. Earnings before taxation for FY24 are now expected to be in the range of $200 million to $240 million. Effectively passenger volumes are strong (as shown by AIA’s results) but ticket prices, which boomed post Covid, are now normalising. Rising oil prices are also an earnings headwind.

Another contrast came from the retirement sector. Ryman’s share price fell heavily as earnings disappointed on the back of lower resale volumes and margins. Debt levels though appear under control, and the company has a number of new developments nearing completion. Sentiment is weak, even as the shares trade at a discount of around 30% to book value.

Summerset meanwhile reported an 11% increase in underlying profit for FY23, to $190.3 million. The retirement care home operator had occupation right sales of 1,103, up 10% on FY22. Development margins increased to 31.6%, up from 29.6% in FY22. The company had a record year of construction and will open its first village in Australia in March, with a second one underway. Two new sites were acquired this year in New Zealand, with four new villages opened during the year. Summerset has a land bank total of 5,571 retirement homes and 1,338 care homes and expects to deliver 675-725 additional homes in 2024.

In the gentailers, there was some variability across the numbers as well. Mercury NZ had a sold result and Contact Energy delivered a 70% rise in underlying net profit in 1H23 to $134m, despite lower hydro generation over the period. On Tiwai, Contact noted that negotiations with Rio Tinto have been “constructive and have re-enforced Contact’s long-held view that the New Zealand Aluminium Smelter (NZAS) appears likely to stay.”

Meridian though was less upbeat on the matter, reminding at its results that the outcome of discussions with Tiwai on a potential contract beyond 2024 remains uncertain. Meridian reported a 5% fall in net profit after tax over the half year to $191 million, due mainly due to changes in the fair value of hedge instruments. Operating earnings rose 4% to $443 million, driven by higher retail and wholesale sales. Agribusiness and large business segments performed strongly, up 9% and 6% respectively.

The headwinds facing the domestic economy were also evident in a number of updates from the retail sector. KMD Brands fell to an all-time low after saying that group sales are expected to fall 14.5% for the six months ending January due to “ongoing weakness in consumer sentiment”. Jeweller Michael Hill reported that earnings fell 34% during the half-year, with sales in the first seven weeks of the second half down 9% in New Zealand (but holding up better in Australia). The Warehouse Group meanwhile announced that it is selling the loss-making Torpedo 7 brand for $1. The challenges facing Kiwi consumers were also evident in weak retail sales figures in February, which fell for the eighth consecutive month.

Declining domestic activity was also evident in results from the Port of Tauranga. The Port reported a 25% fall in its first-half profit to $47.2m, with revenues down 5.6% to $200m. Cargo volumes fell, with a 16% drop in the number of containers handled to 536,930. Much of this is because we are spending less and as such imports fell 23% to 3.9 million tonnes (it also seems that after sorting out some of its issues, Auckland’s port is getting more business). More encouragingly exports held up well.

A company doing well despite a softening domestic environment is Freightways. Top-line revenue growth for the half year of 12.4% was mainly driven by the Allied Express acquisition in Australia. Earnings before interest, tax and amortisation were flat, with higher labour costs a factor. The company expects tight labour markets will remain relevant this year although there are signs of improvement. The result was solid given the economic backdrop.

Spark New Zealand announced a 4.8% fall in net profit after tax for the half year to $157m. Reported revenue declined 22% to $1,976 million, while earnings (EBITDAI) fell 49.1% to $530 million. Comparatives were challenging given the TowerCo and Spark Sport transactions last year. Stripping out one-off benefits last year, the picture was better, driven by ongoing strength in mobile, momentum in data centres and high-tech, continued stabilisation in broadband, and a return to growth in the cloud. The telco sees earnings tailwinds from the ongoing exponential growth in data, business digitisation and cloud adoption, and the rapid uptake of generative AI, which is seeing demand for data centre capacity accelerating.

Vista Group’s results also made for good viewing. Full-year earnings (EBITDA) surged 25% to $13.3m. Total revenue at the cinema software company rose 6% to $143.0m of which $124m is recurring. The company has guided to FY24 revenues of $152m – $157m and is seeking to be cash flow positive in the fourth quarter. Management noted that the first multi-territory client was live on Vista Cloud, with other second-half signings underway. The company noted a strong box office, partly thanks to the “Barbenheimer” phenomenon, with 2023 takings up 30% in 2023 to US$34b.

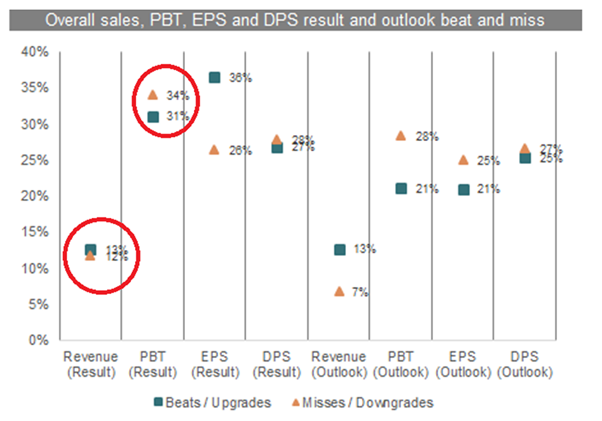

Across the Tasman, results were somewhat more on the positive side of the ledger, even if tailwinds are fading in some cases. There was a contrast however between the bottom and top lines. In terms of revenues, only 12% of ASX300 companies delivered a beat.

Source: Barrenjoey

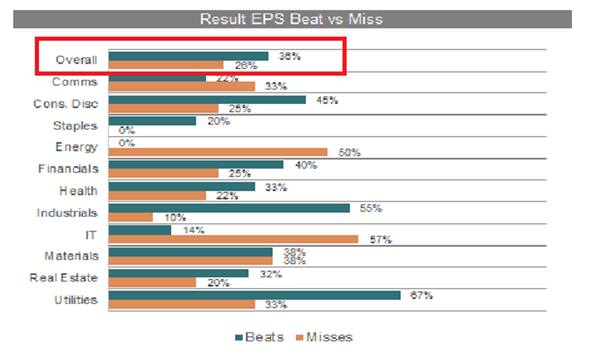

Looking at earnings, the numbers were more robust, with a third of companies beating on profitability, while around a quarter of companies missed. Industries that are seeing a slowdown have managed to navigate this in many cases through taking out costs.

Results from the banks that reported reflected a degree of margin pressure, amidst a competitive mortgage lending market. The miners meanwhile are also seeing growth ease after a period of supernormal profits, with a normalisation of commodity prices. That said, a weaker US$ would serve as a commodity price tailwind.

In the retail sector, Harvey Norman reported a sharp fall in sales but was buoyant about the outlook on the back of rising migration, home renovations, and the construction of new houses. JB Hi-Fi meanwhile came out with a much stronger than expected result and said that the second half had started positively. The electronics retailer has continued to focus on costs, and noted that stage three tax cuts and a peaking of interest rates will provide relief for retailers amid a broader slowdown in spending. The numbers from the retailers demonstrate that the Aussie consumer is in a better place than feared.

Amongst the earnings highlights was Goodman Group which delivered a standout result. Goodman reported a 29% surge in half-year operating profits to A$1.1 billion but delivered an A$220m statutory loss due to A$3.4b in write-downs across its A$79b portfolio. Investors however focussed on upgraded guidance. Rents are picking up (~5%) and demand for logistics facilities is strong. Data centres are a big focus for the company which it sees as a A$50 billion opportunity. These now account for over a third of its work in progress across the globe. Goodman shares are held across a number of the Devon funds.

Gaming technologies business Light & Wonder lit up, soaring after it swung back to profit, following a lift in gaming revenue. Net profits came in at US$180 million compared with a net loss of US$176 million a year ago. Full-year revenues rose 16% to US$2.9 billion in 2023. The company had its eleventh consecutive quarter of revenue growth and sixth consecutive quarter of double-digit growth, year over year. Light and Wonder shares are up ~30% year to date and are held across a number of the Devon funds.

Overall, interest rates remain a key focus point and it will be interesting to see how the coming months play out, with central banks appearing to be somewhat less hawkishly positioned than previously. Our Trans-Tasman strategies have had an overweight stance towards both Australian and NZ companies with offshore-facing businesses. This has proven fruitful from a performance perspective to date. The investment team’s approach as always, however, is an active one.