Animal spirits

An interest piece written by Greg Smith, Head of Distribution at Devon Funds.

November was a very strong month for most equity markets. The US led the way again, with the Dow Jones hitting a new record high. The 30-stock index jumped 7.5% amid optimism over the economy, post the election result. The US indices were buoyant in general. The S&P500 also hit a record, soaring 5.9% over the month, while the Nasdaq rose 5%, and has also hit a fresh record high over the past week. Smaller cap companies did even better with the Russell 2000 surging nearly 11%. Amongst the large caps, Tesla was a standout, soaring over 40% with the EV maker seen as a beneficiary around Musk’s relationship with Trump.

A strong November bodes well for the next year if history is any guide. Going back to 1950, after registering a 5% gain or more in November, the S&P500 has gone on to finish higher over the next 12 months 77% of the time, with an average of 12.8% over the period.

Inspired by another RBNZ rate cut, the Kiwi market also enjoyed a strong performance, with a gain of 3.4%. The Australian market was also robust, with the ASX200 soaring 3.8% to a new record high. Soft inflation and GDP prints have raised hopes of the RBA bringing forward the timeline for rate cuts, while Australia is also seen as a potential beneficiary of some of Donald Trump’s policies. Technology and financials both performed strongly.

Geopolitical events (the ongoing war in Ukraine and an escalation in the Middle East) were largely set to one side by markets. Optimism is in the air around the economy, with investors buying into the momentum provided by Trump’s tax cuts while dismissing for now the negative aspects of a potential trade war. Investors are also happy with how the Fed is behaving. The minutes of the last meeting of the Federal Reserve showed that officials are prepared to cut rates further, albeit at a gradual pace. Markets are assigning a 70% probability of another 25bps cut at the December meeting.

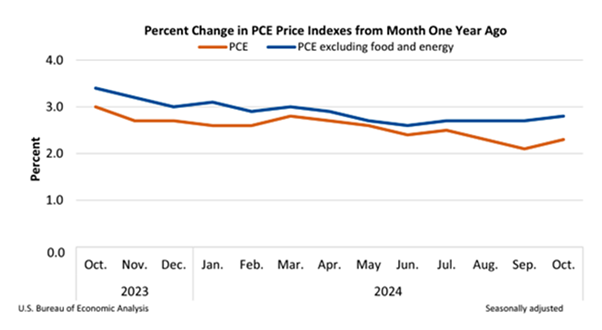

Officials expressed confidence that inflation is easing even though by most measures it remains above the Fed’s 2% goal. This was confirmed by a print on inflation towards the end of November. The Personal Consumption Expenditures index (the Fed’s preferred inflation gauge) rose 0.2% in October and 2.3% on an annualized basis, in line with expectations. The so-called core measure increased 0.3% month over month and 2.8% compared with a year ago, also matching consensus forecasts.

The central bank will be watching how Donald Trump’s protectionist policies play out next year. The President-Elect recently said he plans to sign off on 25% tariffs (it was previously mooted as 20%) on imports from Canada and Mexico on his first day in his office, along with an additional 10% on those from China (above the 60% already proposed). This is said to be part of a clampdown on illegal immigration and drugs. Trump has also posted that he would look to impose a 100% tariff on BRIC nations (which includes Brazil, India and Russia) if they continue to “undermine” or challenge the reserve currency status of the US Dollar.

Time will tell if this is all real or just a massive negotiating tactic. Canada, Mexico and China just happen to be America’s three largest trading partners (in that order) and account for 43% of US imports. Investors are putting aside the potential negative impacts of these policies for now.

Perhaps many are also mindful that putting tariffs up across the board is probably not realistic, and would be a huge call. While some US imports face high tariffs of this magnitude, the average across all industrial goods imported to the US is around 2%.

What Trump is proposing hasn’t been seen for over 100 years, and is much bolder than the first ever-tariff policy – George Washington put a 5% tax on all imports in 1789. Trump imposed new tariffs on Chinese imports that were worth about US$380b in his first term, and these were maintained by the Biden administration. Europe has also imposed sizeable ones on EVs from China, but a blanket application of import duties by the US would be very different.

The tariffs in their current proposed form would see existing projections of inflation fly out the window. It has been estimated that it could add nearly 1% to US inflation. This is all very relevant to the Fed which has expressed comfort with the pace of inflation, even though by most measures it remains above its 2% goal. The minutes made no real mention of the election or the implications of Trump’s policies.

MAGA would come at a cost. It is widely accepted that tariffs would hurt American consumers, as not everything can suddenly be made in the US and certainly not at the cost it is currently imported at. The tariffs would deliver another cost-of-living shock. Cars would probably get more expensive. Over a quarter of imports from Mexico relate to the automotive industry, with companies such as GM having low-cost operations now.

Despite the prospective implication, US consumers are still relatively resilient and upbeat in the here and now. This has shown through in several data prints, including the Conference Board’s Index of Consumer Confidence which moved higher in November. Increased expectations for the labour market helped drive the move. The proportion of consumers anticipating a recession over the next 12 months is the lowest in over two years. Consumer expectations for the stock market climbed to a new record. Inflation expectations also improved, with the five-year outlook down to 4.9%, the lowest since March 2020. It will be very interesting to compare the survey in a year if Trump’s proposals are put through.

Some sectors do appear to be attuned to the prospect of higher inflation. New home sales in the US tumbled more than 17% in October to a 2-year low. Housing stock stands at 9.5 months’ worth of supply, the highest level since 2008. Mortgage rates are picking up, and the 30-year rate has gone from close to 6% when the Fed started cutting to 6.7%, as strong economic data (and the implications of Trump’s policies) suggests the Fed “might” be slower to cut rates.

Nonetheless, currently, the US economy has been resilient, helped along by its engine, US consumers. Retailers were arguably a surprise package of the US earnings season, with many well-positioned names shining. Shares in Walmart, the world’s largest retailer, hit a record high last month.

There are clearly still pockets of weakness in the US, including the manufacturing sector. PMI data showed that the sector improved in November though it remained in contraction (for the 8th consecutive month and the 24th time in the last 25 months). New orders also grew as did employment. Inventories though remain in contraction. Further rate cuts would be helpful here.

Across the Atlantic, UK and European markets were flatter in comparison. The UK budget hasn’t gone down particularly well, with the new government making some “tough” decisions.

European markets have meanwhile been faced with the backdrop of a stuttering economy which could be impacted further by Trump’s tariff plans. The eurozone will require further easing support from the European Central Bank although a complicating factor is that inflation is now rising again (2.3% at the latest print). Employment though is declining at its fastest pace since August 2020. Markets are now pricing in an increased chance of a 50bps rate cut by the ECB this week.

In Asia, the Nikkei was a clear laggard, falling over 2%. The index though is up nearly 20% year to date. Japanese exporters will be waiting with bated breath as well to see how Trump’s tariff plans pay out. The Japanese central bank is meanwhile faced with a delicate decision as it looks to potentially raise rates further.

Chinese markets were understandably weak last month, with China a focal point of Trump’s tariff plans. It will be interesting, to say the least, to see how China responds to the tariffs if they are put through. China is the second-largest foreign creditor to the US government (after Japan), holding about US$775 billion in US Treasuries.

Source: Voronoi

The good news for China is that stimulus measures appear to be having a positive impact. The latest private sector report on China’s manufacturing sector (confirming official measures) showed that it grew at its fastest rate in five months in November. The PMI rose to 51.5 from 50.3 in October, and above consensus estimates for 50.5. This was the second straight month of expansion, helped by the highest rate of growth in foreign orders since February 2023.

Exports continue to power the economy and have it heading for a record trade surplus of US$1 trillion in 2024. Employment remained in contraction for the third straight month, indicating the effect of stimulus has yet to trickle down to the labour market. With recent initiatives starting to work on some parts of the economy, investors are looking for more stimulus to help the economy navigate what could be a challenging 2025.

Concerns over a potential trade war next year haven’t held back the Australian market which hit a record high. The mining sector was mostly subdued but financials were in demand, with CBA also hitting an all-time high. Tech names followed their US counterparts higher. Telix Pharmaceuticals had a strong month, and software giant Xero soared over 15%.

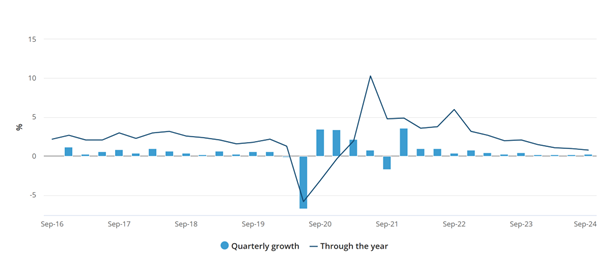

The RBA remains something of an outlier in terms of central banks. Some recent data though has supported the case for cutting sooner rather than later. Whilst retail sales have been strong, the monthly CPI came in at 2.1% when 2.3% had been forecast. The Australian economy expanded by less than forecast in the third quarter, with GDP rising 0.3%, undershooting forecasts of a 0.4% gain. On an annual basis, the economy grew at a slower clip of 0.8% from 1% in June and compared to the 1.1% forecast.

Notably, household consumption and business investment did not contribute to economic growth in the September quarter. Spending by state and local governments is propping up the economy (cost of living support, infrastructure investment and the like). Combined federal and state government spending hit A$195.8 billion in the quarter, an 8% increase on last year and way higher than the 5.3% average annual growth rate in the decade before the pandemic.

Australian GDP growth

Source: ABS

Government outlays are now a record 12.3% of nominal GDP while state government spending hit 16.5%. Activity in the private sector, by contrast, remains muted. Migration is also propping things up. On a per capita basis, GDP per person went backwards for the seventh straight quarter, falling 0.3%. Markets have increased their bets on a February rate cut to 75%.

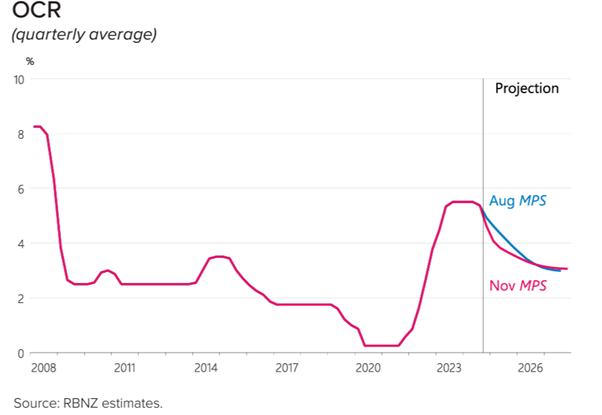

The Kiwi market had a good month. The RBNZ didn’t deliver the 0.75% rate cut we (and much of the economy) were looking for, but officials have acknowledged that the overall amount of rate cuts over the next year needs to increase given economic challenges. Markets appeared to like that the OCR rate track was lowered and that a 50bps cut is on the table for February.

The OCR was cut by 50bps to 4.25% and the OCR is now seen as getting to 3.55% at the end of 2025. In addition, it seems that another 0.5% cut is likely at the February meeting.

The peak unemployment rate has been revised down from 5.4% to 5.2%, but future GDP forecasts have been lowered. Officials see less spare capacity in the economy than anticipated and have acknowledged that migration tailwinds are dissipating. December quarter GDP was revised up slightly to 0.3% but annual growth through to December 2025 is 2.3%, compared to 3.3% in the August statement. Things are tough which makes it all the more amazing a 0.75% cut allegedly wasn’t considered.

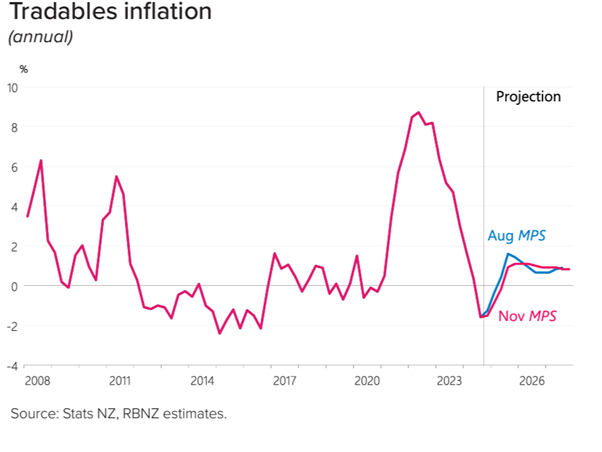

The RBNZ seems comfortable with where inflation is and expects it to remain at or above 2%. They see tradeable/offshore-driven inflation as increasing. This is interesting. While we potentially have tariffs on their way, as Adrian Orr himself acknowledged, a trade war might see the dumping of cheaper Chinese goods in NZ. Oil also remains a wild card and could fall just as easily as go up.

The RBNZ sees domestically driven inflation going up but this is interesting as well, given GDP forecasts have been lowered. It still seems possible that inflation could overshoot on the downside.

Ultimately, as Orr noted, there is still a lot of uncertainty on how the economy will respond to existing rate cuts and this was perhaps reflected in officials giving a wide range for a neutral OCR of 2.5% - 3.5%.

So effectively the RBNZ is saying that an average rate of 3% is neither stimulating nor constricting the economy – that means we are still in line for another 125bps points of rate cuts. Markets liked that. Borrowers will also like that some banks have already passed the full cut on.

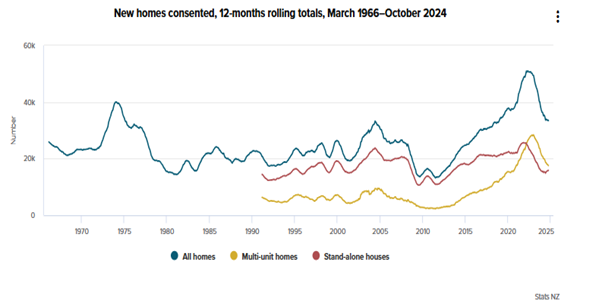

There remain clear pockets of weakness in the economy, including the housing market. Building consents in October fell 6.9% from a year ago. On an annual basis, new homes consented in the year ended October 2024 were down 16% compared with the year ended October 2023. The annual value of new residential construction being consented is down $5bn over the last two years. Time will tell if we are at the bottom.

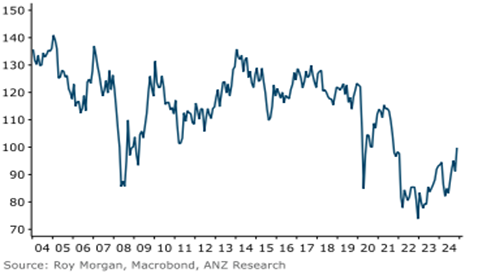

Things are looking slightly more positive it seems on the consumer front. Consumer and business confidence surveys have picked up, albeit from a position of weakness. For consumers, potential drivers included falling interest rates, a (possible) turn higher in the housing market, and easing inflation. These factors appear to be outweighing rising unemployment. Businesses are also more upbeat than they were about the outlook. Both households and businesses are optimistic that falling inflation and interest rates will deliver “better times” ahead. That said it is still very tough out there for many.

Consumer confidence

There are however clear bright spots in the economy. Dairy is doing well – prices were up again at the last auction and farmers may be in line for a record farmgate milk payout of $10. The kiwifruit industry is another that is booming.

Overall investors are looking to a potentially better year in 2025 for an economy that is in recession. Markets are starting to price in the green shoots provided by recent rate cuts, and the further cuts that are to come, which will be helpful to multiple industries.

Falling deposit rates are also boosting the allure of our high-yielding market. The strong demand for Infratil’s $1.15b capital raise and for Auckland Airport shares in the wake of Auckland council selling its 9.7%/ $1.3b stake, highlights the wall of cash on the sidelines waiting for the right opportunities.